BigBear.ai Holdings’ stock jumped 13% on Nov. 12, extending its weekly stock gain to 19%.

The surge continues two days after the company announced a stronger-than-expected Q3 2025 earnings report on Nov. 10 and unveiled a strategic AI acquisition, which positions it more favorably in the defense generative AI market.

This AI-powered solutions provider, which builds software systems for national security and supply-chain management, posted Q3 revenue of $33.1 million, a 20% decrease from its Q3 2024 revenue, citing lower volumes on specific army programs.

However, it was still able to beat the Wall Street consensus of $31.92 million, which has bolstered investors’ optimism about its future operational capabilities.

Simply put, the value of its convertible notes and warrants declined on paper, which helped BigBear.ai post it as a positive on its income statement.

The gain was partly offset by an $8 million increase in SG&A (Selling, General & Administrative expenses), which rose to $25.3 million.

A primary driver was marketing costs and strategic initiatives, which also impacted its Non-GAAP adjusted EBITDA, reported at -$9.4 million.

BigBear.ai’s stock was up more than 270% year over year.

BigBear.ai’s stock was up more than 270% year over year.

BigbearAI/TheStreet

BigBear’s AI expansion plans

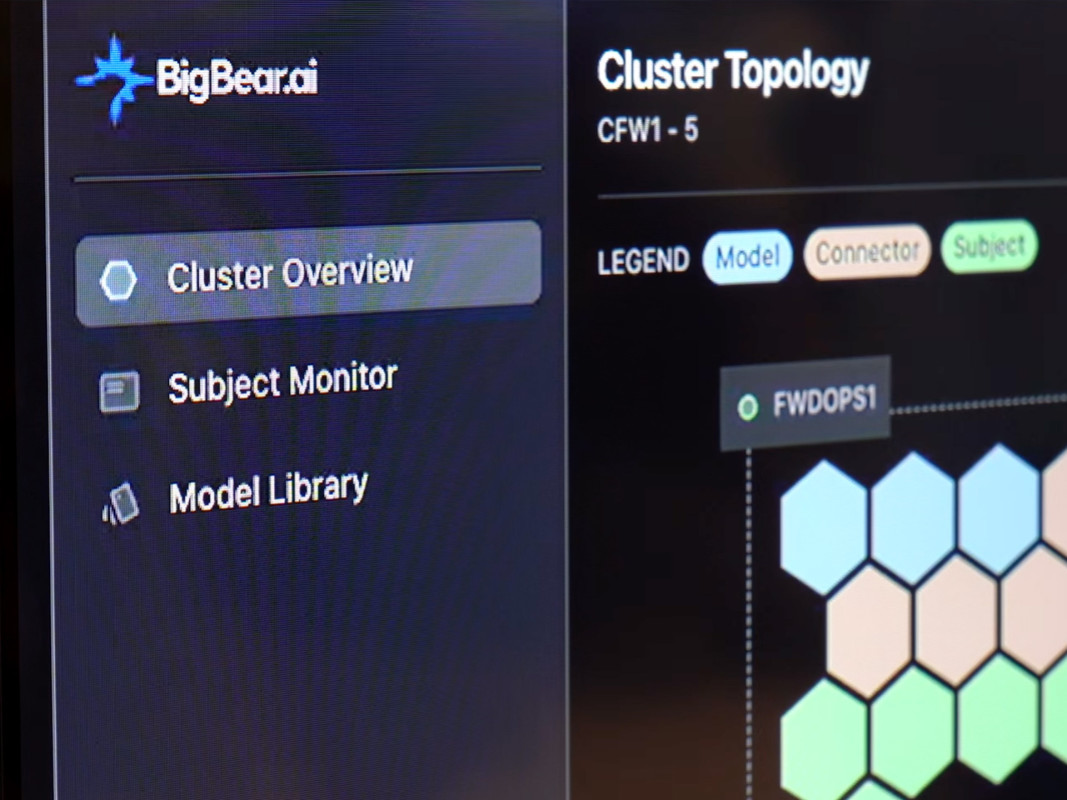

Bigbear.ai, which has seen a 64% stock gain year to date, is now expanding to compete more directly with big players such as Palantir by entering the secure, generative AI decision systems market for national security clients.

It announced a definitive agreement to acquire Ask Sage, a fast-growing generative AI platform that specializes in agentic AI and secure model distribution for defense and other regulated sectors.

More Palantir

- Palantir could be staring at a big problem

- As Palantir rolls on, rivals are worth a second look

- Palantir quietly makes massive AI war play

Platforms like Ask Sage create a user-friendly and secure interface on top of complex LLMs, acting as safe, controlled connectors that let users and AI systems interact with sensitive data without exposing or moving it.

This is a crucial capability for regulated sectors, such as defense.

“Yet integrating Ask Sage with Bigbear.ai, we are creating what the market has been asking for: a secure, integrated AI platform that connects software, data, and mission services in one place,” McAleenan added.

The question also arises of how BigBear.ai would fund the $250 million Ask Sage deal.

Related: AMD flips the script on Nvidia with bold new vision

The company announced $456.6 million in cash flow, along with a $376 million backlog, which signals steady future demand and demonstrates sufficient funds to support this significant acquisition.

With the U.S. government now on the brink of reopening, there is renewed interest in its stock, since it increases potential for new business opportunities in defense and border security, as McAleenan expected.

This acquisition also comes at a pivotal time, when the government is increasing its AI expenditures for defense.

Related: Warren Buffett sends moving 2-word message to Berkshire Hathaway investors