Nvidia (NVDA) didn’t ring the bell on this one, but its shadow was clearly all over it.

A relatively obscure Beijing chipmaker, Moore Threads, just staged perhaps one of China’s wildest IPOs in years.

The so-called “Nvidia of China,” priced 70 million shares at CNY 114.28, raising an eye-popping CNY 8 billion ($1.1 billion), while securing a stratospheric initial valuation near CNY 53.7 billion (around $7.5 billion) when it went public on November 24, on Shanghai’s STAR Market.

Surprisingly, the real kicker wasn’t its valuation but the insatiable investor appetite.

For perspective, it drew 4.83 million retail bidders and an eye-watering 4,126x oversubscription rate.

That equates to nearly CNY 33.7 trillion (about $4.54 trillion) in orders flooding in, with the haul so huge it surged past Nvidia’s entire market cap at the time ($4.5 trillion at the time of writing).

Furthermore, giants such as China Telecom and Meituan scooped up 14 million shares, while retail and smart money investors requested a superb CNY 116.6 billion in combined bids.

But the incredible enthusiasm wasn’t just FOMO.

With U.S. export bans knocking Nvidia’s China market share from approximately 95% to effectively zero, Beijing’s tech sector is in desperate need of a home-grown alternative.

Moore Threads gives them just that, and though it isn’t a threat to Nvidia at this point, the stars are aligning in a way investors just can’t afford to ignore.

A little-known chipmaker is suddenly attracting attention that’s hard to ignore

A little-known chipmaker is suddenly attracting attention that’s hard to ignore

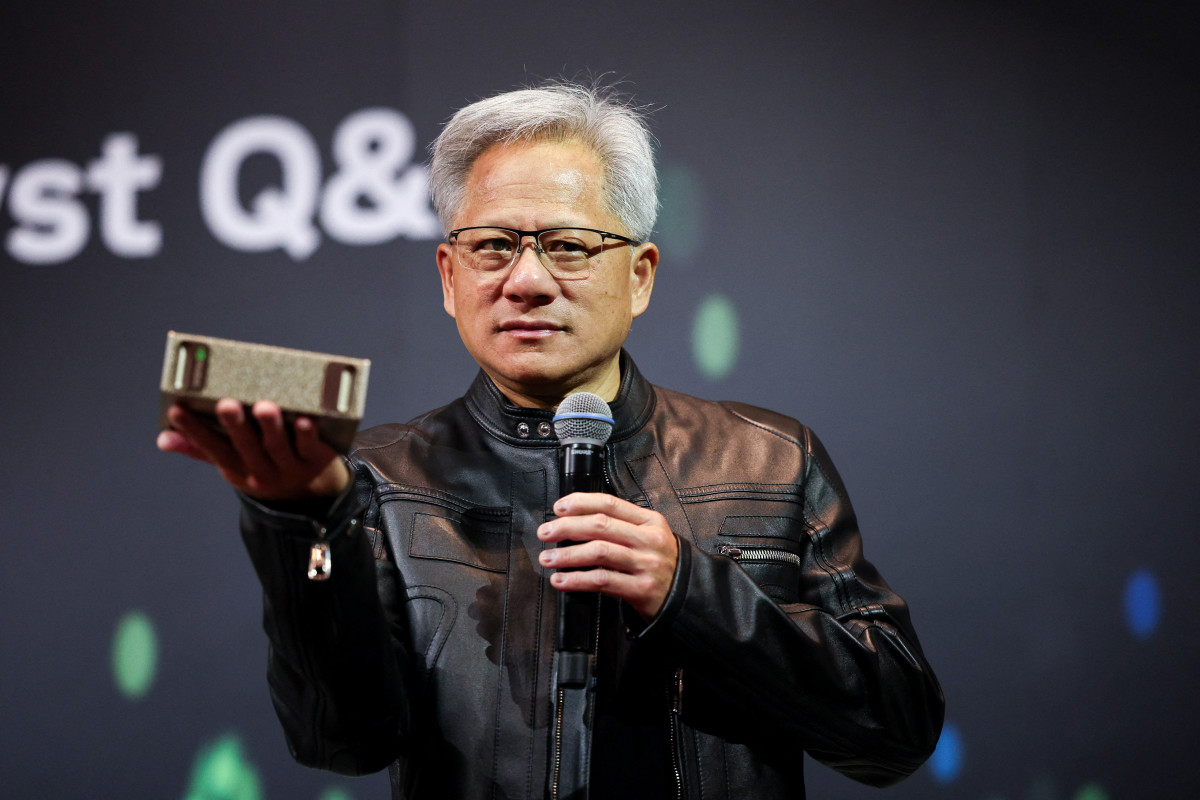

Photo by I-HWA CHENG on Getty Images

All about Moore Threads, China’s Nvidia

Moore Threads clearly isn’t shy about its ambition or its impressive résumé.

