This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Tuesday. This is TheStreet’s Stock Market Today for Dec. 9, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 9:34 a.m. ET

Opening Bell

The U.S. markets are now open. The Dow (+0.20%) and Russell 2000 (-0.17%) are moving higher in tandem this morning. The former, made possible by stronger showings from Johnson & Johnson (+1.35%) and Procter & Gamble (+1.16%), plus 18 other Dow components. The latter owes its optimism to the Fed’s highly-anticipated December policy meeting, which kicks off this morning.

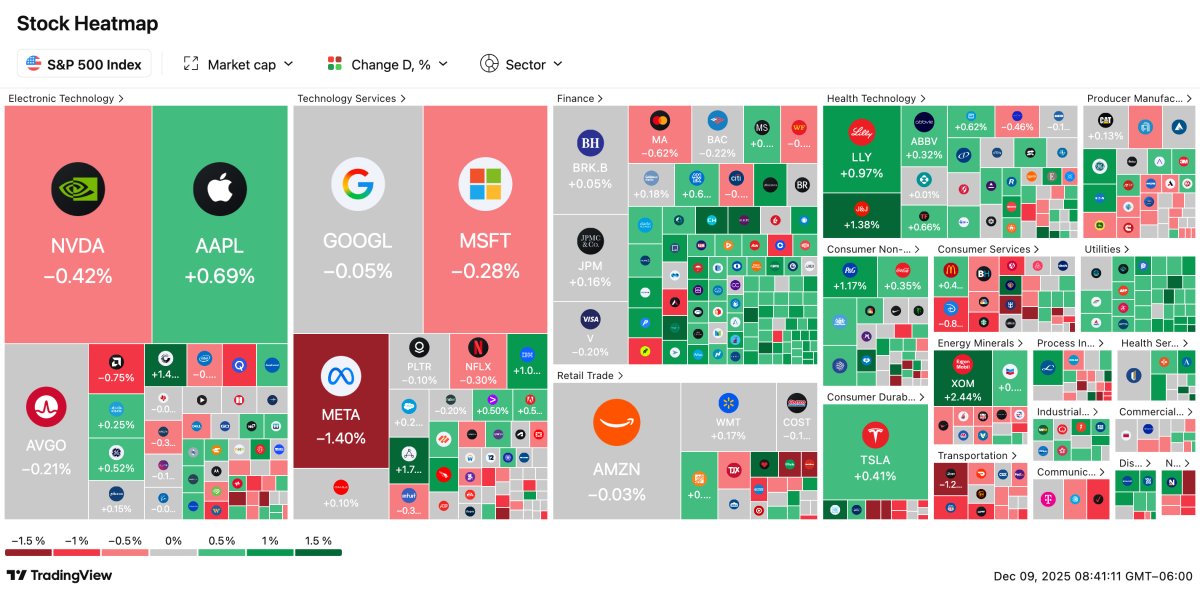

At the same time, the S&P 500(-0.02%) is narrowly in the red, while the Nasdaq (-0.27%) is experiencing some blues this morning, led lower by Meta (-1.40%), which appears to be pulling down similar tech names. Here’s the S&P for some added context:

The U.S. Dollar Index is 0.09% higher at 99.18 as yields reverse from yesterday’s surprise gain. The 10YTreasury is down 2.1 bips.

And in futures land: continuous Silver Futures (+1.36%) could test $60 shortly. Gold Futures (+0.04% to $4,219.40) are narrowly higher, while Brent Crude (-0.18% to $62.37) and Natural Gas (-4.11% to $4.17) are lower on the energy side.

Here’s some of the other stories emerging this morning (as they emerge):

JOLTs Stronger Than Expected As ADP Rebounds

The Job Openings and Labor Turnover Survey (JOLTs) data for September and October showed 7.658 million and 7.67 million open jobs, respectively. This modestly exceeded expectations, suggesting that the labor market has been slowly warming up heading into 2026. Quits were 2.941 million and 3.128 million respectively in the periods.

In more recent news, the ADP Employment (Weekly) data showed 4,750 job additions last week; taking a bite out of some of the previous reporting week’s 13,500 losses.

