This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Friday. This is TheStreet’s Stock Market Today for Oct. 24, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 8:01 a.m. ET

Investors Await CPI Data

The Consumer Price Index is due out at 8:30 a.m. ET, about 30 minutes from now. Analysts polled by Reuters are looking for CPI to jump by 0.4% month-over-month, while Core CPI is seen jumping 0.3%. This would bring inflation to 2.9% and 3.1% year-over-year respectively on these figures.

This section will be updated once the CPI is released.

Update: 7:58 a.m. ET

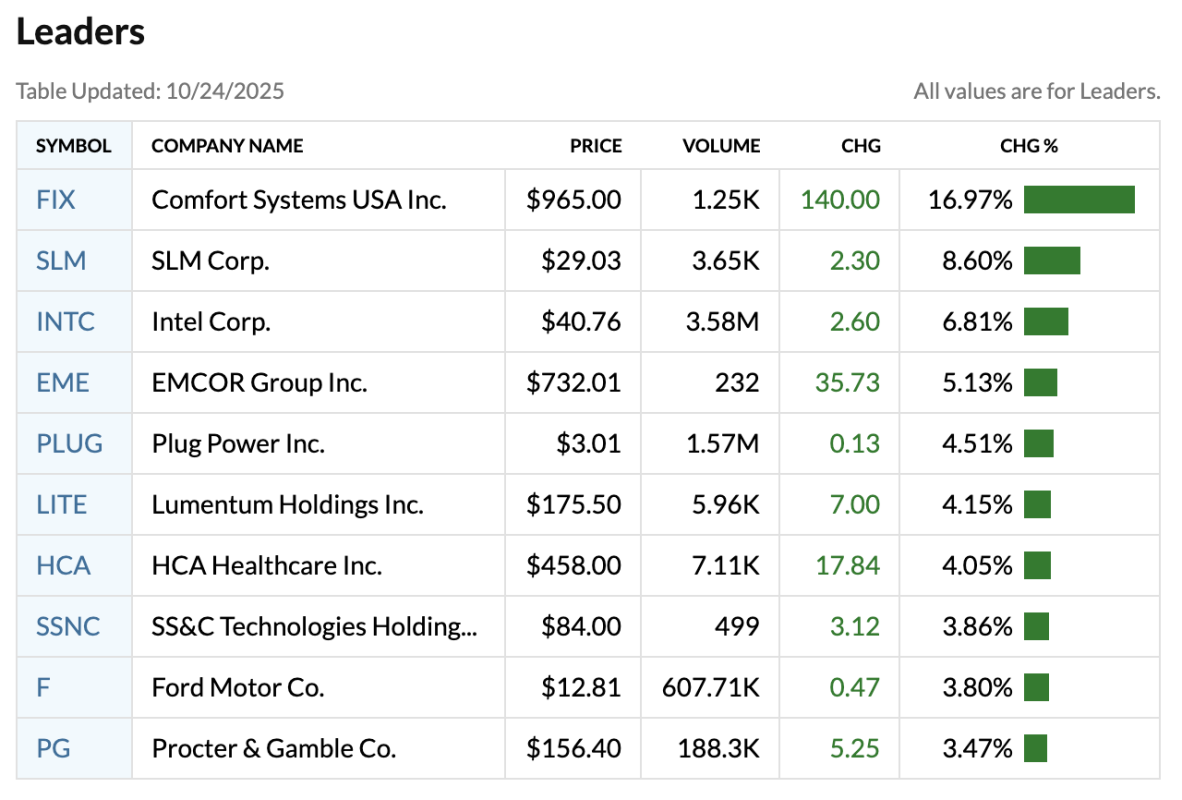

Premarket Movers: Comfort Systems, Intel, Deckers Outdoor, Booz Allen Hamilton

This morning’s moving stocks are — as you likely guessed by now — a product of earnings reports from after hours on Thursday evening and this morning. At the very top of the list is Comfort Systems USA (+17%), while Deckers Outdoors (-12.2%) is seen taking the bottom.

