This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Tuesday. This is TheStreet’s Stock Market Today for Oct. 21, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 8:24 a.m. ET

A.M. Reactions: GM, RTX, Newmont, Northrop

As aforementioned, a number of reports have already happened this morning and elicited reactions from investors. Among them are General Motors (+10.09%) and RTX Corp (+4.8%), as well as PulteGroup (-2.53%) and Northrop Grumman (-2.16%).

Here’s the cropping of some of the largest morning reports sourced from TipRanks, which seem to be coming in mostly in line on revenue, but so-so on EPS earnings:

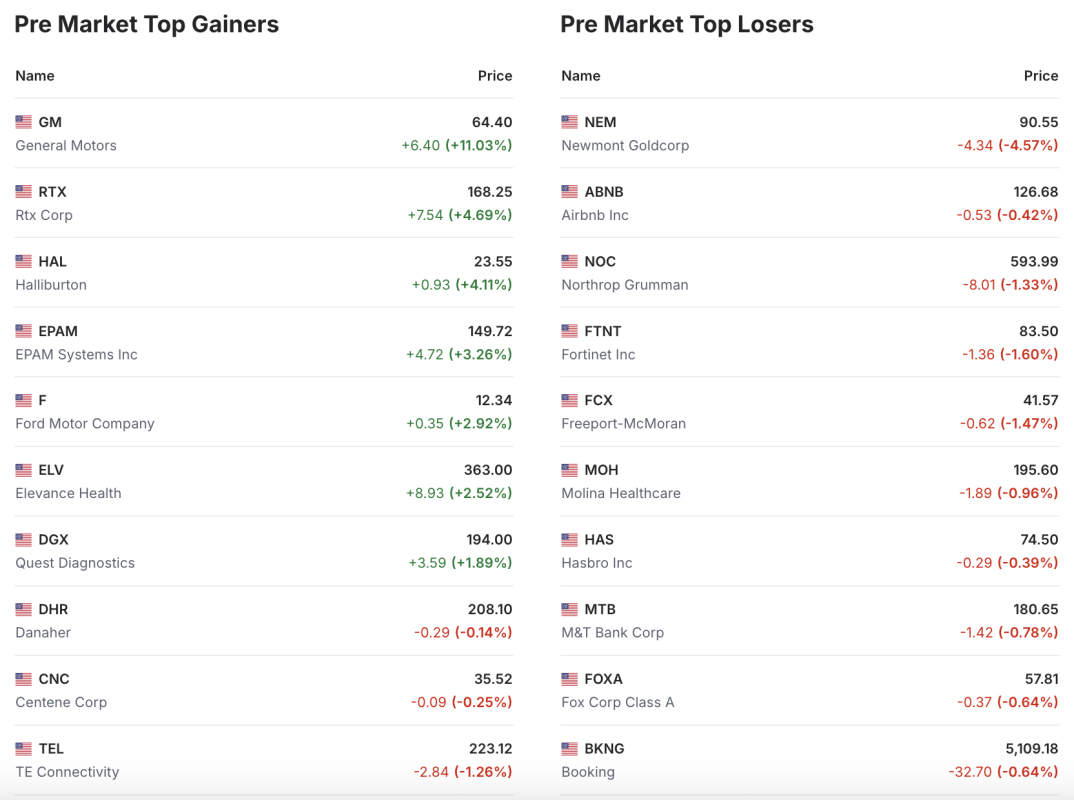

There’s also other companies making moves this morning which haven’t reported, including EPAM Systems (+3.26%) and Newmont Goldcorp (-4.57%). Per data from Investing.com, here are companies which are making big swings ahead of the opening bell today:

Update: 7:42 a.m. ET

Everything Happening (That We Know Of)

Good morning. After a strong start to the week, stocks are flat in futures trading, as a flurry of reports from defense contractors are set to define the morning trade. They won’t be alone.

