Needless to say, Nvidia isn’t just riding the AI wave; it’s effectively building the ocean.

Its power-packed GPUs have become the default rails for training and inference across hyperscalers and Fortune 500 stacks.

Its software stack isn’t far, either, as its CUDA and enterprise AI suites tighten the moat. Additionally, in data centers, at the edge, and even in defense workloads, Nvidia has become the connective tissue for AI infrastructure.

That context adds a ton of weight to Wall Street’s latest call on the stock, making it a potential needle-mover.

Cantor Fitzgerald’s C.J. Muse just reset Nvidia’s stock price target in a big way. The implication is obvious that this isn’t a one-and-done hype phase, but more of a multi-year buildout with superb operating leverage and software monetization that’s still underappreciated.

Muse’s credentials matter here.

He’s a top-ranked semiconductor analyst who’s popular for sharp timing on chip-cycle inflections. Per TipRanks, he’s ranked #62 of 10,081 analysts, boasting a 71% success rate across 244 ratings, along with an average return of +39.2% per call.

And he isn’t just dropping chip takes.

Muse moves sentiment on the sector bellwethers like Nvidia and AMD with real supply-chain intel and valuation chops. That’s exactly the read-through that turns a price-target bump into a more fleshed-out AI-infrastructure thesis.

Cantor Fitzgerald’s C.J. Muse raised eyebrows with a bold new Nvidia call, citing unmatched AI positioning and long-term visibility into 2026.

Cantor Fitzgerald’s C.J. Muse raised eyebrows with a bold new Nvidia call, citing unmatched AI positioning and long-term visibility into 2026.