Movers

Aside from Comfort Systems’ big morning stride, SLM Corp (+8.6%), Intel (+6.8%), SS&C Technologies (+3.86%) and Ford (+3.8%) are also higher this morning after their Thursday P.M. earnings.

HCA Healthcare (+4.05%) and Procter & Gamble (+3.47%) are also making moves after their earnings this morning. The former lifted annual forecasts after a bumper quarter of medical service demand, while the latter warned about a “bifurcation” in consumer spending.

Per data from MarketWatch, here are the stocks making the biggest strides before the bell:

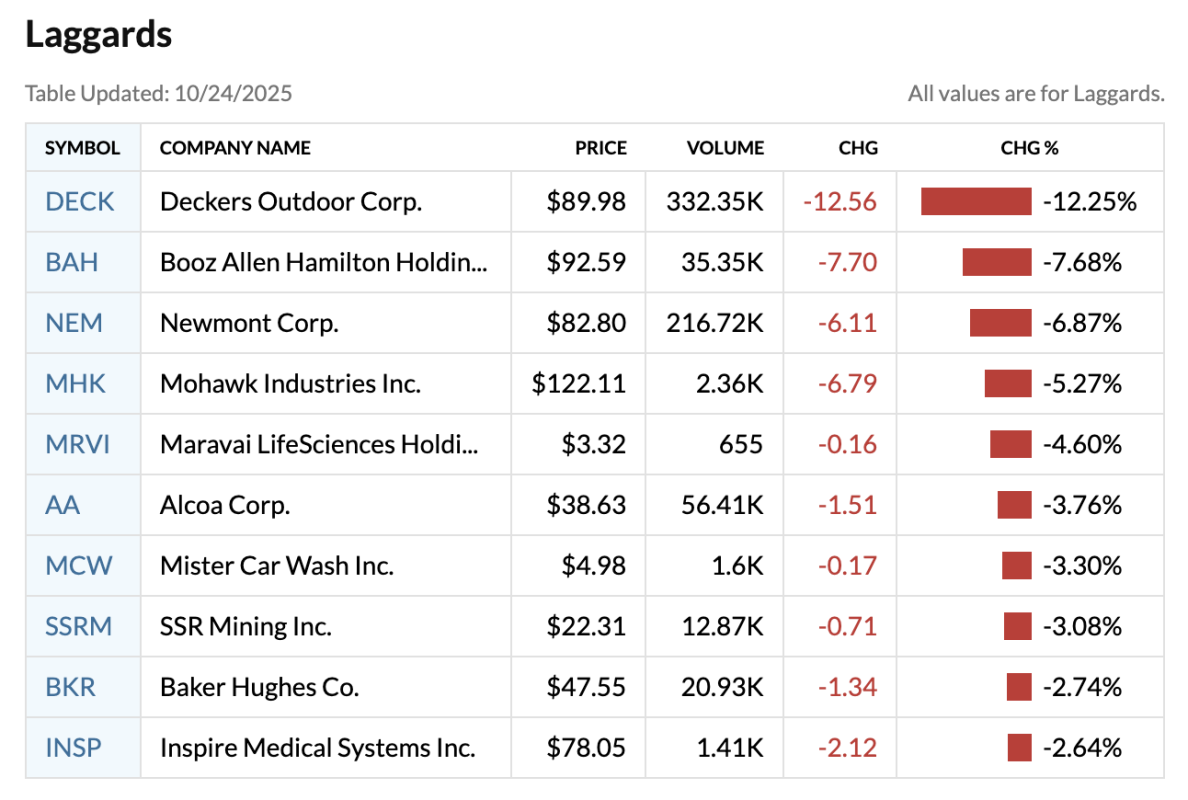

Losers

On the other end of the market, there’s Deckers and a handful of other earnings stragglers.

Booz Allen (-7.68%), which reported this morning, cut its outlook as its quarterly profit and revenue fell. Newmont Gold (-6.87%), Mohawk Industries (-5.27%), and Alcoa (-3.76%) are plummeting after their Thursday evenings reports.

