This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Monday. This is TheStreet’s Stock Market Today for Aug. 26, 2025. You can follow today’s market updates, all day, here on our daily live blog.

Update: 8:08 a.m. ET

Morning Headlines: AT&T and EchoStar make 5G deal; Eli Lilly’s weight loss drug wins out; IBM and AMD partnership

Aside from the Trump news that’s stirring the pot this morning, here are a few other headlines that are crossing the wire this morning (and bound to make an impact on early trading):

AT&T (T) will spend $23 billion to buy 5G spectrum licenses from Dish Network parent EchoStar (SATS) , which has been under pressure to sell its 5G spectrum after failing to build a 5G network of its own.

Eli Lilly’s oral weight loss pill, orforglipron, cleared its primary endpoint in a crucial phase 3 trial, a move which will clear its way for approval next year.

International Business Machines IBM and Advanced Micro Devices have announced a partnership to “develop quantum-centric supercomputing”, per Axios.

Spotify is reportedly considering raising prices in new markets after launching a new direct messaging (DM) feature to the platform, per FT.

New research from Stanford University economists has found “clear, evident change” from the impact of AI on entry-level hiring, per WSJ.

Update: 7:56 a.m. ET

Catching Up: Here’s Why Trump Is Moving Markets

In case you’re just joining us this morning…

- U.S. equities are down in futures trading, led lower by the Nasdaq (-0.22%)

- Gold is up, rising 0.27%

- The 30Y Treasury yield jumped 2.8 basis points to 4.917%

- The U.S. Dollar Index is down 0.27%

The early morning movements are a product of jitters kicked up by two posts that President Trump made last night. One took aim at the Fed, the other at countries floating possible ways to offset the impact of American tech.

The first of the two took aim at the Fed’s Lisa Cook, who Trump and allies have been trying to push out of the central bank’s top governing board on allegations that she committed mortgage fraud. Trump attempted to fire Cook, but she said she isn’t going, claiming he has “no authority.”

Related: Trump rebuffed by Fed Governor who he tried to fire

Not long after, Trump sounded off about countries seeking to tax, regulate, or legislate “incredible American tech companies,” likely taking aim at policies by the European Union and other countries, which have created legislation that allows the bloc to levy significant fines against conglomerates acting in ways they consider anticompetitive.

Both developments are creating waves this morning. At the same time, the President and team have indicated a desire to expand investments in key domestic industries, building a sovereign wealth fund-like investment vehicle to make strategic investments.

Trump has also signaled a willingness to expand the U.S. military and national guard’s presence from Washington, D.C. to Chicago, expanding a federal crackdown his administration says is about taking on crime.

Update: 7:44 a.m. ET

Earnings Today: BMO Bank, Prudential, MongoDB

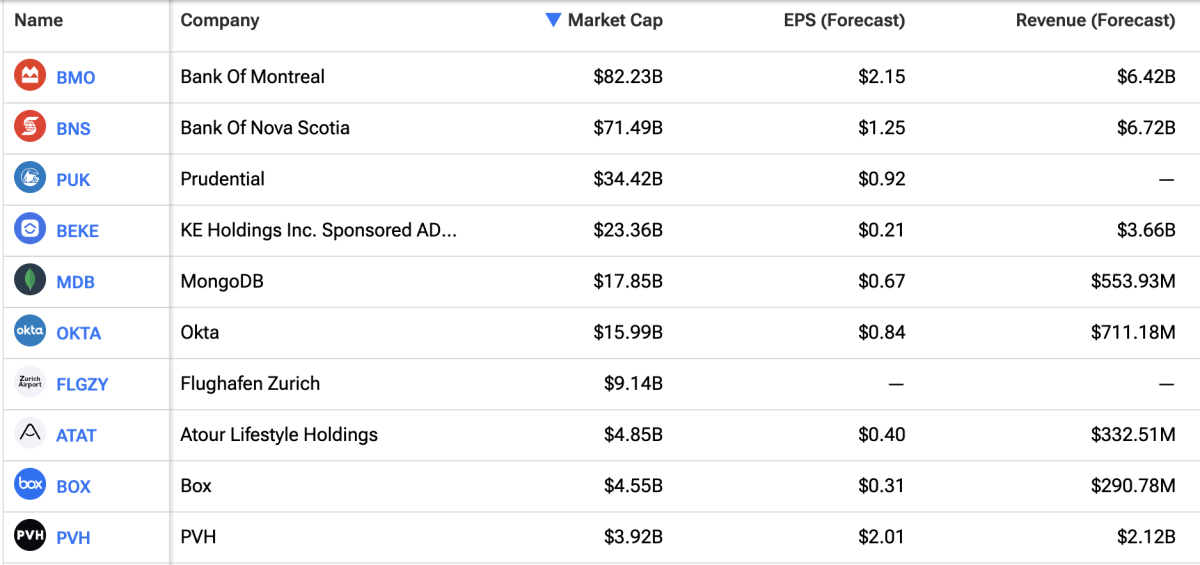

Today, there are 36 earnings calls slated, per data from Nasdaq. Among them are reports from the Bank of Montreal (BMO) , insurance goliath Prudential (PUK) , and software firms like MongoDB (MDB) , Okta (OKTA) , and Box (BOX) , among others.

Here are the top ten, sorted by market cap, per TipRanks:

Economic Data: Durable Orders, Home Prices, CB Consumer Confidence

Today is expected to see some big data reports. Here are a cropping of the most important that will be getting attention throughout the day (All times are in Eastern):

8:30 a.m.

- Durable Goods Orders MoM (Jul) [Prev: -9.3%] [Consensus: 4%]

- Richmond Fed President Barkin will deliver remarks

8:55 a.m.

- Redbook YoY (Wk of Aug. 23) [Prev: +5.9%]

9:00 a.m.

- S&P Case-Shiller Home Price YoY (Jun) [Prev: +2.8% YoY] [Cons: +2.1%]

- S&P Case-Shiller Home Price MoM (Jun) [Prev: -0.2% MoM] [Cons: 0%]

10:00 a.m.

- Conference Board Consumer Confidence (Aug) [Prev: 97.2] [Cons: 96.2]

- Richmond Fed Manufacturing Index (Aug) [Prev: -20] [Cons: -17]

10:30 a.m.

- Dallas Fed Services Index (Aug) [Prev: 2]

1:00 p.m.

- 2-Year Note Auction [Prev: 3.92%]

- Money Supply (Jul) [Prev: $22.02T]

4:30 p.m.

- API Crude Oil Stock Change (Wk of Aug. 22) [Prev: -2.4 million]