Here in today’s America, coffee lovers gulp higher prices as well as caffeine due to sticky tariff inflation.

And we’re not just talking java.

The affordability buzz gets hotter every day.

Consumers are paying more for tea, bananas, and other imported foods courtesy of global trade wars incited by the Trump administration.

Along with rising prices, quivering employment fears are roiling Main Street and Wall Street as major employers including Amazon, UPS, and Meta announced thousands and thousands of layoffs.

- Bigger bills and fewer jobs inch the economy closer to stagflation.

- This is without the backlog of leading economic indicators from the government shutdown.

“It was easier to forecast that we’d have a mild bout of stagflation. It’s another thing to live it,” Diane Swonk, chief economist at KPMG, told The Wall Street Journal Nov. 12.

Yet one Federal Reserve official is optimistic about the future, and is forecasting an economic rebound coming very soon.

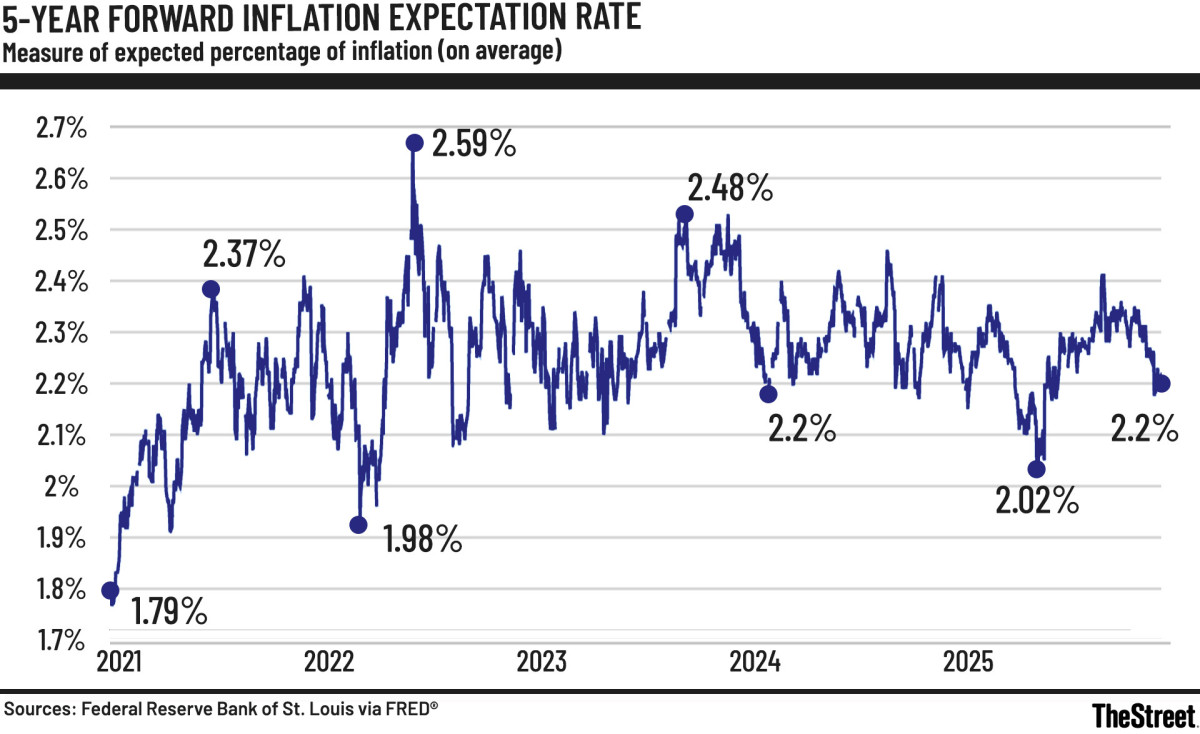

Five-year forward inflation expectation rate from 2021 to 2025.

Fed’s dual mandate creates a delicate balance of monetary policy

The Fed’s dual mandate from Congress requires price stability and low unemployment.

Pre-shutdown data showed unemployment at a relatively stable 4.3% but with rising concerns in other aspects of the labor market.

Inflation is at 3%, not quite post-pandemic craziness, but still above the Fed’s own 2% target.

Balancing the mandate is tricky because:

- Lower interest rates decrease unemployment but increase inflation.

- Higher interest rates lower prices but increase job losses.

A divisive Fed faces upcoming interest-rate decision

The Fed’s quarter-percentage-point cut to a 3.75% to 4.00% benchmark rate in October makes short-term borrowing cheaper, potentially spurring spending and shoring up weakening job numbers.

With grocery, rent, and utility costs still surging, many households and businesses aren’t feeling much financial relief.

Related: Fed’s Miran pivots on interest-rate cut push for December

A growing number of Fed officials have been warning that inflation remains “too high” and could derail progress toward the central bank’s 2% goal.

And the government shutdown means the Fed will be operating in a “data fog,” missing crucial leading economic indicators and forced to rely on private surveys and other data.

That’s why Federal Reserve Chair Jerome Powell knocked back expectations of an additional cut in December with a blunt “Far from it” after the October Federal Open Market Committee meeting.

Musalem forecasts economic rebound in early 2026

Federal Reserve Bank of St. Louis President Alberto Musalem, who voted in favor of the October rate cut, told Bloomberg that he expects the economy to bounce back strongly early in 2026.

He also emphasized the need for Fed officials to be cautious about lowering the benchmark Federal Funds Rate.

“We’re going to get, I think, a substantial rebound in the first quarter,” Musalem said Nov. 10.

He said the expected bump will happen once when the government shutdown ends, and due to deregulation and the impact of rate cuts already made.

Musalem expresses inflation concerns, cites food pantries

Musalem reiterated his view that current Fed policy is close to the level where it would no longer put downward pressure on inflation.

“It is very important that we tread with caution, because I believe there’s limited room for further reductions without monetary policy becoming overly accommodative,” he said.

Musalem said he is seeing increasing signs of strain among low- and middle-income households who are struggling to cover rising expenses.

That’s driving more people to visit food pantries and request assistance with paying utility bills.

He cited those as evidence that consumers are losing purchasing power to inflation.

The trends “drive home the importance of our delivering on the inflation mandate, returning that back toward 2%, so that people can rebuild their real incomes,” he said.

By the way, about those coffee prices…

The Trump administration is planning an announcement that would lower the cost of imported food that is not grown in the United States, Treasury Secretary Scott Bessent told Fox News Nov. 12.

So plan on putting espresso martinis and banana-cream pies back on your Thanksgiving menu.

Related: Fed official warns inflation is still too high for more rate cuts