Personal finance expert, author, and radio show host Dave Ramsey may have hundreds of millions of dollars, but he views his wealth as a gift from God that must be managed responsibly.

His faith stems from an early business catastrophe, when, at age 28, after building a multi-million-dollar real estate portfolio, he lost it all.

Ramsey had owned several properties in the 1980s and used aggressive, leveraged loans to buy even more. But when his banks changed their lending policies, several of his notes became due—and Ramsey didn’t have the cash to cover them.

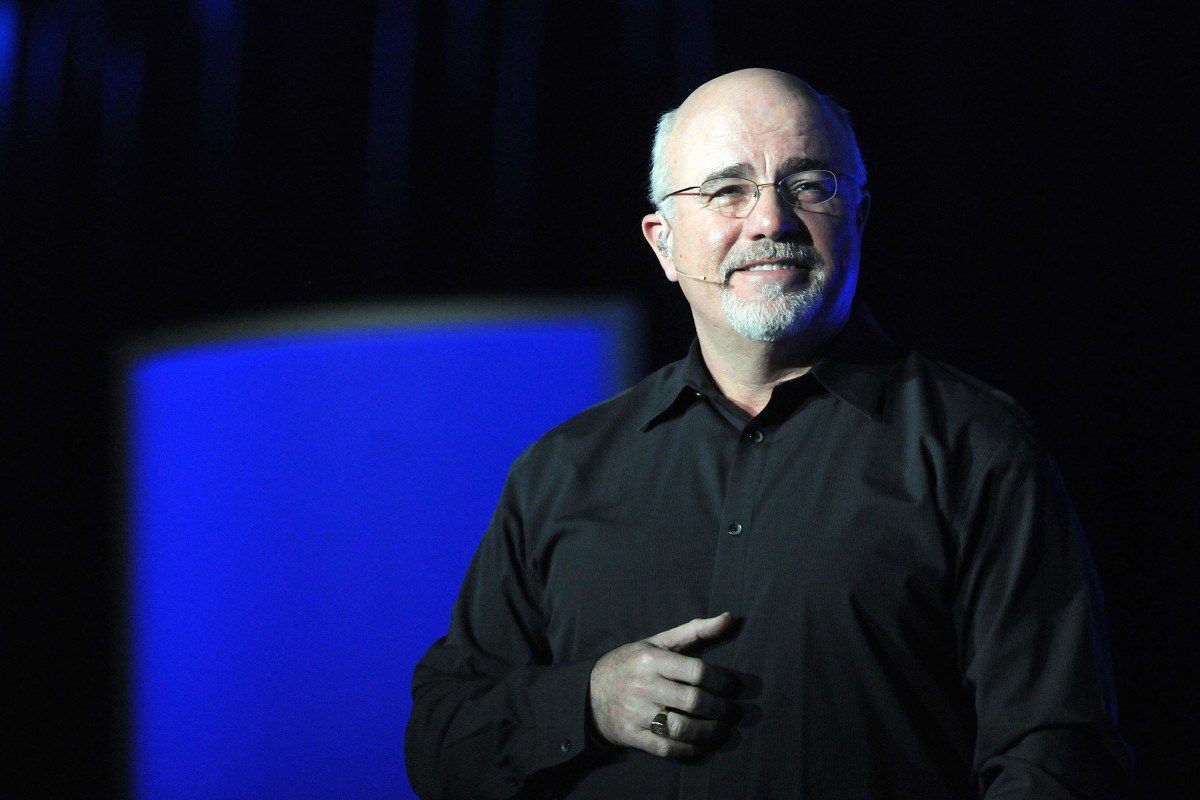

Financial expert Dave Ramsey has helped millions of Americans reduce or get rid of their debt.

Financial expert Dave Ramsey has helped millions of Americans reduce or get rid of their debt.

Jackson Laizure/Getty Images

He declared bankruptcy in 1988.

“I made $250,000 in one year and the next: $6,000.” Ramsey revealed on his radio show. “The odd thing was, I met God on the way up, when I was becoming wealthy. Most people meet him at a point of crisis. I was doing really good, but I got to know him on my way down.”

The loss became Ramsey’s pivotal moment. Diving deep into scripture, he discovered 2,500 Biblical verses about money, insights he summed up as “God’s financial game plan.”

His first book, Financial Peace, published in 1992, detailed his journey out of bankruptcy, and at first he sold copies from the trunk of his car. That same year, Ramsey began hosting “The Money Game,” a call-in radio show out of Nashville, and his popularity started to grow. His show offered practical tips on how people could best manage their money, and he often used his own, personal stories to illustrate how money can affects one’s life and relationships.

Ramsey’s radio show became syndicated in 1996; in 1999, his show was given the simpler title, The Dave Ramsey Show, and its popularity continued to climb. Today, 18 million listeners tune in weekly to hear Ramsey’s insights, making it the #1 Business show on Spotify.

