On TheStreet Pro Stephen “Sarge” Guilfoyle asks whether yesterday’s tariff letter to Canada was one letter too many.

You see, after President Trump shared the letter, which set a 35% tariff on goods not covered under the USMCA trade deal Trump brokered during his first term, futures fell.

After all, we still don’t have a deal with Europe, and if we’re willing to go to 35% with one major partner, what’s in store for our neighbors across the Atlantic?

The president also told NBC News in a phone call with Kristen Welker that the “tariffs have been very well-received. The stock market hit a new high today.”

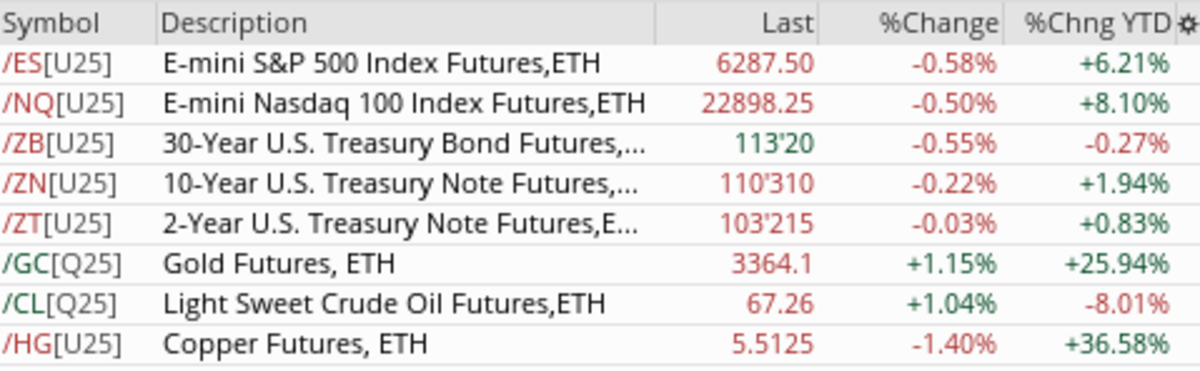

As of now, stock futures indicate that the S&P 500 and Nasdaq will open around 0.6% lower.

Bonds, too, are lower, pushing yields higher across the curve. The U.S. 30-year treasury is priced to yield 4.9%, while the 10-year yields 4.38% and the 2-year yields 3.88%.

Gold is higher by 1.26%, likely following along with bitcoin, which notched a new high yesterday and is even higher in early trading today. The cryptocurrency broke out of a nearly two-month consolidation and has been as high as 118,839 vs. the U.S. dollar.

Yesterday, I asked whether Nvidia (NVDA) could push the market to new highs. And it did. Today, that stock is helping the market lower.

Most of top stocks in the S&P 500, including Microsoft (MSFT) , Apple (AAPL) , Alphabet (GOOGL) , Meta (META) , and Tesla (TSLA) , are down by about 0.5%. Only Amazon (AMZN) is higher, also by 0.5%.