Billionaire fund manager David Tepper sent a clear signal by walking away from Intel (INTC) stock entirely, WhaleWisdom reported.

Following the chipmaker’s comeback rally (nearly a 50% surge) backed by foundry optimism, government support, and renewed faith in its potential turnaround, Tepper hit the exit.

Once we have that in mind, the rest of Appaloosa’s 13F snaps into focus.

He reduced his holdings in most of the big tech companies, freeing up billions, and then went bargain hunting in places the market was overlooking.

Whirlpool, regional banks, and beaten-up cyclicals — Tepper didn’t abandon stocks, but instead his moves show that the easy money in tech has gone, and arguably the real opportunity was in the bruised.

Appaloosa’s Q3 filing reveals a swift departure from high-flying Intel stock.

Appaloosa’s Q3 filing reveals a swift departure from high-flying Intel stock.

Photo by Icon Sportswire on Getty Images

Who is David Tepper?

David Tepper isn’t just any billionaire hedge fund manager; he’s the guy Mr. Market watches intently on Wall Street, where the next big turn might be.

After his successful stint as a high-yield trader at Goldman Sachs, he launched Appaloosa Management in 1993, racking up a stellar 25% average annual return over more than two decades.

Fund manager buys and sells

- Stanley Druckenmiller’s latest buys suggest shifting tech trend

- Fund manager has surprising take on big Tesla stock drop

- Jim Cramer delivers urgent take on the stock market

- Cathie Wood dumps $30 million in longtime favorite

Forbes pegs his net worth at $23.7 billion. That, plus his powerful track record, puts him in an elite group of investors whose moves essentially become headlines.

Today, Appaloosa manages nearly $17 billion, most of which is Tepper’s own capital, essentially functioning as his family office out of Miami Beach, while he also owns the NFL’s Carolina Panthers.

Related: Morgan Stanley revamps Nvidia’s price target ahead of big Q3

Over the years, he has built a solid reputation forged on bold, contrarian calls.

Perhaps his most famous bet was when he scooped up beaten-down bank stocks in 2009 and minted billions when the sector rebounded.

His investing style is best described as elastic but conviction-driven, which essentially involves buying what’s hated, selling what’s overheated, and pivoting quickly when the cycle shifts.

Why Tepper walked away from Intel

Chip giant Intel’s Q2 comeback was arguably the market’s loudest surprise this year.

Over the past three months, the stock has risen 40%, driven by government subsidies, early traction in its hotly anticipated foundry reboot, and investor excitement over Nvidia-linked tech wins.

Tepper used that strength to dump his entire stake in the company. For a value stock opportunist who’s been known to buy distressed turnarounds, that exit was perhaps the quarter’s biggest tell.

