With 90 minutes to the market open, all three major indexes are flat. The S&P 500 is seeking its fifth consecutive record close.

Premarket Preview: Four Dozen Earnings Reports

Friday is generally a quieter day for earnings, but per Nasdaq, we’re getting 47 reports today; almost all of which will be before the market opens today.

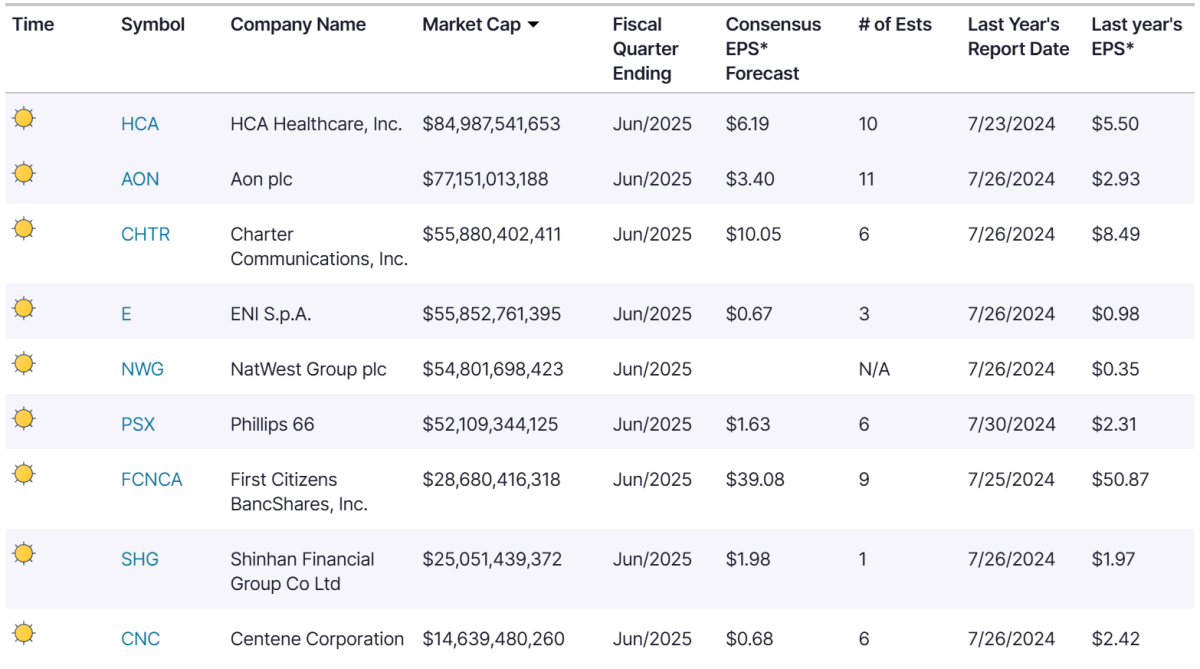

Among the largest are hospital operator HCA Healthcare (HCA) , insurer Aon (AON) , and Charter Communications (CHTR) , the communications-services parent of Spectrum.

A.M. Earnings

A.M. Earnings

In addition, investors can also expect some illuminative reports from government services contractor Booz Allen Hamilton (BAH) and car retailer AutoNation (AN) .

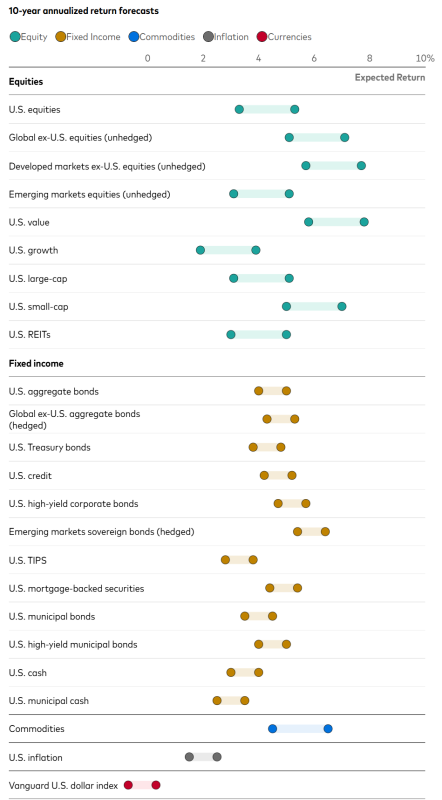

Vanguard Warns on Growth

A month ago, passive-investing goliath Vanguard published findings from its Capital Markets Model, which showed that commodities, global equities, and U.S. value stocks could deliver the most compelling returns over the next decade.

It even made some fixed-income investments look compelling compared with U.S. growth, U.S. REITs, and emerging-market equities.