Perhaps supporting some of the recent job strength is a rebound in business sentiment. The NFIB Small Business Optimism Index rose to 99 in November, up from 98.2 last month. That’s still down from 101.7 year-over-year, but the percent of businesses assessing their business as excellent (11%) and good (53%) was 64%, roughly a one point increase. Signs continue to point to better hiring in 2026.

Update: 9:04 a.m. ET

Premarket Movers: Ares Management, CVS Health, SLM Corp, Astera Labs

Tuning back in before the opening bell in about half an hour, equity futures are narrowly lower — just a few bips each for the major indexes.

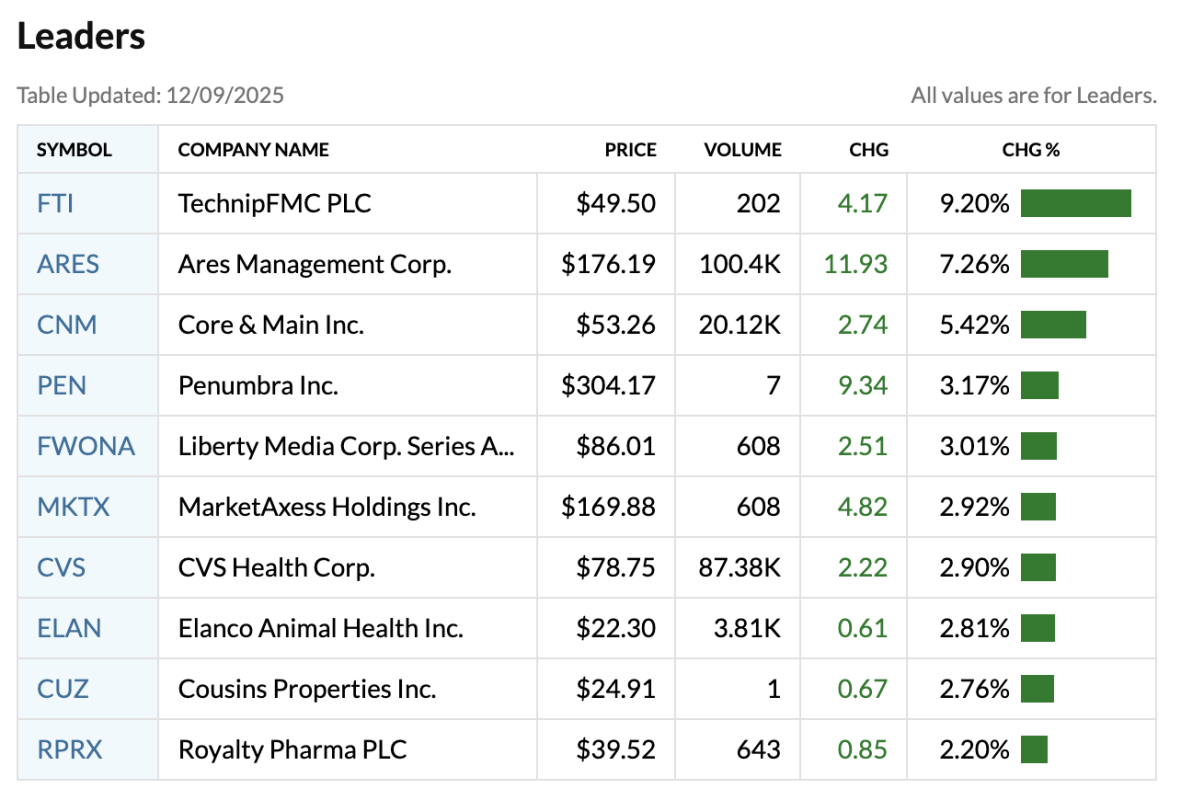

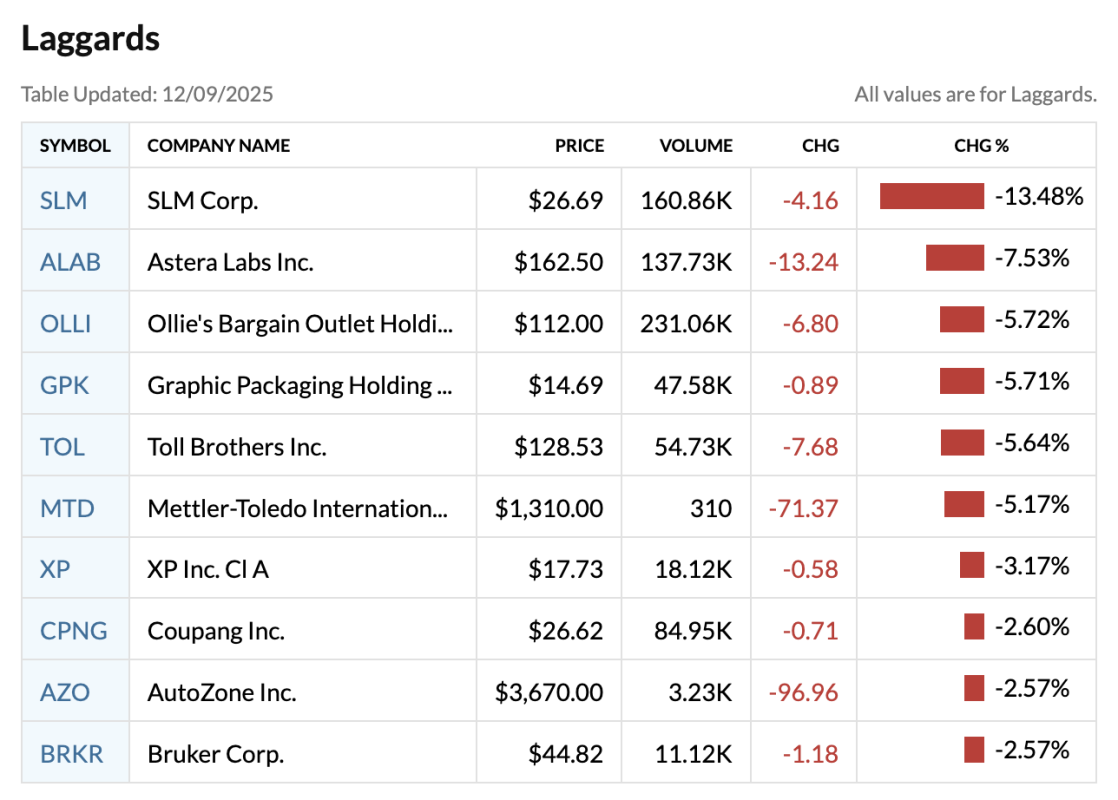

Among leaders this morning, TechnipFMC PLC (+9.2%) is leading the way after scoring a contract to lay a flexible subsea pipe for Ithaca Energy’s Scottish field. At the bottom of the market is consumer banking company SLM Corp (-13%), which is falling after a JPMorgan downgrade this morning.

Here are this morning’s premarket movers, per data from MarketWatch:

Update: 4:47 a.m. ET

A.M Update: Fed Day Arrives

Good morning. As the sun rises over the U.S. this morning, members of the Federal Reserve are set to kick off their two-day FOMC meeting, which is largely expected to culminate in one more quarter-point rate cut to cap off 2025.

In anticipation of the festivities, U.S. stock futures are effectively flat, including the S&P 500 (+0.02% in futures) and Dow (+0.00%). Meanwhile, the Nasdaq (-0.03%) is also saddling a modest decline, while the Russell 2000 (-0.17%) is seen reversing yesterday’s gains.