Here’s what is on deck for today:

Earnings Today: Netflix, Coca Cola, GE Aerospace

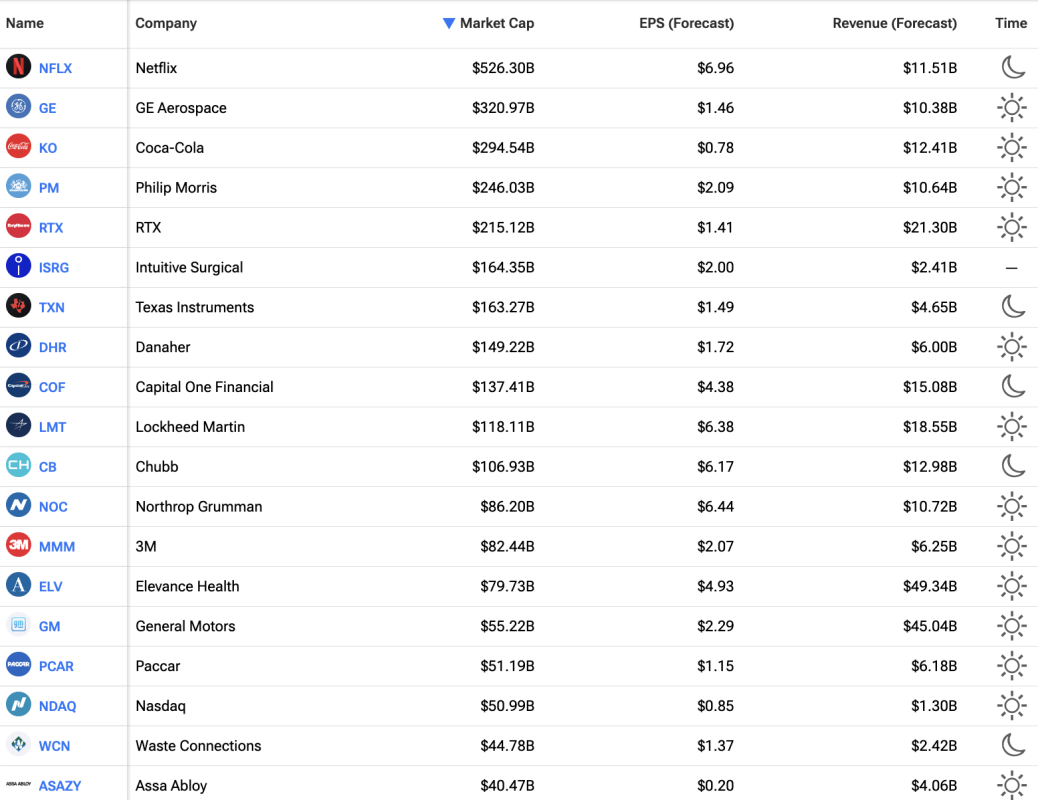

Rolling into midweek, data from Nasdaq says there will be 62 earnings reports today, with GE Aerospace, Coca-Cola, and Philip Morris International heading up the morning reports.

Defense contractors RTX Corporation, LockheedMartin, and Northrop Grumman are also on deck this morning, with their reports likely to offer investors perspective on the ongoing government shutdown.

This evening, we’ll also get today’s biggest report in Netflix, plus some other results from Texas Instruments and Capital One Financial, among others.

Here are today’s reports:

Economic Events & Data

This morning, Redbook for Oct. 18 should be out just before 9:00 a.m. ET, at which point the Fed’s Christopher Waller is expected to give remarks. Later today, at 3:30 p.m. ET, we’ll also hear from him again.

Aside from the NY Fed’s 1-2.5 yrs Treasury Purchase report and a refreshed on API Crude Oil Stocks throughout today, those are the largest and most significant economic data reports out today.

Meanwhile, the government enters its 21st day of shutdown. Still, seemingly with no end in sight.