This live blog is refreshed periodically throughout the day with the latest updates from the market. To find the latest Stock Market Today threads, click here.

Happy Thursday. This is TheStreet’s Stock Market Today for Aug. 28, 2025. You can follow today’s market updates here on our daily live blog.

Update: 4:48 a.m. ET

Pre-Market Reactions: Stocks higher after Nvidia earnings

By many measures, Nvidia’s (NVDA) Wednesday evening earnings report was average. At first, investors didn’t love that, even if it came with a healthy beat and raise. But after a modest downturn in the after hours trade, it’s once again on the rise.

U.S. equity indexes are coming along with. At last glance, the Russell 2000 (+0.66%) was leading the pack, continuing its recent string of strong showings. Dow (+0.23%), S&P 500 (+0.13%), and the Nasdaq Composite (+0.08%) are also up.

Update: 4:32 a.m. ET

A.M. Earnings: TD Bank, Dollar General, Li Auto

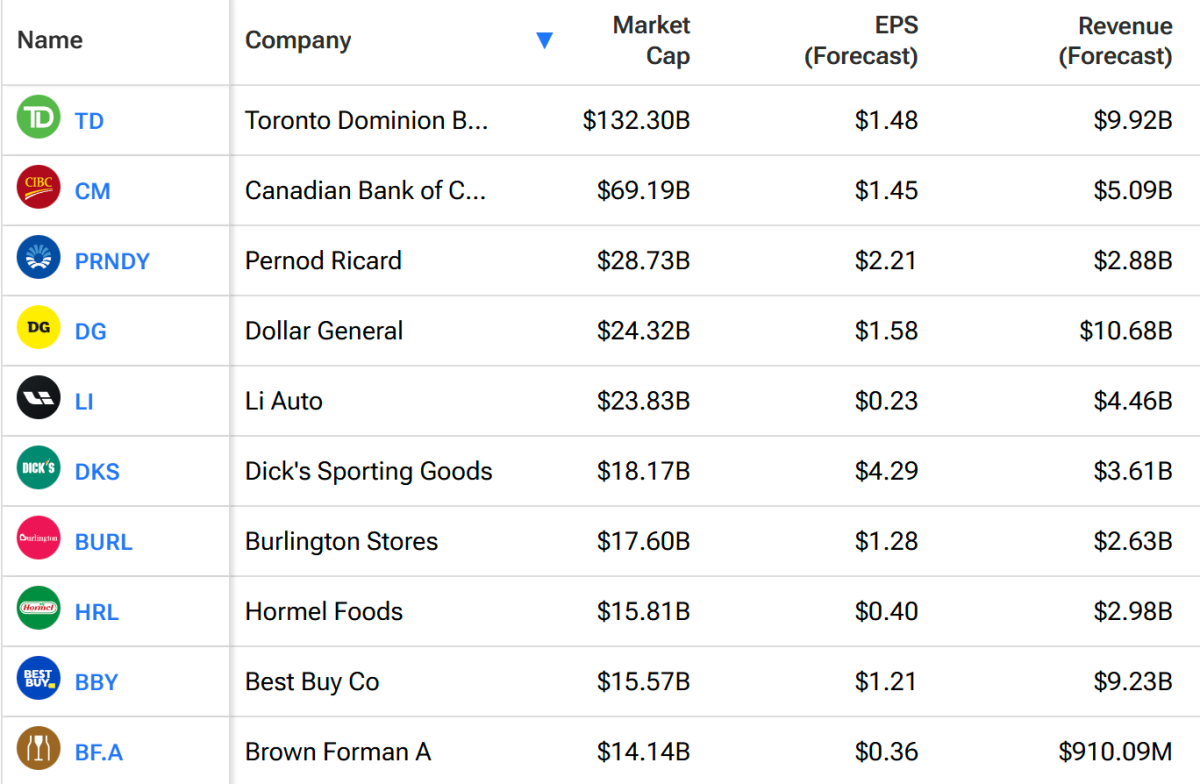

Per Nasdaq, there are 53 reports today. This morning, we’ll be seeing about half of those reports, per TipRanks. The largest among them will be two Canadian banks, discount retailer Dollar General (DG) , and Chinese EV brand Li Auto (LI) .

A.M. earnings (Aug. 28, 2025)

A.M. earnings (Aug. 28, 2025)

Economic Data: MBA Mortgage Data & EIA Data

After a quieter Wednesday, Thursday is shaping up to be a big day of economic reports. At the top of the morning, we’ll be getting a fresh estimate of Q2’s GDP, plus jobless claims data. And later in the morning, we’ll get a glimpse of personal consumption expenditure (PCE) data.

Where not expressed, growth figures are year-over-year. QoQ signifies quarter-over-quarter growth in a figure. MoM refers to month-over-month. Est signifies that the figure is an estimate.

Here’s what is top of mind:

8:30 a.m. ET

- GDP Growth Rate Q2 2nd Est [Prev: -0.5% QoQ] [Consensus: +3.1%]

- GDP Price Index 2nd Est [Prev: 3.8% QoQ]

- Corporate Profits QoQ Prel [Prev: -3.3%]

- Initial Jobless Claims [Prev: 235,000] [Cons: 230,000]

- Continuing Jobless Claims [Prev: 1,972,000] [Consensus: 1,970,000]

- PCE Prices 2nd Est

- Real Consumer Spending

10:00 a.m. ET

- Pending Home Sales (Jul) [Prev: -0.8% MoM; -2.8% YoY]

4:30 p.m. ET

- Fed Balance Sheet (Wk of Aug. 27) [Prev: $6.62 trillion]

6:00 p.m. ET

- Fed Governor Christopher Waller is set to speak