Wall Street loves a comeback story, but Intel’s (INTC) might come with a twist no one expected.

As the chip giant attempts a high-stakes turnaround, a top analyst warns that the road ahead may not just be bumpy, but structurally flawed.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

And with the competition racing ahead, time is unlikely to be on Intel’s side.

Nevertheless, the investing world is watching intently, but something’s brewing behind the scenes, where one key rival is now playing a bigger role than ever.

Intel stock faces pressure as Taiwan Semiconductor tightens its grip on next-gen chipmaking.

Intel stock faces pressure as Taiwan Semiconductor tightens its grip on next-gen chipmaking.

Image source: picture alliance/Getty Images

How Intel lost its lead and Taiwan Semiconductor took the crown

Not long ago, Intel ruled the roost in the semiconductor space.

In the 2000s and early 2010s, it threw its weight around with robust x86 CPUs, while running its own world-class fabs.

The company had this tight “design-and-build” model and kept nailing process-node upgrades like clockwork. Then it got cocky.

Intel had an “oops” moment when it passed up making the chip for the original iPhone. It also shrugged off Arm-based CPUs, and perhaps worst of all, it started blowing its 10 nm and 7 nm roadmaps.

Related: Mark Cuban delivers 8-word truth bomb on AI wars

Meanwhile, the competition chipped away at its lead.

By the time generative AI burst out onto the scene in 2022, Intel was on the ropes. Its once mighty data-center share tanked from 70% in 2021 to just 10% by 2024.

That same year, it posted a jaw-dropping $19 billion loss, just three years after a $20 billion profit.

Meanwhile, TSMC (TSM) surged. While Intel stumbled, TSMC nailed 5 nm and 3 nm manufacturing, and it has arguably become the go-to foundry for Nvidia and AMD’s AI chips.

Those monster GPUs training ChatGPT, Gemini, Grok, and other generative AI models? Yeah, most of those are built in TSMC fabs.

To make things worse for Intel bulls, TSMC’s market cap blew past $1.2 trillion by July 2025.

Intel, on the flip side, is still outsourcing 30% of its own production to — you guessed it — TSMC. Even components of its flagship Lunar Lake and Meteor Lake chips are built by its chief rival.

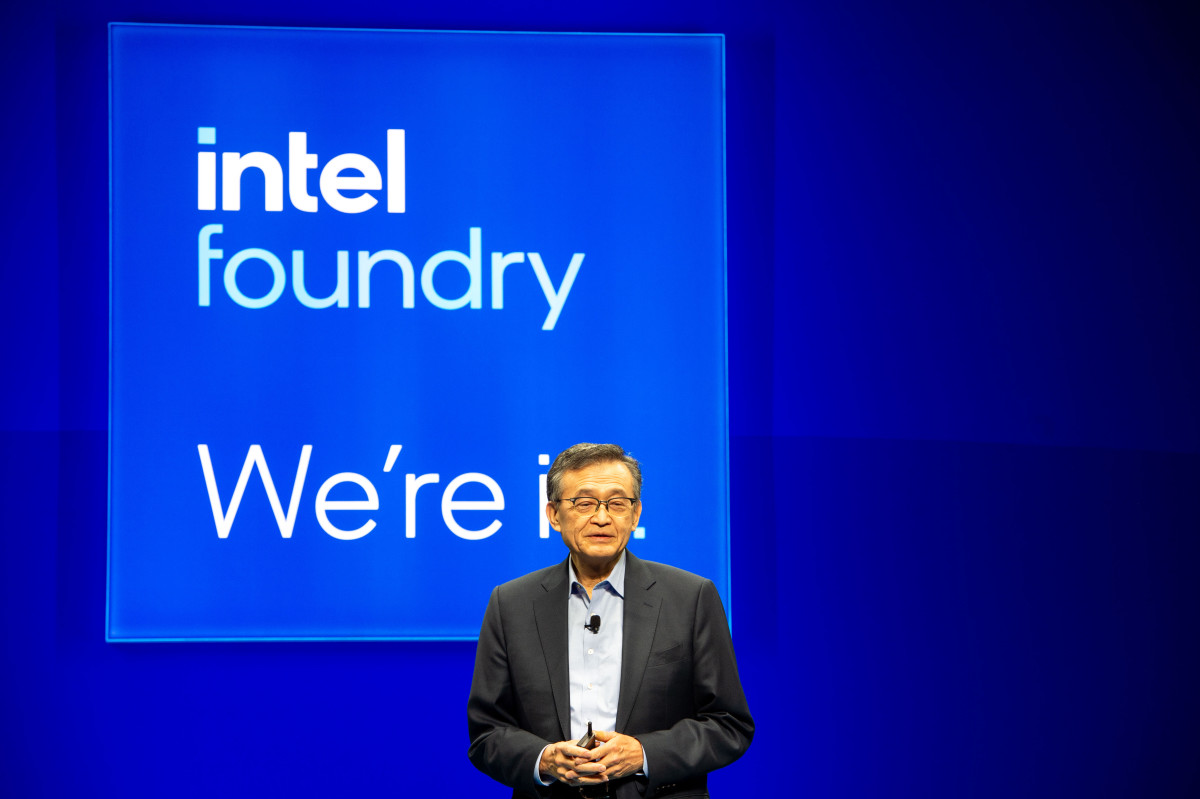

Things got bad enough that Intel booted CEO Pat Gelsinger in early 2025, bringing in Lip-Bu Tan to fix the mess.

He swung hard, reducing 20% of the headcount, while pivoting sharply to edge and agentic AI. But even Tan admitted that catching up to the Nvidia behemoth in AI training was a lost cause.

Now Intel’s looking to rebrand as a player in specialized AI accelerators and shake things up in its foundry business.

More News:

- Top economist drops 6-word verdict on Trump tariffs, inflation

- JPMorgan reveals 9 stocks with major problems

- Major analyst revamps Nvidia stock price target after China surprise

However, with TSMC running laps in tech and ecosystem scale, it’s clear who’s calling the shots in this new AI chip war.

Loop Capital analyst flags a Catch-22 with Intel’s turnaround plans

Loop Capital’s Gary Mobley feels Intel is caught in perhaps the nastiest investing trap around: a full-blown Catch-22.

The chipmaker is looking to play catch-up to rivals like Nvidia and AMD on the product side. However, in doing that, it needs to rely on the same competitor that’s eating its lunch in Taiwan Semiconductor.

Mobley’s core argument is simple; Intel’s Foundry division needs to help turn the company around, but it’s what is actually dragging it down.

Intel’s in-house advanced-node manufacturing is still far behind TSMC’s. So if Intel wants to make cutting-edge chips that can compete with the best, it may have to outsource to TSMC.

Related: Bank of America makes its boldest AMD call yet

That’s already a tough pill to swallow, but it gets worse.

Intel needs higher product volumes to make its Foundry arm profitable, as its fixed costs would only make sense at scale.

However, funneling more chip production to TSMC undermines its own Foundry business. So Intel can either lose out on quality or on margin. That’s the Catch-22.

Meanwhile, Taiwan just took things up a notch again.

The island nation showed off a humongous $510 billion national strategy in dominating global AI development by 2040.

The plan includes the development of three major global research hubs, creating close to half a million jobs, while securing billions in VC capital.

That said, if TSMC continues charging ahead, Intel could find itself even more dependent on its rival to compete in the AI arms race.