Premarket Update: Nvidia Q1 report on deck

Happy Wednesday!

After the close of trading today, all eyes will turn to Nvidia (NVDA) as investors await the company’s Q1 earnings release. The Santa Clara, Calif., semiconductor maker is expected to report earnings of 93 cents a share on revenue of $43.2 billion, according to LSEG.

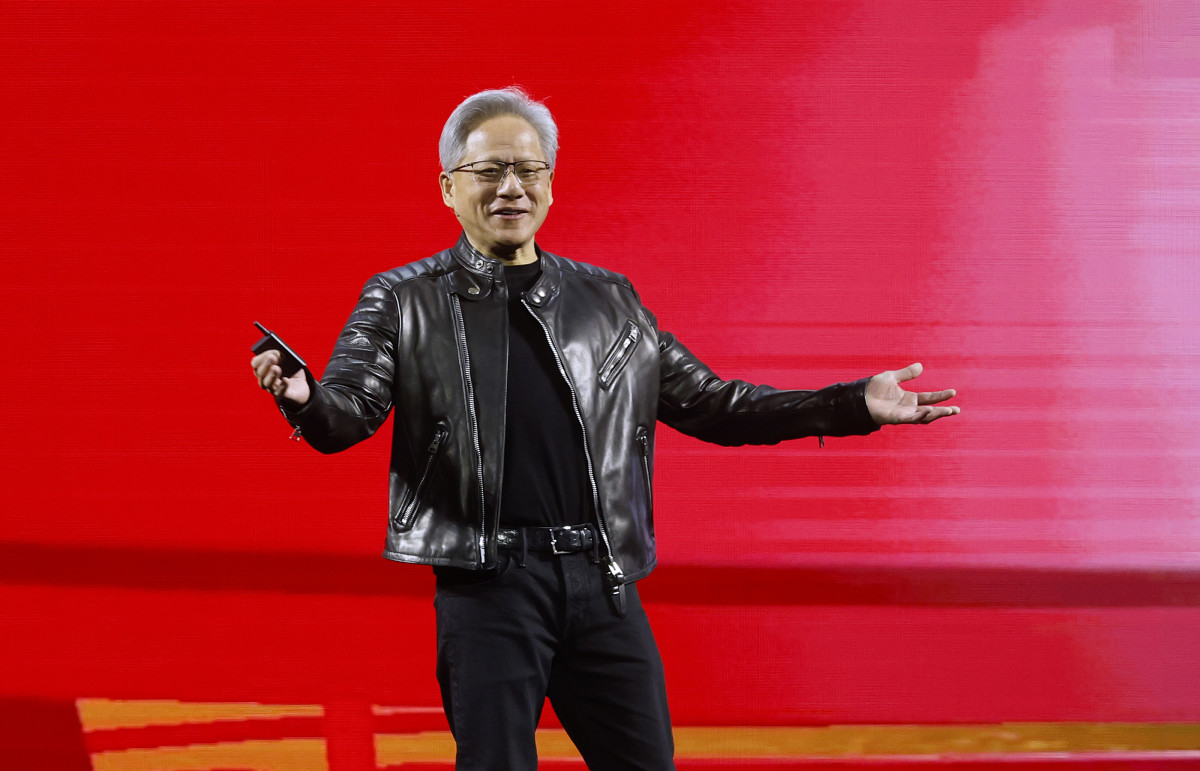

Nvidia CEO Jensen Huang delivers the keynote address during the Nvidia GTC 2025 at SAP Center on March 18, 2025, in San Jose, Calif. The company’s fiscal Q1 report is due after the bell May 28.

Nvidia CEO Jensen Huang delivers the keynote address during the Nvidia GTC 2025 at SAP Center on March 18, 2025, in San Jose, Calif. The company’s fiscal Q1 report is due after the bell May 28.

Justin Sullivan/Getty Images

TheStreet Pro’s Stephen “Sarge” Guilfoyle says in his Market Recon column today that investors should also be on the lookout for “the reality (or not) of the company’s April projection of a $5.5 billion inventory-based charge after President Trump tightened export controls for high-technology-type products headed for mainland China that could be used for military purposes.”

Nvidia shares are up in premarket trading.

What else is happening today? Salesforce (CRM) is also set to report after the close. Expectations are for quarterly earnings per share of $2.55 on revenue of $9.75 billion.

Yesterday was quite a day. Following Sunday’s news that the Trump administration’s aggressive tariffs on Europe would be delayed at least until July, stocks ripped more than 2% higher. All sectors were up, led by Consumer Discretionary, which gained nearly 3%. Breadth was strong, too.

As for today, expect the market to be less exuberant. S&P futures are up 0.11%, while the Dow is down slightly. European markets are lower.

Bond prices are slightly lower, sending yields up, while gold and crude oil are higher.