Stock Market Today

U.S. exceptionalism

This tweet is interesting:

Since Liberation Day, US stocks are exactly flat against the rest of the world pic.twitter.com/tr37nF1c8n

— Joe Weisenthal (@TheStalwart) July 7, 2025

The chart is a ratio of the price of two ETFs: The Vanguard Total Stock Market ETF versus the Vanguard FTSE All-World ex-US ETF. Essentially, it’s a chart of U.S. exceptionalism. When it’s going up, the U.S. stock market is outperforming the rest of the world.

You can see that it topped out in January 2025 as investors began moving money into the markets of other countries.

*Offers are valid for limited memberships

It has rallied since April, as our own stock market bottomed and rallied significantly off the lows, but even with the rally, in 2025, you’d be better off with your money in other countries.

Additionally, while the S&P 500 is off to new all-time highs, the rally is not lifting all sectors. Four out of the 11 S&P sectors remain below their “Liberation Day” levels. The winning sectors are tech, financials, industrials and communication services (aka Meta (META) and Google (GOOGL) ).

So, yeah, money’s flowing back into the U.S., but not to levels that indicate investors have trust in our markets.

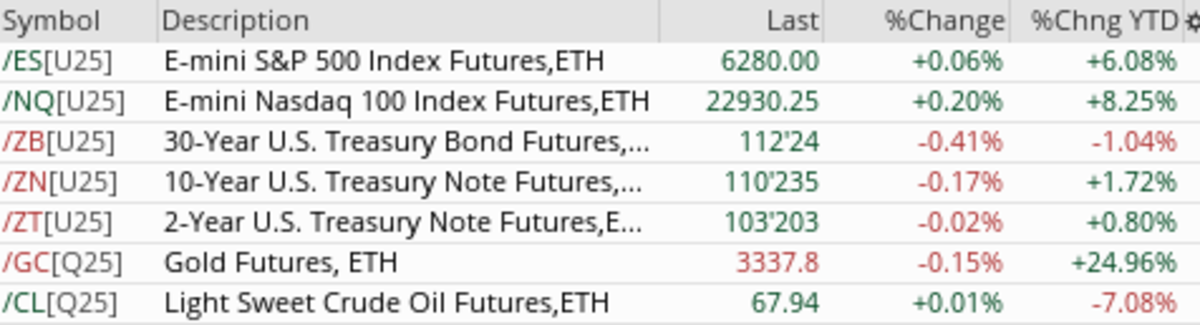

Premarket indications

The news on Monday was tariffs. We learned that 90 deals in 90 days was a bit too optimistic and that, while some deals have been made, many other countries have either not come to the table or are still negotiating. The deadline has been pushed to August 1 from July 9 (Wednesday).

President Trump on Monday shared that he will be sending letters to those trade partners that haven’t struck a new deal. Japan, South Korea and Malaysia, all key trading partners, are included in that list and will currently see tariffs of between 25% and 40%. Stocks, which were already down, sunk on the news.

On Tuesday morning, stock futures are slightly higher.

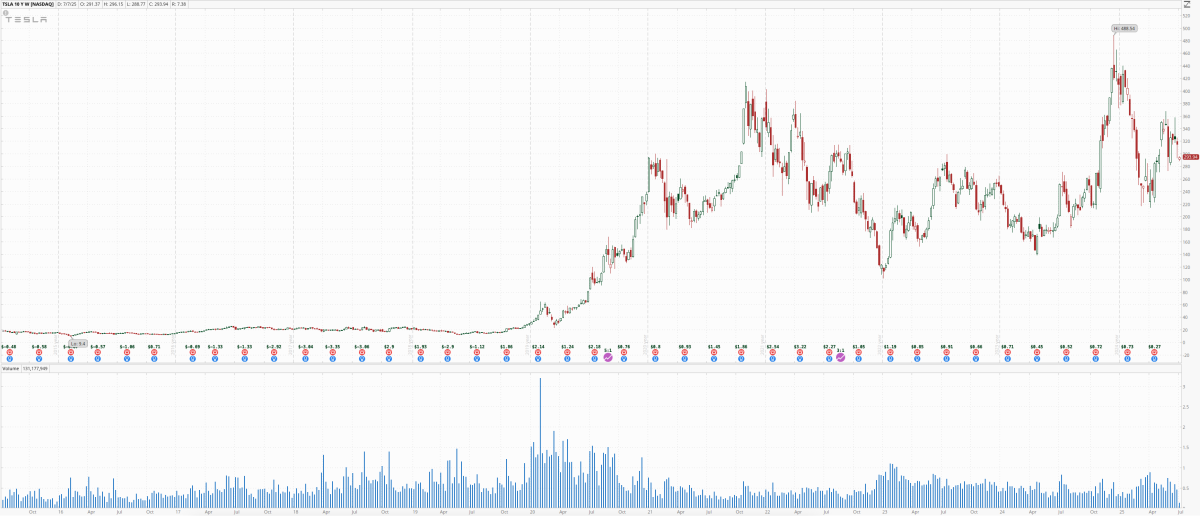

Among the Tuesday morning leaders are Nvidia (NVDA) and Tesla (TSLA) , gaining 0.70% and 1.23%, respectively. While Nvidia is up on Tuesday morning on continued investment into the AI arena, Tesla investors are enjoying a bounce following Monday’s 6.79% drop. Wedbush analysts reiterated their $500 price target on the stock but also implored the board to act to reign in Musk’s political activities and require him to spend more time doing his job as CEO and technoking.

Tesla stock is off 27.04% in 2025 and has basically traded sideways in a giant trading range since late 2020. Can Tesla regain the magic?