For Nvidia bulls, the question is not whether NVDA stock can continue its momentum. Rather, the main question on everyone’s mind on Wall Street is how far the stock can go. On that note, Oppenheimer is providing some hints.

The global financial institution reiterated its outperform rating on NVDA stock, but there’s a twist heading into earnings season. The company believes the semiconductor giant is sitting pretty, which is why Oppenheimer now anticipates the chipmaker will hit $265, a bump from an earlier $225 prediction.

For bulls, Nvidia remains the backbone of the AI build-out; for bears, expectations are already stretched.

For bulls, Nvidia remains the backbone of the AI build-out; for bears, expectations are already stretched.

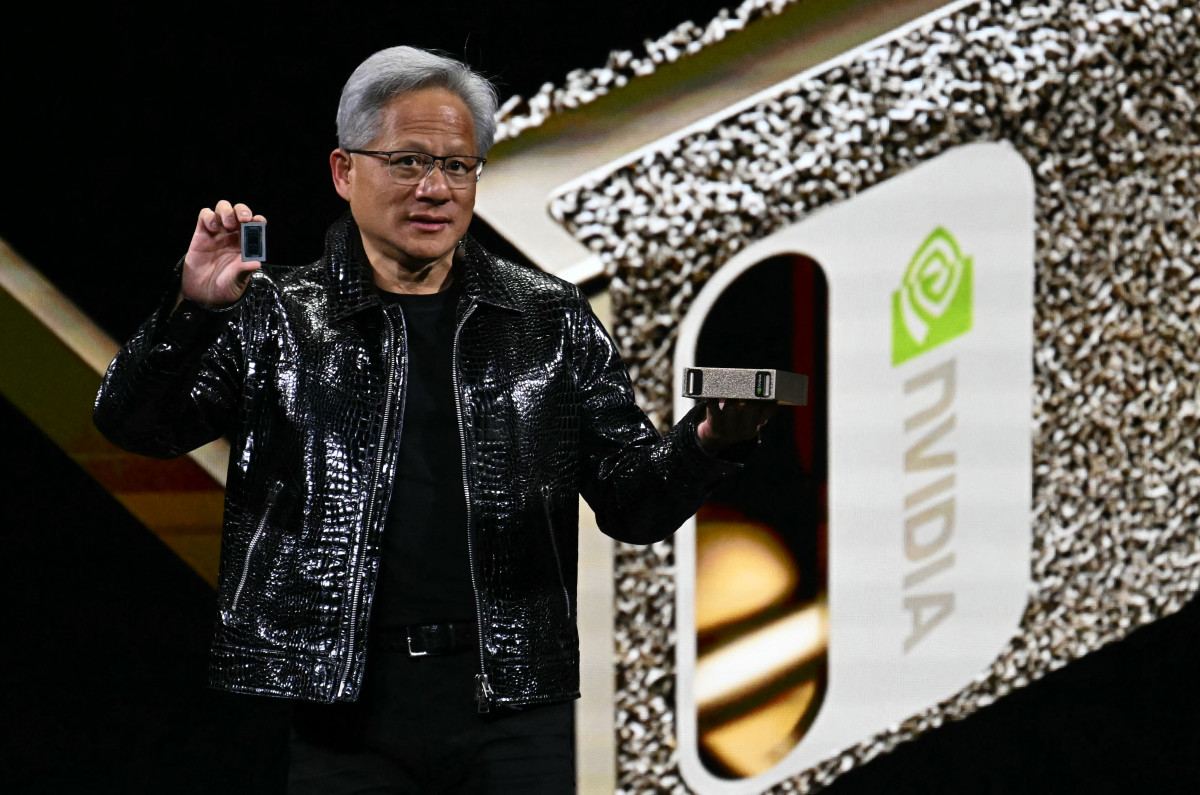

Photo by PATRICK T. FALLON on Getty Images

What’s really behind Oppenheimer’s $265 call

This analysis is based on three main points: the current demand, the level of visibility, and Nvidia’s strategic position in the next stage of artificial intelligence.

Oppenheimer anticipates Nvidia will surpass even the most optimistic projections. Wall Street is projecting over $54 billion in quarterly revenue, including earnings per share in the mid-$1 range.

Hyperscalers and AI companies continue to compete fiercely in the construction of data centers, where Nvidia’s processors are still a key component.

Related: Warner Bros. Discovery just got a boost, and buyers are circling

Nvidia anticipates its Blackwell and Rubin platforms to drive hundreds of billions in data center revenue over the next two years. Given the existing infrastructure and budget allocations, the real issue isn’t whether Nvidia can move its processors, but rather how quickly the present demand translates into actual revenue figures.

