Michael Burry’s digital smackdowns on AI’s head honchos are only getting more interesting with every new post.

In the latest round, “The Big Short” investor swung harder than ever, offering a scathing takedown of two of the biggest AI bellwethers.

Posting a new set of “fun facts” on X, Burry stunned everyone by saying that OpenAI is headed for a Netscape-like fate, regardless of how big its IPO becomes.

Similarly, he likened Palantir (PLTR) to DiamondCluster, the dot-com consulting rocket that eventually fizzled into an acquisition.

The comparisons are sharp and audacious, particularly for OpenAI, with Google pressuring it on users, benchmarks, and momentum.

Over the past month, Google has effectively transitioned from an AI laggard to a major threat, which OpenAI CEO Sam Altman has internally labeled a “code red,” as the Wall Street Journal reported.

Consequently, reports suggest that OpenAI is shelving side projects while redeploying teams to ensure ChatGPT remains competitive as Google’s Gemini surge accelerates.

At the same time, Gemini 3 is reportedly outperforming OpenAI on key language and reasoning benchmarks, according to The Verge, reversing a script that GPT-4 once dominated.

Hence, Burry’s skepticism feels like provocation and more of a warning sign that investors just cannot avoid.

MichaelBurry’s latest warnings target two of the sector’s biggest cult favorites.

MichaelBurry’s latest warnings target two of the sector’s biggest cult favorites.

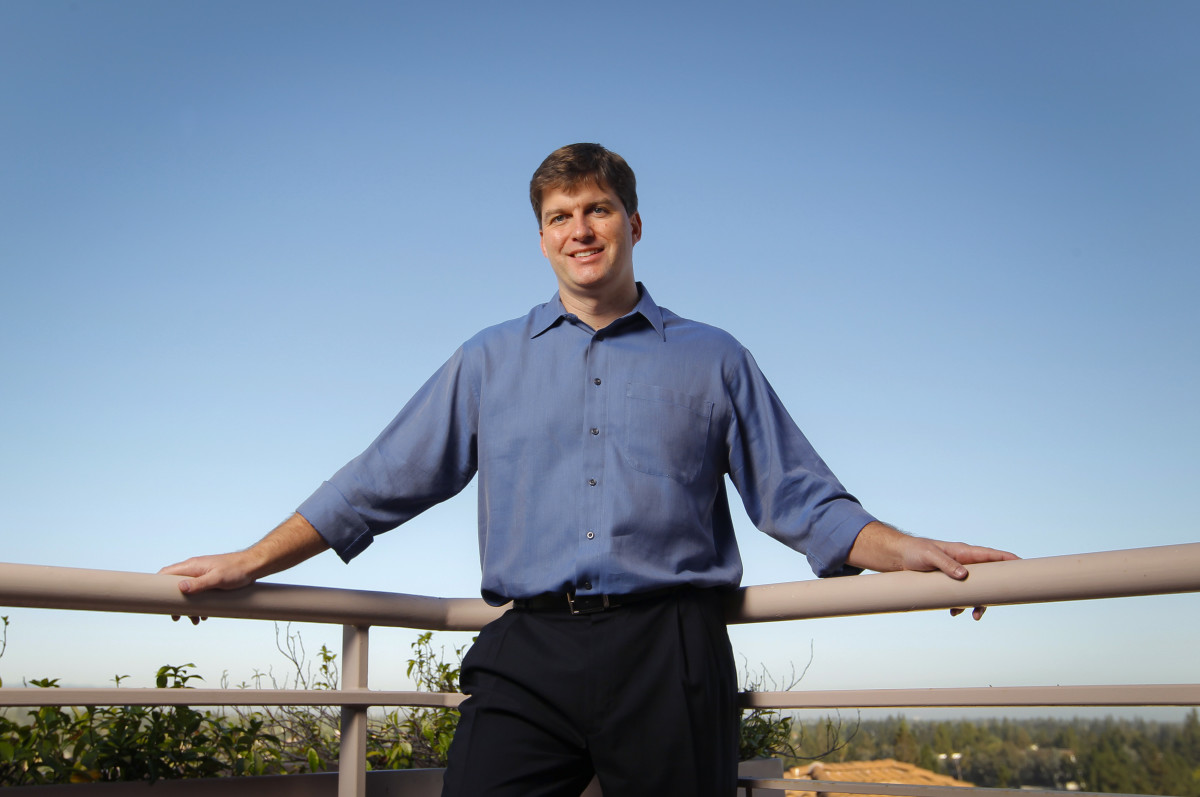

Photo by Bloomberg on Getty Images

Who is Michael Burry?

