Nvidia (NVDA) has been the ultimate bellwether in GPUs, carving out a league of its own over time.

Whether it’s AI, gaming, or data centers, Nvidia’s been the top dog to which everyone’s been playing catch-up.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

Nvidia’s stock has been on fire, rocketing to the top spot as the most valuable company in town, defying the broader market’s wobble.

That said, how far can this rocket ship potentially soar? Some say Nvidia stock has done all the running it possibly can, while others feel it still has a sizeable upside ahead.

A fresh take from an old-hand analyst tells us about a key piece of information that could show where Nvidia stock is headed next.

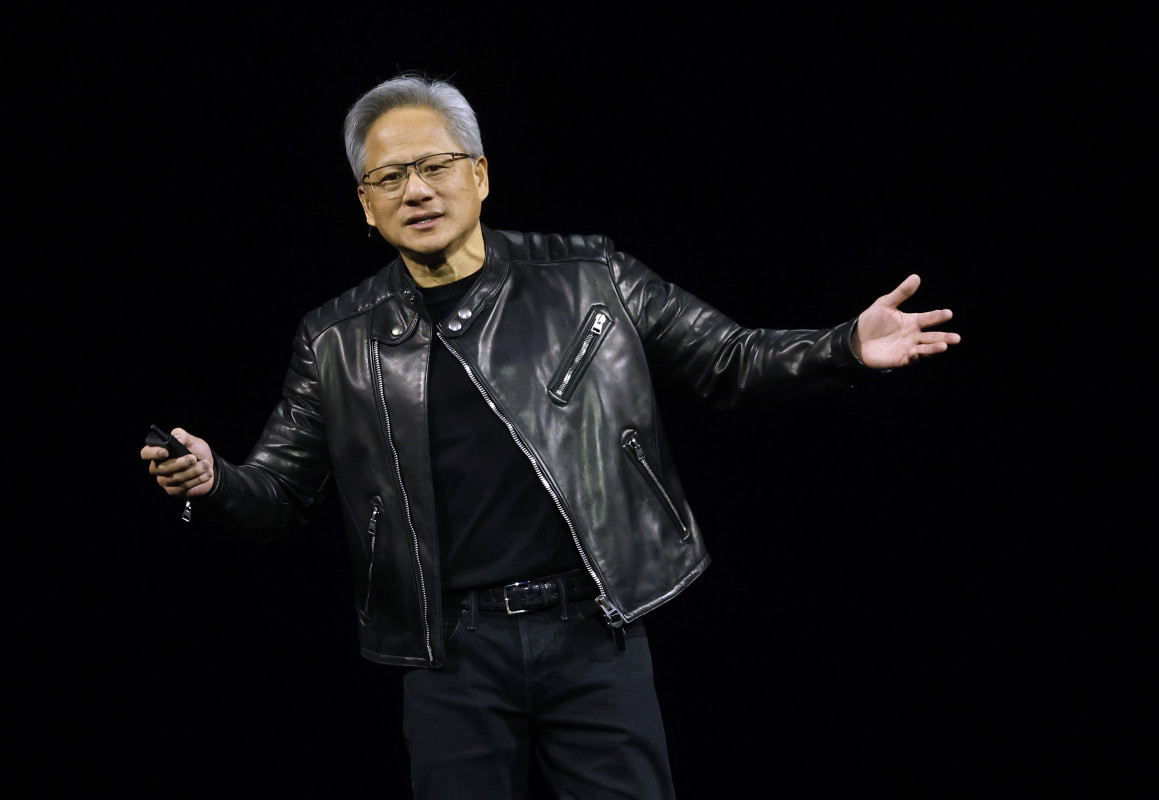

Investors watch Nvidia stock closely as demand keeps climbing.

Investors watch Nvidia stock closely as demand keeps climbing.

Image source: Justin Sullivan/Getty Images

Nvidia’s runaway GPU demand brings new questions

Since Nvidia CEO Jensen Huang showed off the company’s shiny new Blackwell chips last year, everyone from tech heavyweights to server makers has been lining up to grab them.

The show-stopper is undoubtedly the GB200 Grace Blackwell Superchip.

It’s essentially two of Nvidia’s powerful B200 GPUs layered with a custom CPU and tied together by a super-fast connection.

Tech giants like Dell, Cisco, Lenovo, HPE, and Supermicro jumped in on the action early to sidestep any supply snags.

Here’s the catch, though: the standalone B200 chip, targeted for server suppliers, has become hard to find. Nvidia has been putting most of its production muscle into the bigger GB200 version, making the B200 a lot scarcer.

Related: Nvidia-backed stock sends a quiet shockwave through the AI world

Meanwhile, demand for these chips has gone through the roof.

Microsoft alone brought close to half a million GPUs last year, double its nearest competitor. That massive buying spree helped propel Nvidia’s data center business to an eye-popping $26.3 billion in revenues in just the first quarter of 2025.

That’s roughly 90% of Nvidia’s total sales and more than double last year’s numbers.

On the supply side, Nvidia controls the game. Its partnership with TSMC lets it get the best production slots for its advanced chips.

However, even with such help, Nvidia needs to contend with bottlenecks in chip packaging and memory parts, which pushes prices up.

More Tech Stock News:

- Google’s quiet AI win spells trouble for Amazon

- JPMorgan delivers blunt warning on S&P 500

- Veteran Tesla analyst drops 4-word call

Nevertheless, given Nvidia’s powerful positioning, it commands robust pricing power and an iron grip on the AI chip market.

Nvidia’s B200 shortage could power more growth

Nvidia’s supply problem could potentially be its biggest edge.

Related: Top analyst revamps Nvidia price target for one surprising reason

Wedbush analysts recently wrapped up a two-week check across Asia and said that the demand for B200 chips is still way ahead of what Nvidia can make.

According to Wedbush, Nvidia is still focusing on premium GB200 unit shipments, the more power-packed combo chips that power the latest AI servers. That effectively means the standard B200, running on PCIe slots that work in more generic servers, is scarce.

For Nvidia, that’s great news.

More GB200 sales mean bigger, more complex servers, including larger orders for related Nvidia products like high-speed networking gear.

Companies such as Dell are already riding this wave. Wedbush highlights Dell’s solid second-quarter guidance, including healthier sales from Gigabyte and Wistron, suggesting these high-end AI servers are moving quickly.

Wedbush also notes that old-school, non-AI server demand is also picking up. It’s unclear, though, if that bump will last through the rest of the year, and it may not matter much with AI demand stealing the spotlight.

On the sidelines, AMD could chip away at more CPU market share this year. However, Wedbush says it’s still waiting to see real momentum for AMD’s new MI350 chips before declaring it a winner.

Similarly, there’s another supply squeeze brewing in the storage industry. Hard drive makers like Western Digital and Seagate are seeing tighter supplies for drive heads, which could drive prices higher and result in higher profit margins.

Western Digital has a big edge with its PMR drives, but Seagate could pull ahead in 2026 as it ramps up its latest HAMR tech.

Bottom line? Nvidia’s supply crunch keeps prices elevated and Wall Street happy.

Related: Europe’s bold AI play spells jackpot for Nvidia and AMD