More Nvidia:

- Is Nvidia’s AI boom already priced in? Oppenheimer doesn’t think so

- Morgan Stanley revamps Nvidia’s price target ahead of big Q3

- Investors hope good news from Nvidia gives the rally more life

- Bank of America resets Nvidia stock forecast before earnings

- AMD flips the script on Nvidia with bold new vision

James Zhang, a 14-year Nvidia veteran and the tech giant’s former China GM, founded the company in 2020 with the mission to produce robust GPUs for gaming and AI.

In doing that, the businesses created their very own CUDA-compatible architecture, MUSA, enabling Chinese developers to run AI and graphics workloads on domestically produced chips.

Its pace of expansion has been dizzying.

In just four short years, Moore Threads pushed out four GPU generations in Sudi, Chunxiao, Quyuan, and 2024’s Pinghu.

Related: Jim Cramer drops blunt call on Nvidia stock

If that wasn’t dizzying enough, the latest can reportedly train trillion-parameter models, which puts it in the same league as OpenAI’s GPT or DeepSeek’s LLMs.

Here are the top general-purpose LLMs right now:

- OpenAI: GPT (e.g., GPT-5.1 class): “Best all-rounder.”

- Anthropic: Claude 3.5: “Calm analyst.”

- Google: Gemini 1.5/2.0: “Context + multimodal beast.”

- Meta: Llama 3.x: “Open-weight workhorse”

- DeepSeek: DeepSeek-V3/R1: “Aggressive efficiency plus math/coding”

From a financial standpoint, it’s all growth and red ink, though.

Moore Threads’ top-line numbers surged from CNY 124 million in 2022 to CNY 438.5 million in 2024, hitting CNY 701.8 million in the first three quarters of 2025.

However, the losses continued piling up, jumping to CNY 1.49 billion in 2024 and CNY 1.67 billion in the previous year.

China’s GPU upstart takes its shot

Moore Threads generated a ton of IPO traction to say the least, but the real question is whether it can seriously dent Nvidia’s GPU fortress.

Purely on scale, the gap is incredible.

Nvidia brings in over $187 billion in trailing-twelve-month sales, while Moore Threads is working with sales near the $100 million to $150 million range.

Additionally, the technical gulf is also just as wide.

Related: Goldman Sachs revamps Broadcom stock price target with a twist

Nvidia’s H100 data-center GPU pushes 1,000+ TFLOPS of tensor compute, whereas according to Wccftech, Moore Threads’ MTT S80 peaks at 14.4 TFLOPS FP32, which is great for serviceable mid-range gaming but nowhere near the power of an H100-class AI accelerator.

On top of that, the export restrictions mean Moore Threads is likely to be struck on older manufacturing nodes, compromising its performance.

Early reviews show that Moore’s GPUs have a ton of ground to cover.

In a popular Reddit forum, one of the users lamented their experience:

“China’s first gaming GPU, the Lisuan G100, performs like a 13-year-old Nvidia GTX 660 Ti.”

— Posted by u/nhansieu1 in r/pcmasterrace, alongside their PC specs (Ryzen 7 5700X3D + 3060 Ti).

Nevertheless, China’s massive domestic market gives Moore Threads a protected space to scale quickly. It will be a tall order, though, considering Nvidia’s shelling out a massive$12.9 billion a year on R&D (fiscal 2025 figure), while commanding a reported 90% of the AI accelerator market.

Nvidia’s China saga: Export controls, roadblocks, and local rivals

The way Nvidia’s China business imploded was nothing short of extraordinary.

A market that drove up a quarter of its data-center sales just vanished when Washington decided that advanced GPUs were effectively a national-security risk, potentially accelerating China’s military AI power.

That said, here’s the grim timeline that flipped Nvidia’s China story:

- Oct 2022: U.S. bans A100/H100 exports over military-use concerns; Nvidia pushes out the significantly weaker A800/H800 chips.

- Mid-2023: China stockpiles GPUs, as Nvidia forecasts $5 billion in second-half sales.

- Oct 2023: Loopholes close out; A800/H800 also banned as Nvidia designs limited H20.

- Late 2023: Moore Threads, Biren added to the Entity List; China mandates 50% domestic chips.

- Apr 2025: Even H20 requires licenses, leaving an eye-catching $18 billion in orders jeopardized.

- Oct 2025: CEO Jensen Huang says Nvidia basically went from “95% to 0%” market share in China.

Nonetheless, Nvidia’s China problem has effectively gone from painful to existential.

It went from $4.6 billion in H20 chip sales in Q1 2025 to virtually zero the next quarter, with China sales plummeting 63% as export rules shut the door.

Unsurprisingly, that incredible vacuum paved the way for local rivals to take charge. Huawei’s Ascend chips, Cambricon’s AI accelerators, Biren, and now IPO-fueled Moore Threads are looking to fill the gap, supercharged by conducive government policies and insatiable local demand.

Related: Billionaire Steve Cohen loads up on top AI stock, calms bubble fears