Michael Burry was once a prominent fund manager, recognized by many as the protagonist from the movie “The Big Short.”

The former doctor-turned-investor ran Scion Capital in the 2000s, becoming one of the earliest, loudest skeptics of subprime mortgages.

The contrarian bet he executed through credit swaps made him nearly $100 million personally and $700 million for his investors.

More Wall Street:

- Stanley Druckenmiller’s latest buys suggest shifting tech trend

- Goldman Sachs unveils stock market forecast through 2035

- Dalio’s Bridgewater quietly reshapes its portfolio amid bubble warnings

- Peter Thiel dumps top AI stock, stirring bubble fears

His call powered Michael Lewis’s book “The Big Short” and the Oscar-winning film, in which Christian Bale played him as the socially awkward, numbers-first outsider who predicted the crisis.

Recently, Burry shut down its SEC-registered fund when his assets sat at nearly $155 million, focusing on market commentary, particularly on the AI bubble debate.

Burry’s AI-bubble positioning

- Early November 2025: Scion’s 13F showed put optionson 1 million Nvidia and 5 million Palantir shares, roughly $1.1 billion notional, which made AI shorts nearly 80% of his total portfolio.

- Nov. 10-13: He terminated Scion’s SEC registration, wrapping up the fund with $155 million in assets.

- Mid-late November: Burry vehemently argued that popular hyperscalers are extending Nvidia gear life cycles, while overstating big-tech earnings by up to $176 billion between 2026 and 2028, CNBC reported.

Burry says OpenAI is tracking Netscape’s fall

Burry didn’t pull any punches in his assessment of AI’s poster child in ChatGPT-maker OpenAI.

On Dec. 7, he posted on X (formerly Twitter):

Netscape is perhaps the most popular cautionary tale in the tech world over the past 30 years.

Back in 1995, it took a 16-month-old browser with fewer than 20 million internet users to the stock market.

Debuting at a whopping $2.9 billion valuation, it was swallowed by AOL just four years later. For those who were around at the time, it would be known that the collapse accelerated when Microsoft integrated Internet Explorer into Windows, essentially wiping out its standalone edge.

Related: SoftBank billionaire quietly unveils project of staggering size

Arguably, OpenAI is in a similar cultural spot.

ChatGPT is the on-ramp that made generative AI feel mainstream, propelling OpenAI into the ranks of the most valuable startups of all time.

Revenues are exploding, and as reported by CNBC, CEO Sam Altman says the company’s on track to post $20 billion in annual recurring revenue this year.

At the same time, it’s shelling out eye-popping losses to the tune of a whopping $9 billion this year alone, with a 70% cash burn rate.

Burry’s point is well-taken as trailblazers spark the boom and spend the most, but often see the value migrating to giants that end up finishing the job.

Palantir reminds Burry of DiamondCluster

Palantir versus DiamondCluster is a different sort of dot-com echo altogether, but the rhyme is tough to miss.

Back in 2000, Diamond Management & Technology Consultants rode the consulting and dot-com boom, becoming a high-end IT advisor at the time, only to end up in PwC’s shopping bag a decade later for nearly $378 million, according to Bloomberg.

Although many in the tech punditry considered it a respectable exit, it was hardly the world-changing disruptor status it had targeted.

On the other hand, Palantir is a bona fide defense AI giant, with orders of magnitude larger, boasting trailing 12-month sales of nearly $4 billion and a market cap of $433 billion.

Nevertheless, what Burry is getting at is structural similarity.

Both businesses are data-heavy, selling expensive software and advice to governments and big enterprises. It’s a model that grows nicely, but finds it virtually impossible to sustain bubble-era, mega-cap expectations forever.

Related: Major used-car retailer gets set to join the S&P 500