This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Friday. This is TheStreet’s Stock Market Today for Nov. 14, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 4:36 a.m. ET

Everything Happening (That We Know Of)

Good morning. It was the hope of rate cuts that helped drive markets to all-time highs. But with the timing of future rate cuts looking less sure, a delay on anticipated cuts might make it difficult for U.S. equities to revisit those highs soon.

This morning, U.S. equity futures are down, putting equities on track to continue a days-long skid. It comes amid a meltdown in tech and AI-flavored bets, the reopening of the Federal government, and an increasingly visible schism Federal Reserve members over what might be the right course of action at the forthcoming December meeting.

The Nasdaq Composite is leading the futures lower, along with the S&P 500 and small cap-focused Russell 2000. The Dow is also a few dips lower, perhaps an indication that the 30-strong index might get back to outperforming other major indexes after a rough Thursday.

That said, it’s a new day: Friday. Here’s what is on deck for today:

Earnings Today: Mitsubishi UFJ, Sumitomo Mitsui, Mizuho Financial

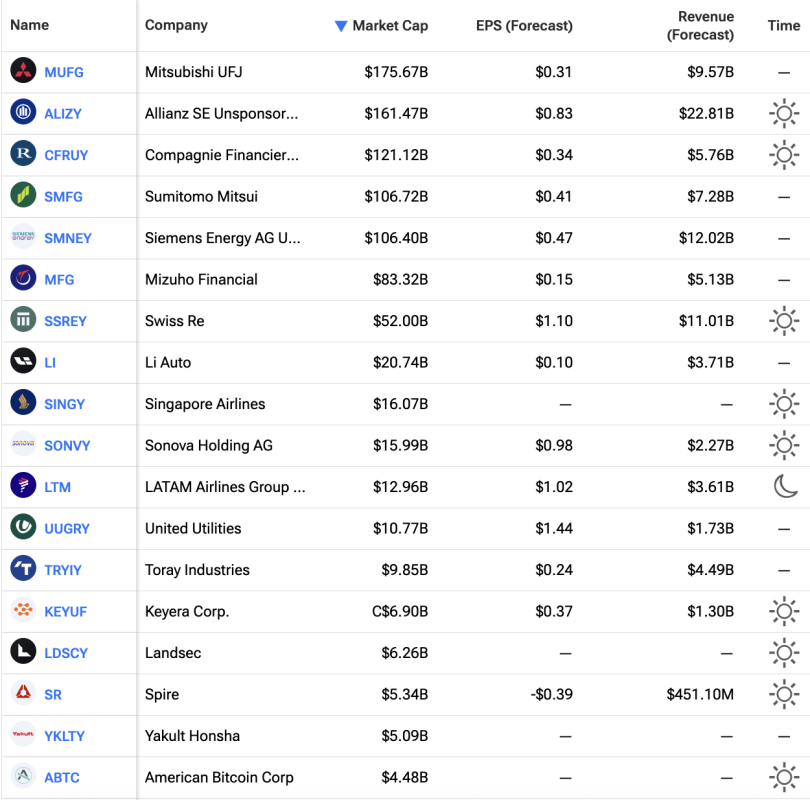

Capping off this week of earnings will be a handful of reports from overseas firms. Among them will be one of the world’s largest banks, Mitsubishi UFJ, which is listed on the NYSE. It’ll also be joined by other financials — including some domestically-listed names and some others on the OTC Markets — such as Allianz, Compagnie Financier Richmont, and Sumitomo Mitsui, among others.

Here’s a list of the reports coming today, ordered by market cap:

Events + Data Today

We’ve still got a backlog of inflation, labor market, and other data reports to work through. Thankfully, with the government reopened, we could be seeing the first cropping of that overdue data in the coming weeks.

In the meantime, investors will have to suffice with commentary from Fed Governors. And make no mistake: investors will be paying special attention to remarks from the Kansas City Fed’s Jeffrey Schmid (11:05 a.m.), Dallas’s Lorie Logan (3:30 p.m.), and Atlanta’s Raphael Bostic (4:20 p.m.) after Minneapolis Fed President Neel Kashkari indicated that he remained ‘undecided’ on the Fed’s all-important December policy meeting.

That information shouldn’t be new information to traders, but for some reason, it has been. Yesterday, markets plummeted after Kaskhari’s comments. In recent days, as establishment reports have once again entered the picture, CME Group’s FedWatch has showed tapering odds of a December rate cut.