Also notable but not included on MarketWatch’s list: Alaska Air Group (-3.5%) is down this morning after an IT outage affected flights on Thursday. 19% (158) flights were cancelled, while 27% (224) were delayed at some point Thursday. Today, 15% (116) flights have been cancelled as a result, mostly at its hub in Seattle.

Here’s the stocks missing the mark in the premarket:

Update: 7:31 a.m. ET

Everything Happening (That We Know Of)

Good morning. After a row of after hour earnings reports from firms like Intel, Ford, and American Airlines on Thursday, U.S. equity futures are higher this morning. The Russell 2000 (+0.45%) and Nasdaq Composite (+0.44%) are seeing the biggest gains in futures trading, even despite President Donald Trump “cancelling” trade talks with Canada and cautioning about “land action” in Venezuela.

However, those early gains will face their match in about an hour’s time as the Consumer Price Index (CPI) is set to be released. It’ll be the first major report issued by the Bureau of Labor Statistics since the government shutdown. Analysts have settled in around 3%, which would be a modest acceleration month-over-month.

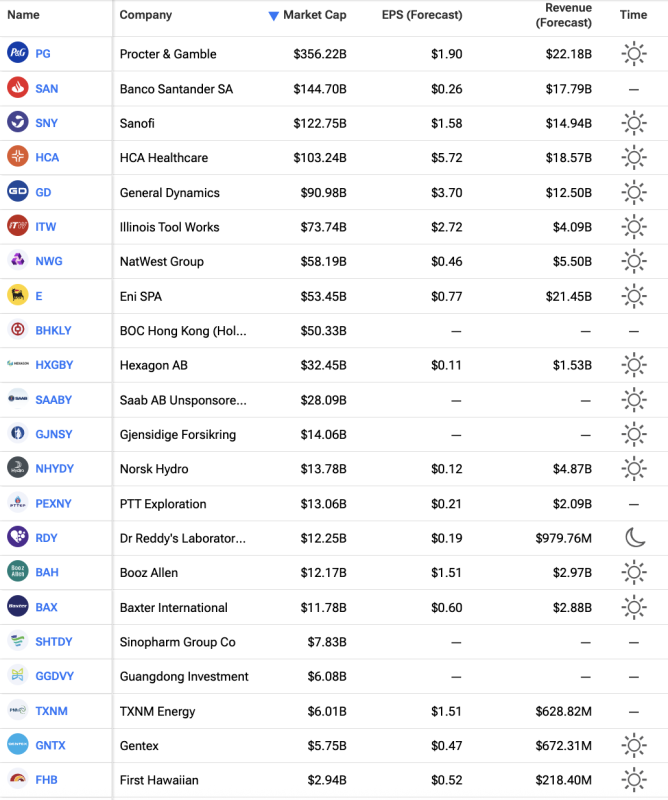

Earnings Today: Procter & Gamble, Banco Santander, Sanofi

It’s Friday, so most earnings are packed towards the A.M. hours. We’ve already got a set of earnings out from consumer giant P&G, the Spanish bank Banco Santander, and pharma giant Sanofi, among others.

Here’s as many earnings as we could fit on a single page, per TipRanks, who advises there’s about 41 reports today:

Economic Data + Events

Aside from the Consumer Price Index, which is out at 8:30 a.m. ET, there’s also a number of other reports for investors to keep an eye on today. In fact, today might be one of the busiest days of economic data we’ve seen in recent weeks.

The S&P Global Composite and Manufacturing PMI Flash for October are out at 9:45 a.m ET, while the Michigan Consumer Sentiment Final for October will be out at 10:00 a.m. ET. Analysts are looking for moderation in both data readouts.

Rounding out the economic picture for the day, Baker Hughes Oil Rig Count and Total Rigs are out at 1:00 p.m. ET. New Home Sales for September will also be out at some point this morning after a big jump in August. Existing Home Sales, which released yesterday, showed more than 4 million sales in September, within lines.