Oppenheimer claims that the GB300 Ultra and the NVL72 rack platform still provide the highest performance per watt for demanding AI workloads. This is especially important as power limitations and energy costs become more significant.

Nvidia’s high costs are justifiable, provided competitors can’t replicate its combination of performance, efficiency, and software capabilities.

Related: Why Nvidia’s ‘big sellers’ might secretly be its biggest believers

Oppenheimer estimates Nvidia’s AI total addressable market exceeds $4 trillion. This figure encompasses cloud providers, government AI initiatives, and commercial clients. China’s potential offers more than $50 billion in upside; however, it’s absent from the central predictions because of export restrictions.

Oppenheimer’s $265 price target hinges largely on the assumption that hyperscalers and governments, except those in China, will continue to invest heavily in extensive AI infrastructure projects.

The Street vs. the outliers

When you have a stock like NVDA, it is unsurprising that several bulls continue to line up in record numbers. Nvidia’s five-year growth is more than 1,300%, but there are several analysts, apart from Oppenheimer, that believe the joyride is far from over, with Susquehanna giving a price target of $230.

Where Oppenheimer stands apart is that the average price target for the stock hovers around the low $230s, while Oppenheimer is predicting higher upside based on the fact that AI growth will not slow down. As a result, NVDA will be a net beneficiary of these moves, considering it provides the hardware for the AI revolution.

Related: Stagwell’s Palantir pact boosts shares, slashes labor needs

However, some analysts will view the Oppenheimer price target as a moonshot, not because they do not believe in NVDA’s future, but because things look ominous from a valuation perspective.

Michael Burry, founder of Scion Asset Management; Jay Goldberg, a semiconductor analyst and founder of Digits to Dollars; and David Solomon, CEO of Goldman Sachs, are among the notable names who have presented their own arguments challenging Nvidia’s much-vaunted valuation.

Under these circumstances, Oppenheimer’s $265 price target stands out. The bet makes sense, considering Nvidia’s execution thus far, and Jensen Huang’s opinion where he said:

Where the two sets of analysts differ is in their assumptions.

The bear case: when “priced for perfection” becomes a problem

There is a lot of thought given to the bull case for NVDA, but for a holistic overview, let us all take a breath and also acknowledge the naysayers and the skeptics.

First is the age-old argument against Nvidia, which is that the semiconductor giant cannot deliver as much growth as the stock’s valuation suggests.

Related: Tesla: what must happen for the $1 trillion payout

Here are some stats to back up this argument:

- Nvidia’s market capitalization is about $4.5 trillion.

- The trailing price-to-earnings ratio is roughly 53.

- The forward price-to-earnings ratio is about 29.

- The price-to-sales ratio is near 28.

- The price-to-book ratio is around 47.

With the valuation argument for NVDA out of the way, let us examine the other major issue at hand: execution, not just for NVDA, but for the entire market. Companies may be investing heavily in GPUs, potentially without a clear path to profitability.

More Nvidia:

- Nvidia makes a major push for quantum computing

- Nvidia’s next big thing could be flying cars

- Bank of America revamps Nvidia stock price after meeting with CFO

The true threat isn’t a single lackluster quarter; it’s a sharp slowdown if boards start demanding tangible results, which will ultimately lead to severe pressure on NVDA stock.

Nvidia stock will also suffer if, at a certain point, the following happen, concurrently or at one time:

- Demand might level off if major companies and enterprises feel they have sufficient AI capacity.

- Competition from AMD, Intel and in-house accelerators at big cloud players can dent Nvidia’s market share.

- Even if the U.S. and China mend fences, geopolitical uncertainty will remain a concern for NVDA bulls.

These are not assumptions and predictions to be taken lightly. If anything, savvy NVDA investors need to keep all of this in mind when making a decision to increase their stake in NVDA, or when initiating a new position.

What Oppenheimer’s $265 call really means for Nvidia

Oppenheimer’s $265 target is, at its core, a wager on the future. For me, the verdict is not on NVDA, but instead is more of an assumption that the AI mania, which propelled it to new heights in 2025, will not slow down, at least for the foreseeable future.

For the target to remain a viable one, the following needs to happen:

- Revenue growth needs to remain high through 2026, powered by Blackwell and Rubin, even if there is an overall slowdown in AI demand.

- High margins must maintain an edge over the competition in terms of price, particularly when it comes to AMD and Intel.

- Politically, things need to hold steady, but NVDA will manage if China and the U.S. rock the boat, considering size and diversification.

Ultimately, whether you are a bull or bear, Oppenheimer’s optimism will be put to the test very soon. Coming up on Nov. 19, we will see where Nvidia is heading next when the semiconductor company reports its latest earnings.

Related: Arm’s ‘AI tollbooth’ keeps ringing, but SoftBank’s 16% sales slice is the tell