Yesterday, in a rerunning of its markets-model forecast, it eased up on some of its U.S. optimism, pointing to stretched valuations in U.S. equities. Notably, U.S. growth stocks are now seen growing at a rate barely beating inflation expectations.

Per Vanguard, here’s the 50th percentile range of returns for the next 10 years:

Vanguard’s 10-year annualized nominal return and volatility forecast (July 2025)

Vanguard’s 10-year annualized nominal return and volatility forecast (July 2025)

Over the longer run Vanguard sees domestic returns being a bit stronger. Over 30 years, investors can expect returns to be multiple percentage points higher on an annualized basis.

Vanguard notes that the outlook of the VCMM could change over time based on market conditions. The model’s perspective can be ascribed in large part to its assessment of the market environment and valuations, which we’ll touch on later today.

Uh, Everything All Right, Intel?

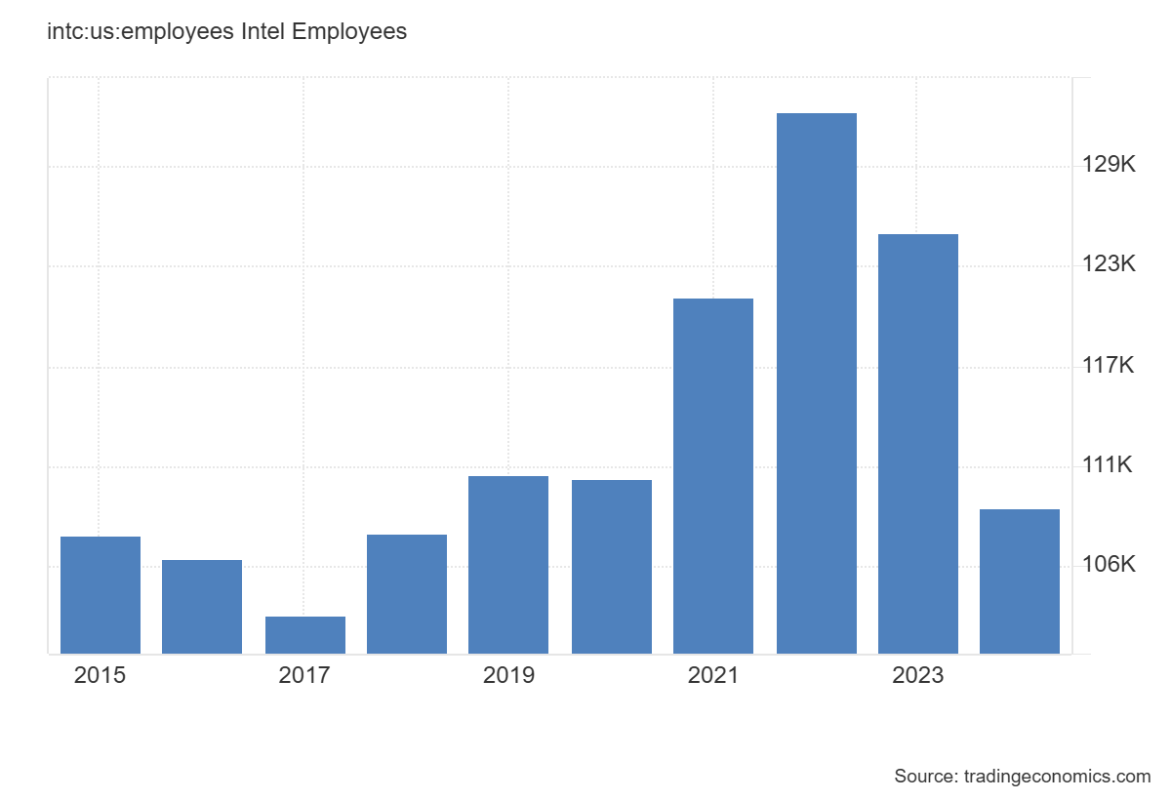

Intel (INTC) might have beaten analyst expectations and notched a small gain after its quarterly results, but investors weren’t in love with the story that new CEO Lip-Bu Tan laid out on the company’s 5 p.m. EDT Thursday earnings call.

After reporting a fifth consecutive quarter of losses — this time, $2.9 billion — the company said it would cut 25,000 employees and reduce its foundry investments. The stock pared its early gains on the news.

With that, Intel says it planned “to end the year with a core workforce of about 75,000 employees.” That will still be substantially more than foundry competitors like Taiwan Semiconductor (TSM) , as well as chip competitors Advanced Micro Devices (AMD) and Nvidia (NVDA) . Still, it’d be the fewest number of employees since fiscal 2009.

Intel employee count at end of fiscal year (2015-2024)

Intel employee count at end of fiscal year (2015-2024)

That would mean that 45% of the company’s workforce has either been dismissed or has abandoned ship since 2022, eliminating substantially all the job additions it made as it pursued its foundry expansion.