That said, here is what’s on deck for today’s trading day ahead:

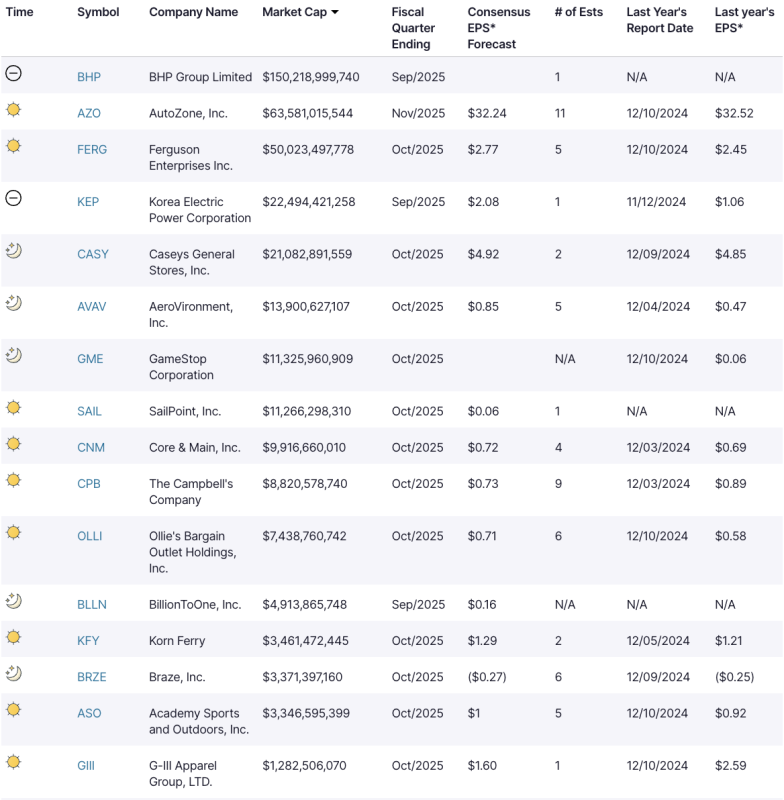

Earnings Today: BHP Group, AutoZone, Ferguson Enterprises

Here are this morning’s earnings reports among firms worth at least $1 billion in market cap, per Nasdaq:

Economic Data + Events: JOLTs (From the Past)

This morning, as the Federal Open Market Committee (FOMC) meeting is set to kick off, we’ll be getting a glimpse at some old news: the Job Opening & Labor Turnover Survey data for September and October, which might offer one last bit of information for policymakers as they’re slated to cast votes on where interest rates will end off 2025.

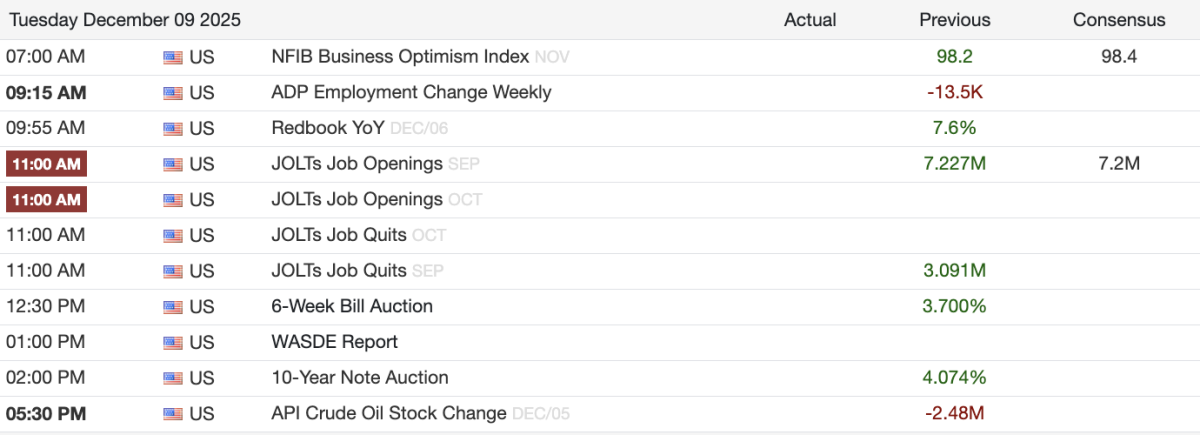

In addition, we’ll be getting a look at the NFIB Business Optimism Index for November, the latest weekly data from ADP Employment, and the Redbook data. Here’s the full list: