U.S. stocks were mixed in early Friday trading, while the dollar extended its recent decline, as markets picked through details of President Donald Trump’s latest tariff plan and a busy slate of economic data prior to the opening bell.

Updated at 11:50 AM EST

Doing the robot

Meta Platforms (META) shares are on pace to extend their historic winning streak to twenty consecutive sessions, the longest for any Nasdaq-listed stock in decades, with Friday gains powered by a report that it’s planning significant investments in humanoid robots.

Bloomberg, which reported the plans, says Meta has reached out to Unitree Robotics, as well as Figure AI Inc. as part of the newly-created divisions early-stage ambitions, which will be lead by former General Motors (GM) Cruise executive Marc Whitten.

Meta shares were last marked 0.93% higher on the session at $735.36 each, a move that would extend the stock’s year-to-date gain to around 22.7%.

Related: Meta stock eyes history as Facebook parent leaves Mag 7 rivals behind

Updated at 10:26 AM EST

Mixed early action

Stocks are edging into modest early gains, with the S&P 500 rising 5 points, or 0.08% and the Nasdaq up 30 points, or 0.15%, as markets get a boost from a weaker dollar and a pullback in Treasury bond yields following the softer-than-expected January retail sales report.

The Dow, meanwhile, slipped 55 points while the mid-cap Russell 2000 added 14 points, or 0.62%.

“Consumers pulled back hard on spending after a generous holiday season, but they were still willing to open their pocketbooks when it came to dining out,” said Ellen Zentner, chief economic strategist for Morgan Stanley Wealth Management. “This suggests households remain confident in the economy even as policy uncertainty has risen.

Benchmark 10-year note yields were last marked 5 basis points lower on the session at 4.471% while 2 year note yields were 4 basis points lower at 4.259%.

GS: Retail Sales Well Below Expectations; Import Prices Somewhat Below Expectations;

Estimating 0.29% for January Core PCE pic.twitter.com/WQcfknK4L0

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) February 14, 2025

Updated at 8:44 AM EST

Spending hangover

U.S. retail sales tumbled sharply lower in January, snapping a five-month winning streak, as extreme weather, California fires and surging inflation trigged a consumer spending hangover following December’s solid gains.

Headline sales fell 0.9% last month to a collective tally of $723.9 billion, the Commerce Department, well south of Wall Street’s consensus forecast of a 0.1% decline and the upwardly-revised December reading of 0.7%.

The closely tracked control-group number, which excludes autos, building materials, office supplies, gas-station sales and tobacco, and feeds into the government’s GDP calculations, fell 0.8% on the month, again firmly below the Wall Street consensus forecast of a 0..3% gain and December’s gain of 0.7% advance.

Stocks were little-changed following the data release, with futures contracts tied to the S&P 500 suggesting a 3 point opening bell dip while those linked to the Dow Jones Industrial Average are priced for an 82 point decline. The tech-focused Nasdaq is priced for a 50-point gain.

Benchmark 10-year Treasury note yields slipped 2 basis points lower to 4.494% following the data release, while 2-year notes were down 2 basis points to 4.272%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.37% lower at 106.901.

US January Retail Sales: the traditional holiday hangover & a nasty winter freeze combined to cool topline retail sales which declined 0.9% while the control group fell 0.8%.

However there were upward revisions to the December estimate which based on a quick look appeared to…

— Joseph Brusuelas (@joebrusuelas) February 14, 2025

Updated at 8:21 AM EST

New game plan?

GameStop (GME) shares were an active early mover after the money-losing video game retailer, and one of the original meme stocks, said it was considering investments in the cryptocurrency space.

CNBC reported late Thursday that GameStop is looking into bitcoin and other digital currency purchases following retail investors speculation prompted by a post from CEO Ryan Cohen posing with MicroStrategy (MSTR) chairman Michael Saylor, the world’s biggest corporate holder of bitcoin.

GameStop shares were last marked 8.2% higher in premarket trading to indicate an opening bell price of $28.50 each.

— Ryan Cohen (@ryancohen) February 8, 2025

Stock Market Today

Stocks ended firmly higher on Thursday, with the S&P 500 closing near to its all-time peak, following big intra-day moves for index heavyweights Tesla (TSLA) , Nvidia (NVDA) and Apple (AAPL) . A mixed reading of producer price inflation, which showed some components that feed into the Federal Reserve’s PCE price index slowing down, added to the session’s bullish tenor.

