Apple is notoriously close-to-the-vest when it comes to making announcements, preferring to keep loyal fans and die-hard investors in the dark until the timing is right.

The company’s “one more thing” mentality, reflected by founder Steve Jobs’s surprising product reveals at Apple keynote conferences, appears shared by current CEO Tim Cook. In contrast to other big tech leaders, including Elon Musk, Cook often lets Apple’s products do the talking.

As a result, investors often look closely at Cook’s comments during conference calls, looking for clues to what he may have planned for the company next.

During Apple’s second-quarter earnings conference call, Cook may have dropped his guard a little when he offered an interesting response about Apple’s massive cash stockpile and artificial intelligence ambitions.

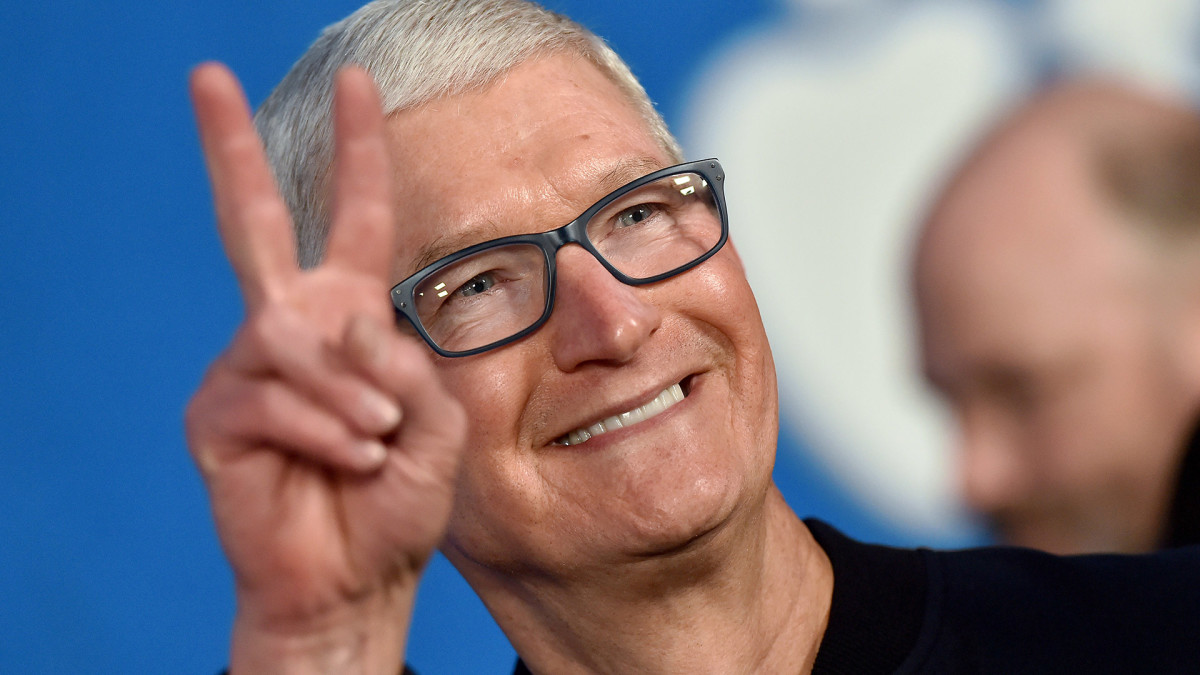

Apple CEO Tim Cook is under pressure to accelerate Apple’s artificial intelligence roadmap.

Apple CEO Tim Cook is under pressure to accelerate Apple’s artificial intelligence roadmap.

Axelle/Bauer-Griffin/FilmMagic

CEO Tim Cook says Apple is open for business

Apple reported a solid June quarter that outpaced analysts’ expectations.

Revenue was a whopping $94 billion, up 10% year over year, and almost $5 billion better than Wall Street expected. Net income was over $23 billion, resulting in earnings per share, or EPS, of $1.57, up 12% from one year ago, and 14 cents ahead of estimates.

Related: Veteran analyst spots unexpected star in Apple’s earnings report

The company’s massive profit lifted its cash hoard to about $36 billion from roughly $30 billion last year, giving it plenty of financial firepower to invest in its products and software.

And that’s precisely what investors want to see happen.

While competitors like Google have gone all in on artificial intelligence, developing the AI chatbot Gemini, Apple’s AI strategy has been criticized as too little, too late.

The company’s arguably slow development of AI solutions relative to peers has left many investors wondering if Tim Cook’s number-crunching mindset sets Apple on a course of missing out on the most significant opportunity since the dawn of the Internet.

However, during Apple’s earnings conference call, Cook acknowledged that he’d consider accelerating Apple’s AI efforts by using its massive cash war chest.

When Citi analyst Atif Malik asked about the prospects of “big M&A,” Cook responded bluntly.

“We’ve acquired around seven companies this year,” said Cook on the call. “We’re very open to M&A that accelerates our road map… We are not stuck on a certain size company.”

Cook said he didn’t have anything to announce currently, but his willingness to consider a big deal could mean that reports of interest in Perplexity, a major AI player, may have merit.

Buying Perplexity could make sense for Apple

Cook aims to accelerate Apple’s development timeline, ostensibly via internal research and development and smaller bolt-on deals. However, if he really wanted to, he could do a deal to acquire Perplexity that could, as he put it, “help us accelerate a road map.”

Related: Apple looks to ditch Goldman Sachs for big bank rival

Perplexity provides an AI chatbot similar to Google and OpenAI’s ChatGPT, but there are key differences. It has its own in-house model, Sonar, that’s built on Meta Platforms’ Llama open source code. It’s also leaned on rival chatbots, including DeepSeek’s R1. Subscribers to its Pro tier can also toggle between other large language models, including OpenAI, Gemini, Anthropic’s Claude, and Elon Musk’s Grok.

Acquiring Perplexity would instantly give Apple an established model for monetizing AI. Perplexity operates on a freemium model, with a no-cost introductory subscription and paid service.

Perplexity prioritizes real-time insight with direct responses — a design that arguably matches Apple’s deep focus on user experience.

In short, Perplexity’s desire for a better chatbot user experience aligns nicely with Apple’s approach, historically.

Perplexity would cost Apple a pretty penny

Cook says Apple has acquired seven companies this year, about one “every several weeks.” Those deals, however, are small and haven’t cost the company much of its war chest.

Buying Perplexity would be a different story.

Perplexity, which launched in 2022 around the same time as ChatGPT, has over 22 million monthly active users. Its annualized revenue could hit $150 million this summer, according to About Chromebooks data, up from an ARR of $63 million exiting last year.

The company’s rapid user growth translated into Perplexity answering 780 million queries in May, according to Index.dev, which was up from 230 million in August 2024. Also in May, its website recorded 153 million visits, about triple the number from March.

Perplexity isn’t publicly traded, is currently reportedly valued at $18 billion, and its AI search market share is about 6%.

Related: Apple announces major store closing and new opening