Shortly before midnight on Oct. 19, 1987, Stephen Guilfoyle finally called his fiancée.

The Wall Street veteran had been working all day on that infamous Black Monday when the Dow Jones Industrial Average — still the primary measure for U.S. stock market performance at the time — lost 22.6% in a single trading session.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰

Guilfoyle’s spot on the New York Stock Exchange trading floor that day was just under the podium, where the bell is rung, right in front of Post 9, now the CNBC NYSE studio.

“NYSE trading volume for that day was three times the daily average,” Guilfoyle wrote in his TheStreet Pro column, “and at that time, we traded each and every share the old-fashioned way, priced in Spanish pieces of eight and in the old open-outcry, two-way, ongoing auction model. No circuit breakers. No time-outs.”

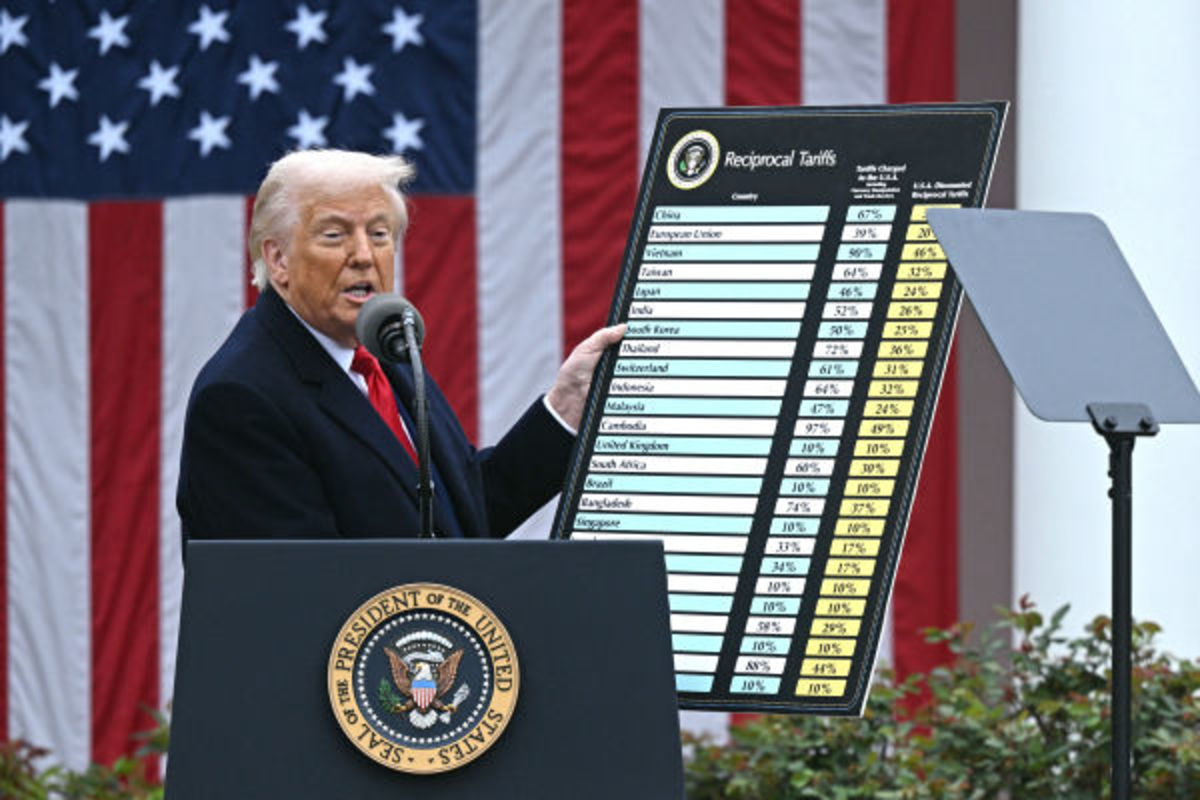

President Donald Trump unveiling his tariff plans.

President Donald Trump unveiling his tariff plans.

BRENDAN SMIALOWSKI/Getty Images

Veteran trader recalls market’s dark days

Worldwide losses were estimated at $1.71 trillion and the severity of the crash sparked fears of extended economic instability or even a repeat of the Great Depression.

“On a normal day, we would be done with our paperwork by sometime between 5 p.m. and 6 p.m.” Guilfoyle said. “That day, the trading floor looked like it was still open for business at 11:30 p.m., when I took my first break of the day.”

More Experts

- Stanley Druckenmiller sends curt 7-word response to tariff war

- Jim Cramer delivers blunt take on tariffs after stocks crash

- Scott Galloway sends strong message on Social Security

- Suze Orman sends strong message on 401(k)s, recession

Guilfoyle went to a bank of pay phones outside the stock exchange and called his fiancée, now his wife of many years.

“I told her that it would probably be a while until we saw each other again,” he said.

The Wall Street veteran used this blistering first-hand account to look back on the various times the market has been pummeled over the decades, dating back to 1929, as he assesses the current tariff-spawned rout.

“Since then, we’ve had the mini-crash of 1989, the dot-com bubble crash of March 2000, we had the 9/11 terrorist attacks that ultimately landed me back in the U.S. military after a long break in service, and we had the crash of 2008 that led to, or rather was a symptom of the ‘Great Recession’ or ‘Great Financial Crisis.'” Guilfoyle said.

Guilfoyle also recalled the Covid Crash of 2020, which he worked straight through, without missing a single day, despite becoming quite ill with the first variant of that virus and a horrific bout with long Covid that lasted more than two years.

Analyst: Panic thresholds largely met

“Now this?” he asked. “Is this a crash? It might be. I don’t count the flash crashes. Those only happened because Wall Street replaced human traders with algorithms. Thursday and Friday did have that sickening feeling hanging over them.”

The S&P 500 lost more than $5.4 trillion in value last week, while on a global basis stocks have lost around $9.5 trillion in value, including selling in Europe and Asia on April 7, TheStreet’s Martin Baccardax reports.

Related: Stanley Druckenmiller sends curt 7-word response to tariff war

“We continue to watch for stocks to find support amid this historic selloff,” said Adam Turnquist, chief technical strategist for LPL Financial. “Technical damage has been severe but importantly, the thresholds for panic and washed-out/oversold market conditions have now largely been met.”

First-quarter-earnings season begins in earnest week when some of the large banks begin to report their numbers.

Guilfoyle wondered how many companies, “in this new era of extreme uncertainty, despite what appears to be some negative certainty, will actually issue forward-looking guidance.”

“Many firms did not offer guidance for a year or more after the Covid shutdowns and Covid-era supply constraints,” he said. “Will they resort to that kind of evasive behavior yet again? I know if I were CEO of a multinational corporation, that’s exactly what I would do.”

Stocks were being whipsawed at last check, with the Dow down 721 points or nearly 2%, after National Economic Council Director Kevin Hassett told Fox News that more than 50 countries have responded to President Donald Trump’s tariff policy by approaching the U.S. with some “great” deals.

On the X platform the prominent hedge-fund manager Bill Ackman called for a 90-day pause of the tariffs “to give the president time to carefully and strategically resolve our historically unfair global trading position.”

“Futures opened on Sunday night in the same ugly fashion that they went out with on Friday,” Guilfoyle said. “That reminds me. Friday, Oct. 16, 1987, was a fairly awful day for U.S. markets as well. Buckle those chinstraps, kids.”

Related: Veteran fund manager who forecast S&P 500 crash unveils surprising update