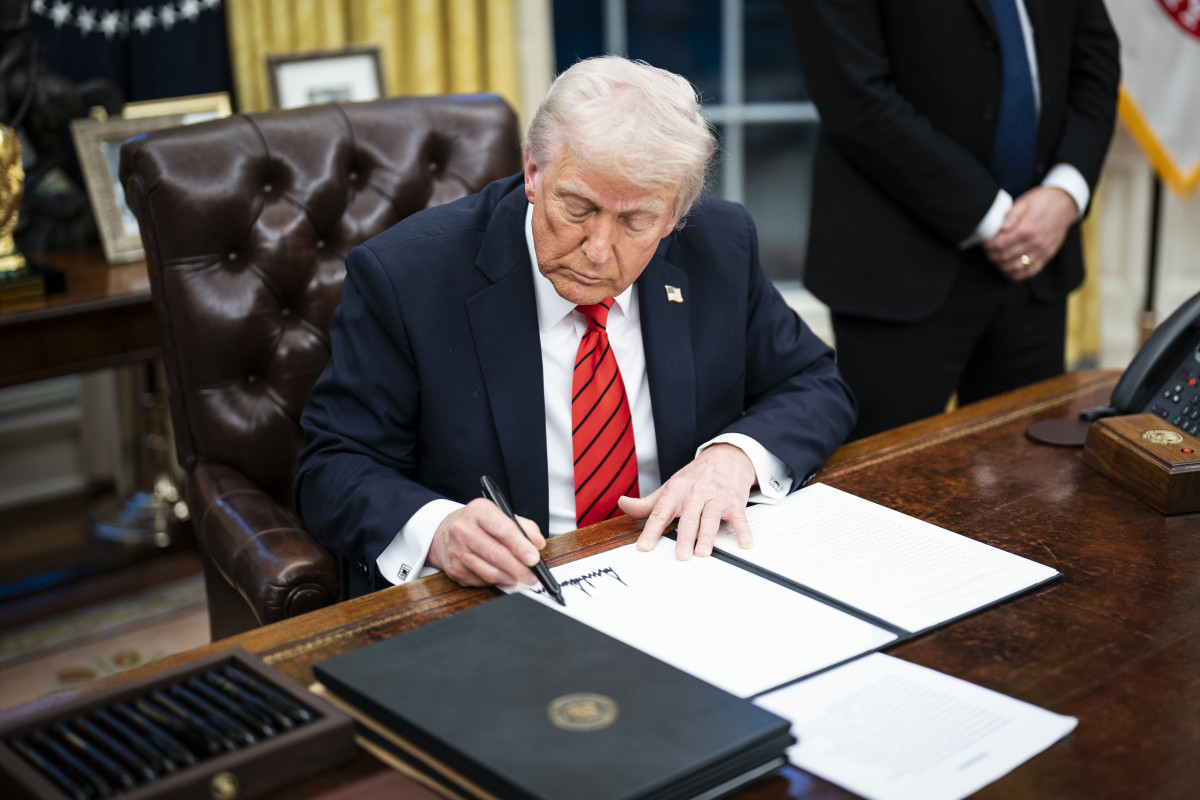

President Trump’s tariff unveiling, which began late afternoon in the White House, didn’t undo the market rally, either, as traders continue to fade comments from the Executive amid the dizzying pace of headlines, orders and edicts since his inauguration in January.

Trump vowed to impose ‘reciprocal’ tariffs on U.S. trading partners, but gave his Commerce Secretary, Howard Lutnik, until April to come up with a formula for doing so, raising the prospect of either negotiated terms or a pullback in the strategy altogether.

“I’ve decided, for purposes of fairness, that I will charge a reciprocal tariff, meaning whatever countries charge the United States of America,” Trump said. “In almost all cases, they’re charging us vastly more than we charge them but those days are over.”

The U.S. dollar index extended its biggest decline in three weeks in overnight trading, and was last marked 0.37% lower at 106.912, suggesting global investors aren’t as affect by Trump’s announcements as they have been in the past.

Related: Stocks are shaking off huge risks for one crucial reason

“Trump’s trade rhetoric will continue influencing the market, but investors are becoming more selective in their responses,” said Boris Kovacevic, global macro strategist at Convera. Due to his shifting positions on key trade issues, markets are reacting cautiously rather than to every headline.”

On Wall Street, stocks are set for a muted open, with a key January reading of retail sales, as well as trade and industrial production data, slated to arrive before the opening bell.

Futures contracts tied to the S&P 500, which is now up 0.19% for the month and 2.9% for the year, are priced for a modest 5 point pullback at the start of trading.

The Dow Jones Industrial Average, meanwhile, is called 110 points lower with the tech-focused Nasdaq priced for a 5 point dip.

Stocks on the move include Intel (INTC) , which is having its best run of gains since 1975, as investors bet on a the chipmakers turnaround and spinoff plans. Shares in the group were last marked 3.5% higher in premarket trading at 24.99 each.

Related: Analyst revisits Intel stock forecast amid surprise plans for a key spinoff

In overseas markets, Europe’s Stoxx 600 was marked 0.02% lower in mid-day Frankfurt trading, but are still on pace for their eighth straight weekly advance, while Britain’s FTSE 100 slipped 0.3% lower in muted London trading.

More Wall Street Analysis:

- Goldman Sachs analysts warn on Trump tariff impact for stocks

- Analyst predicts stocks likely to join the S&P 500 in 2025

- Every major Wall Street analyst’s S&P 500 forecast for 2025

Overnight in Asia, Japan’s Nikkei 225 ended 0.79% lower on the session, but ended the week with a 1.74% gain, thanks in part to a weaker yen and solid tech stock performance.

The regional MSCI ex-Japan benchmark, meanwhile, was last seen 1.07% higher after tech stocks in China rallied hard on reports that President Xi Jinping will chair an industry summit, along with billionaire investor Jack Ma, early next week.

Related: Veteran fund manager issues dire S&P 500 warning for 2025