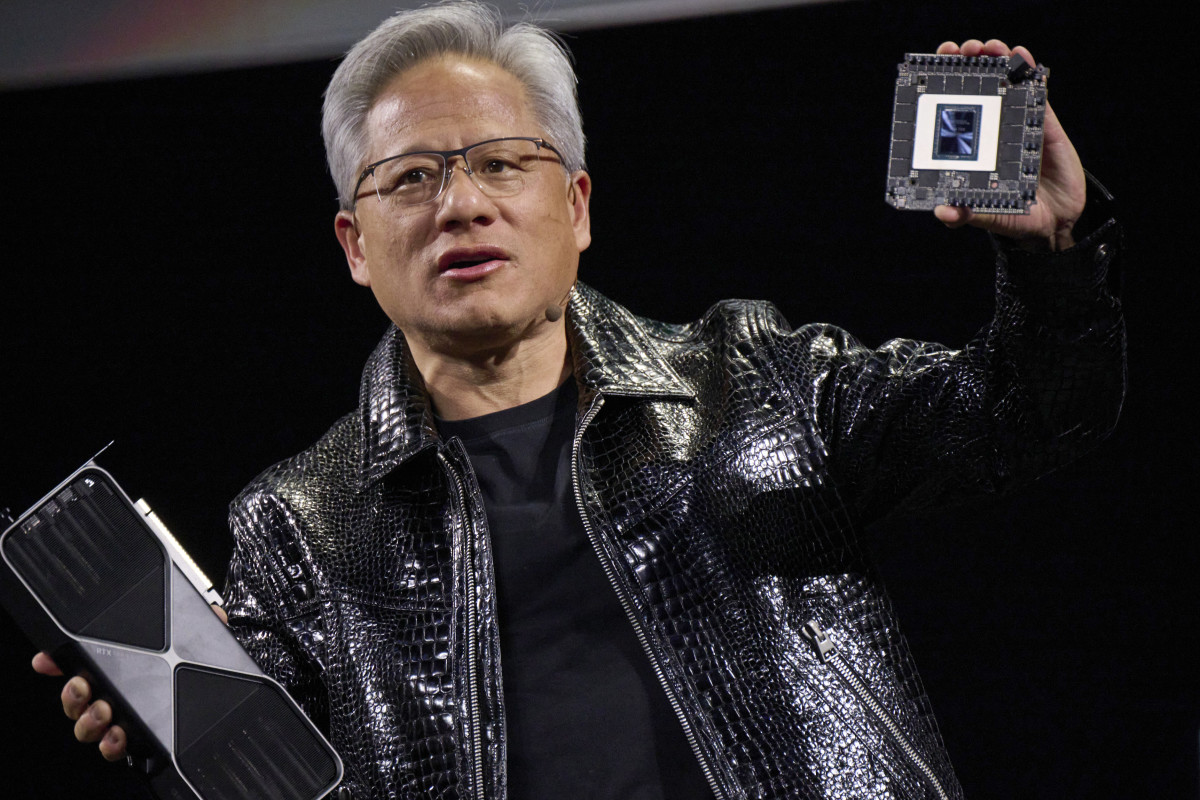

Image source: Bennett/Bloomberg/Getty Images

Top-rated analyst unveils eye-popping Nvidia price target

Cantor Fitzgerald’s C.J. Muse just turned the volume up on Nvidia’s latest rally.

In a fresh note, Muse bumped his price target on Nvidia stock to $300 from $240, calling it “a reflection of the company’s unmatched position at the center of the AI infrastructure buildout.”

For context, Nvidia’s stock traded around $183 at the latest close. The new target implies a nearly a 64% upside, suggesting that the chipmaker’s dominance isn’t ending anytime soon.

More Nvidia:

- Amazon’s new Alexa feature impacts Nvidia

- Goldman Sachs tweaks Nvidia’s stock price target with a twist

- Fund manager drops bombshell call on Nvidia stock

Muse hailed Nvidia’s H100 and H200 Tensor Core GPUs as the “undisputed standard for AI workloads,” with demand bleeding into hyperscalers, enterprise build-outs, and defense networks.

Also, he didn’t just hype the hardware, with Muse flagging Nvidia’s underloved software goldmine, from CUDA to DGX Cloud and enterprise AI. According to Muse, this sticky layer “will ultimately drive higher-margin, more durable earnings power” as customers look to lock in more to Nvidia’s ecosystem.

Related: Veteran Tesla analyst drops jaw-dropping new price target

Speaking of earnings, Cantor just raised its FY2026 EPS forecast to $5.55 from $4.82, projecting sustained long-term upside as the company looks to scale its AI-as-a-service offerings.

Wall Street has followed suit, with bullish targets now clustering between $250 and $350. That said, it’s important to note that Nvidia’s stock is already up more than 37% YTD. It continues defining the AI trade this year, with Muse’s call just pouring more fuel on that fire.

Quick takeaways:

- Cantor Fitzgerald’s C.J. Muse bumped Nvidia stock’s price target to $300 from $240 (a 64% upside from the stock’s latest close near $183).

- Muse says Nvidia’s H100 and H200 GPUs remain the “undisputed standard” for AI workloads.

- Cantor raised its FY2026 EPS forecast to an incredible $5.55.

- Nvidia stock is up more than 37% YTD, solidifying its lead in the global AI buildout.

Nvidia outlook: what to watch into year-end

Nvidia is heading into the final stretch of 2025 with some massive tailwinds powering it.

Hyperscaler AI spend isn’t slowing down anytime soon, with Microsoft, Amazon, Meta, and Google still scaling both training and inference infrastructure. Additionally, the public sector and defense sectors’ traction only adds to the tremendous backlog.

Hence, if that second leg of demand plays out, Nvidia’s data-center growth stays elevated through Q4. Also, H200 deployment and the transition to Blackwell will be critical in how cleanly Nvidia sustains its superb momentum.

Related: Major analyst drops 5-word take on market pullback

That means that if lead times hold and packaging capacity scales, it’s a green light. Any supply friction or weaker Blackwell launch signals could shift timing.

Moreover, software remains Nvidia’s biggest re-rating lever.

CUDA, DGX Cloud, and enterprise AI subscriptions continue expanding recurring sales while pushing its gross margins higher. If we see a shift in the mix, Nvidia could look more like a software platform than a chip vendor by the close of the year.

Potential headwinds remain, though.

Tighter U.S.-China export controls, an evolving geopolitical climate, and growing pressure from AMD and hyperscaler custom silicon can weigh on sentiment. However, if Nvidia executes impressively on its roadmap and hyperscaler demand holds up, the setup into 2026 remains structurally robust.