Stop acting rich. You don’t have any money. #daveramsey #moneytok #moneytips #debtfree

Dave Ramsey’s 5 best tips for homebuyers

Real estate was Ramsey’s entry point into wealth, which makes him well-qualified to offer guidance for homebuyers—as seen through his signature, conservative approach. Here are five of his most crucial home-buying tips, which are especially important for first-time homeowners.

1. Save up a large down payment

When buying a home, Ramsey consistently recommends putting down 20%—or more, if one can afford to. A bigger down payment equates to lower monthly payments as well as a smaller loan, and Ramsey has even gone so far to suggest that homebuyers should ideally pay for their homes with 100% cash, although he acknowledges that this is unrealistic for most people.

By striving to put down 20%, homebuyers will avoid paying Private Mortgage Insurance (PMI), but if they can’t make that a goal, then Ramsey suggests that they try to get the PMI cancelled as soon as possible by making extra mortgage payments.

Related: 3 things Mark Cuban & Dave Ramsey agree on about personal finance

2. Buy a house you can afford

Simple advice always rings true—don’t live beyond your means. Ramsey’s core rule for housing is that your monthly house payment should never be more than 25% of your take-home pay.

“Tying up that much of your income in a house payment won’t leave you enough money to put toward other important financial goals like saving for retirement, ” Ramsey writes on his website. “That’s what we call house poor.”

Instead, Ramsey emphasizes buying a home you can pay off in a reasonable amount of time so that you eventually live mortgage-free, which aligns with his broader mantra of “debt freedom.”

3. Steer clear of ‘interest traps’

These are the things that keep people mired in debt: credit card balances, adjustable-rate mortgages or no-money-down financing, and payday loans. Each uses high levels of interest to keep consumers paying more money over longer periods of time.

Instead, Ramsey favors eschewing credit cards completely, and obtaining a fixed-rate mortgage, which offers predictable repayment terms.

More on wealth-building:

- Warren Buffett’s most insightful investing quotes as he celebrates retirement

- Scott Galloway’s 5 best wealth-building tips for young people

- Suze Orman’s 5 best insights on saving and spending wisely

4. Don’t use down-payment assistance

While some states offer down payment assistance programs for first-time homebuyers, Ramsey cautions people against using them. “They typically offer that ‘assistance’ in the form of extra debt,” he says, because these programs include strings that he believes undermine long-term wealth building.

Unless the “help” is a grant that doesn’t need to be paid back, Ramsey cautions homebuyers from entangling themselves in yet another web of complexity.

5. Build your emergency savings first

Purchasing a home is only the first step of a years-long commitment. Ramsey stresses the importance of stockpiling an emergency fund with three to six months’ of expenses saved so that unexpected repairs or other shocks, such as losing one’s job or getting divorced, don’t force the borrower back into debt.

Surprises are inevitable in life, but following Ramsey’s advice prevents one’s house from becoming their financial burden.

Related: Robert Herjavec’s financial wisdom: The ‘Shark Tank’ star’s 4 takeaways for investors

Dave Ramsey’s Net Worth & how he made his money

According to TheStreet, Dave Ramsey has an estimated net worth of $200 million in 2025.

As the son of two real estate developers, Ramsey learned the value of hard work early on. At age 18, he took the real estate exam and began flipping houses while studying at the University of Tennessee. His early wealth stemmed from the financial counselling business he started after declaring bankruptcy. That led to his books and his radio programs, then a live seminar business called “Financial Peace University,” as well as Ramsey Solutions, a financial education company devoted to Ramsey’s seminars and courses. Ramsey also owns a sizable portfolio of commercial real estate.

Ramsey’s seven books have sold more than 11 million total copies.

Related: Dave Ramsey’s 5 best retirement tips

Dave Ramsey’s Baby Steps & other terms

Ramsey offers a clear financial philosophy to his middle-American audience—one which comes with a lingo that’s best explained:

- Ramsey’s iconic baby steps are his seven-point financial framework for getting out of debt and saving money.

- A debt snowball is Ramsey’s suggested method for paying off debt by getting rid of the smallest balances first. This helps to build psychological momentum.

- Four walls are how Ramsey describes one’s basic necessities, like food, water, and shelter.

- Gazelle intensity refers to Ramsey’s preferred method of lasering-in on cutting down expenses and debts.

- Living on beans and rice is Ramsey’s euphemism for living frugally and below one’s means.

- Ramsey offers his listeners the chance to give a debt-free scream on his show, to celebrate their accomplishment of getting out of debt.

- Plastic is the term Ramsey uses when speaking of any type of credit card, a financial tool he admonishes his listeners to avoid.

Related: Barbara Corcoran’s 4 best personal finance insights