Hey, it turns out the Beatles were right after all: Money really can’t buy you love.

Back in December, we all heard how Amazon (AMZN) had donated $1 million to President Donald Trump’s inaugural fund.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter 💰

The e-commerce and entertainment giant had a lot of company in the Million Dollar Club, including big-time tech names such as Alphabet/Google (GOOGL) , Apple (AAPL) and Microsoft (MSFT) .

In addition, Amazon Founder and Executive Chairman Jeff Bezos, who also owns The Washington Post, blocked publication of a planned endorsement of Vice President Kamala Harris over Donald Trump in the presidential race.

The Post also rejected a cartoon that depicted the owner of the Blue Origin space-tech company and other tech and entertainment giants kneeling before Trump.

The Pulitzer-Prize-winning cartoonist, Ann Telnaes, later resigned.

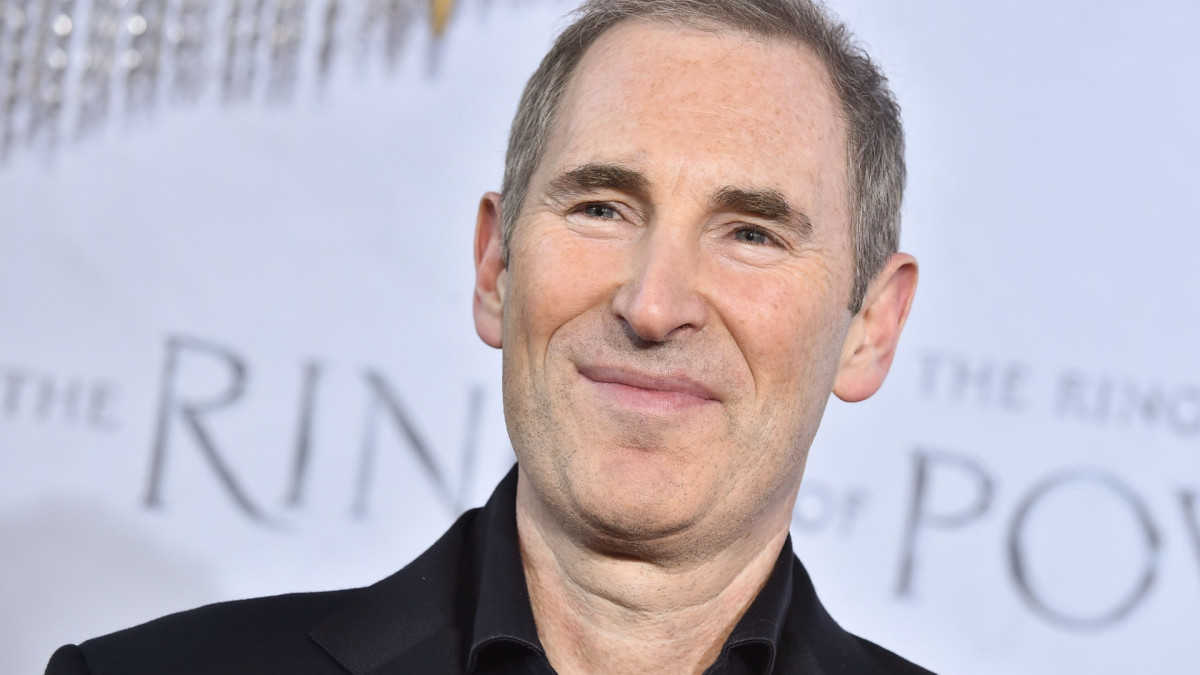

Amazon CEO Andy Jassy’s company will post quarterly earnings on May 1.

Amazon CEO Andy Jassy’s company will post quarterly earnings on May 1.

Amazon harshly criticized by White House

Nevertheless, the White House came out swinging at Amazon on April 29 for reportedly planning to display the cost of Trump’s tariffs next to the total prices of products on its site.

The amount added as a result of tariffs will be displayed right next to each product’s total price, Punchbowl News reported.

More Tech Stocks:

- Top analyst revisits Tesla stock price target as Q1 earnings loom

- Google’s Waymo is planning a move that’s downright creepy

- Analyst reboots Apple stock price target after tariff meltdown

“This is a hostile and political act by Amazon,” White House Press Secretary Karoline Leavitt said at a briefing, according to CNBC reported. “Why didn’t Amazon do this when the Biden administration hiked inflation to the highest level in 40 years?”

Leavitt added that “this is another reason why Americans should buy American.”

An Amazon spokesperson told CNBC that the company was considering listing tariff charges only for some products on Amazon Haul, its budget-focused shopping section.

But it’s not just Amazon doing the tariff-label two-step.

China-based fast-fashion giants Shein and Temu have both added massive surcharges in recent days. Temu now includes a line on its checkout tally showing an “import charge” that adds around 145% for each item.

Meanwhile, Amazon Prime Day is losing some of its luster among its sellers. Some third-party merchants who previously sold China-made goods during the July shopping event now are sitting out or reducing the amount of discounted merchandise they offer, according to Reuters.

The planned pullback is a way for sellers to protect their profit margins amid the U.S.-China trade war.

Amazon merchants are hiking prices for everything from diaper bags and refrigerator magnets to charm necklaces and other top-selling items as they confront higher import costs, CNBC reported.

Analyst cuts Amazon estimates due to tariffs

E-commerce software company SmartScout tracked 930 products on Amazon for which prices have increased since April 9, with an average jump of 29% in categories, including clothing, jewelry, household items, office supplies, electronics and toys.

The company told CNBC that the claim was “sensationalized” and said the research covers “a tiny fraction of items in our store.”

Amazon said that based on its view of the research, less than 1% “of the items studied saw an increase in price.”

Related: Analysts reboot Amazon stock price targets

Prime Day has traditionally been one of Amazon’s biggest shopping events of the year, behind Black Friday and Cyber Monday, respectively.

And while participation is optional, Amazon spends millions promoting Prime Day on television and social media ads, telling sellers that they will benefit from a halo effect by getting their merchandise in front of a larger audience of shoppers.

Amazon has around 200 million Prime subscribers worldwide.

United Parcel Service (UPS) executives are clearly concerned about the impact of tariffs.

The world’s largest package delivery company said it would cut 20,000 jobs and shut 73 facilities to lower costs in an uncertain economy and to brace for a potential pullback from Amazon, its largest customer, Reuters reported.

“The world has not been faced with such enormous potential impacts to trade in more than 100 years,” CEO Carol Tome said on the company’s earnings call.

“The actions we are taking to reconfigure our network and reduce cost across our business could not be timelier,” she said.

UPS, which beat Wall Street’s first-quarter-earnings forecasts, said in a statement that given the current macroeconomic uncertainty, “the company is not providing any updates to its previously issued consolidated full-year outlook.”

Thought all this drama, Amazon is preparing to report quarterly results on May 1.

Oppenheimer analyst Jason Helfstein lowered the investment firm’s price target on Amazon to $220 from $260 and affirmed an outperform rating on the shares.

At the same time Helfstein reduced his Amazon estimates to incorporate the uncertainty surrounding the tariffs.

Investors are highly uncertain about the tariff impact on e-commerce, the analyst said, but he expects the impact on profit margins to be greater than that for revenue, as Amazon tries to protect market share and its customers’ experience.

Related: Veteran fund manager who forecast S&P 500 crash unveils surprising update