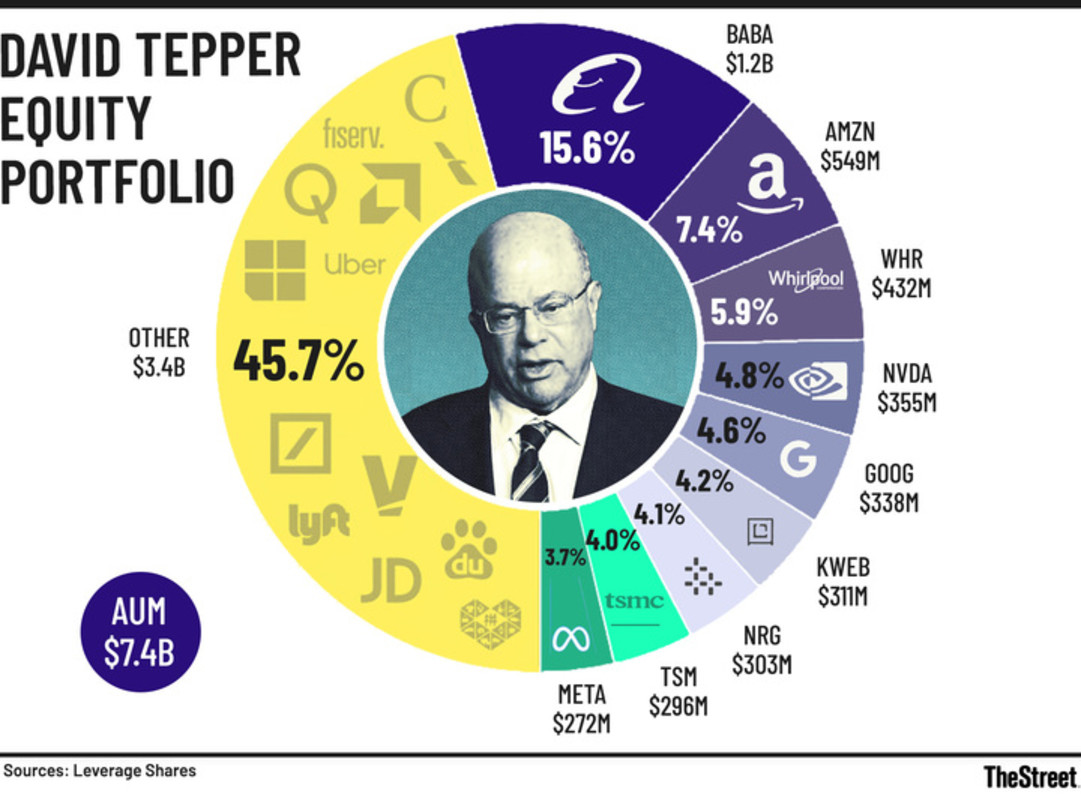

David Tepper Q3 Equity Portfolio

David Tepper Q3 Equity Portfolio

TheStreet

Intel’s revival is real, but it’s essential to acknowledge that it’s slow and capital-intensive, and it comes with a significant execution risk.

And Intel wasn’t exactly an isolated move.

The same playbook was fully on display across Appaloosa’s Q3 trims in Amazon, Alphabet, Meta, Microsoft, Alibaba, and JD.com, along with a near-complete exit from UnitedHealth.

Tepper’s tech trims are essentially down to the math and timing.

Following the power-packed surge in AI valuations from 2023 to 2025, valuations across big tech have clearly become stretched, with cloud earnings being virtually priced for perfection, and China tech remaining mostly volatile.

How much Tepper trimmed each major tech name:

- Amazon: Reduced his stake by nearly 7%

- Alibaba: Reduced by nearly 9%

- Alphabet (Class A & C): Modest trims across both share classes

- Meta Platforms: Small reduction to lock in gains

- Microsoft: Small trim as part of the broader tech de-risking

- JD.com: Meaningful reduction in line with his China tech pullback

- UnitedHealth: Slashed by 92%

- Oracle: Fully exited

- Intel: 100% exit

Tepper buys pain, not hype

Tepper cashed out of Intel, trimming most of his big tech holdings. But he didn’t just sit on the cash; he redeployed it in the more-overlooked corners of the market.

Arguably, the biggest swing came with home appliances giant Whirlpool, where his firm opened a 5.5 million-share position worth nearly $432 million.

That bet made it roughly 6% of his portfolio, turning Whirlpool into Appaloosa’s third-largest holding.

The stock took a monumental beating, down 75% from its 2021 highs and nearly 40% year to date, which is why Tepper pounced.

He also made a push into the regional banks, scooping up Truist (1.39 million shares), KeyCorp (2.02 million), and Fiserv (925,000), along with new/expanded stakes in CFG, Comerica, Western Alliance, and Zions. These were the businesses that came under duress due to funding-related troubles and deposit-cost spikes.

Moreover, he didn’t abandon tech entirely, adding AI poster-child Nvidia into the mix.

Related: Peter Thiel dumps top AI stock, stirring bubble fears