Financial markets have been confident for weeks that the Federal Reserve will cut interest rates by a quarter point at this week’s Federal Open Market Committee meeting.

But beneath that expectation lies a growing disconnect: investors foresee a series of rate cuts through next year while Fed officials have signaled only cautious steps amid persistent inflation uncertainty and a weakening labor market.

That gap will be front and center as policymakers gather for the Dec. 9-10 meeting and also release a new quarterly Summary of Economic Projections (SEP).

The new “dot plot,” which charts each official’s forecast for interest rates, may deliver a reality check for markets — and the White House — betting on a faster pivot to easing.

T

The Fed cut interest rates twice this year

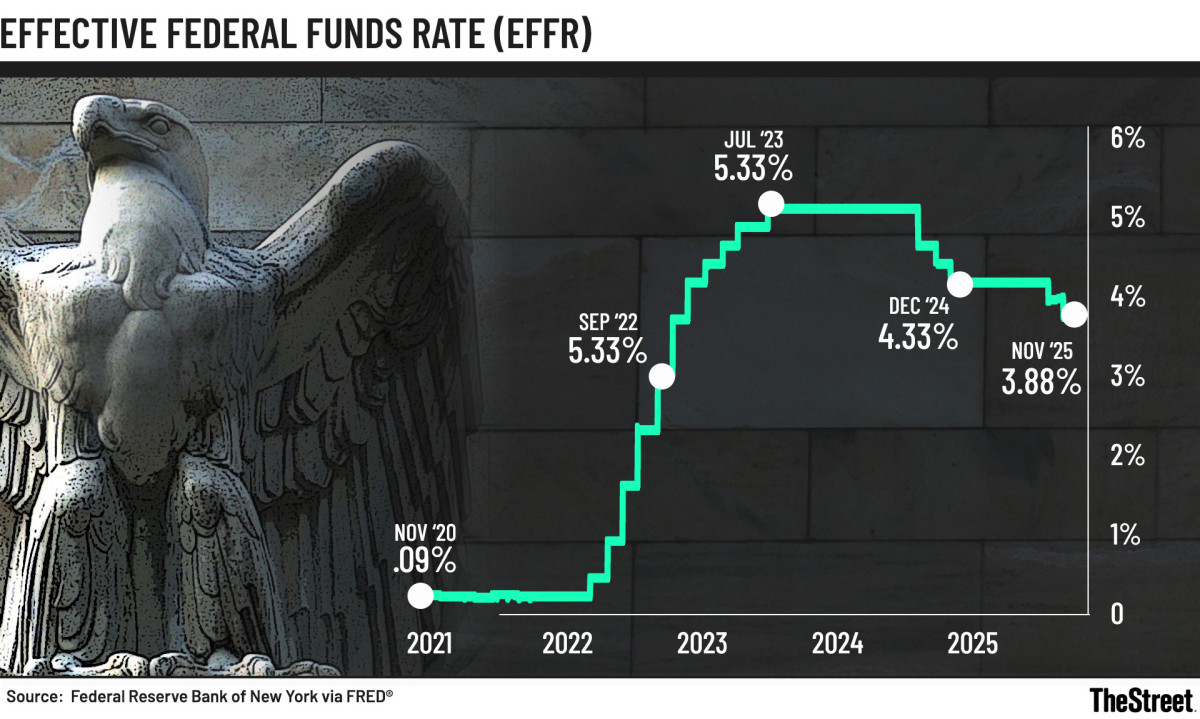

The benchmark Federal Funds Rate, which controls the cost of short-term borrowing like credit cards and auto loans, currently is 3.75% to 4%.

The FOMC held the rate steady for most of the year.

This “wait-and-see” approach was driven by caution over tariff inflation and trade policy.

It then lowered it by a quarter percentage point in both September and October over labor market concerns.

Fed’s dual mandate often at odds

The Fed’s dual congressional mandate requires it to balance inflation and job growth via interest rates.

- Lower interest rates support hiring but can fuel inflation.

- Higher rates cool prices but can weaken the job market.

The two goals often conflict, operate on different timelines, and are influenced by unpredictable global events.

Investors bet on Fed interest-rate cut

Investors have been encouraged by several better-than-expected inflation readings and signs that consumer spending is slowing.

With long-term Treasury yields stabilizing and credit spreads narrowing, markets are leaning into the idea that the Fed is about to enter a steady cutting cycle.

Futures pricing implies confidence in multiple reductions after this week’s anticipated quarter-point move.

The CME Group FedWatch Tool is pricing in a 89.6% chance of a quarter-percentage point cut this week.

Some Fed officials sport hawkish outlooks

Some Fed officials, however, have spent the last month pushing back.

Several policymakers have argued that while progress on inflation is welcome, core price pressures remain too high to justify aggressive easing.

They also note that global risks, including energy volatility and geopolitical tension, could re-ignite inflation later in the year.

The weakening labor market adds another layer of complexity.

Hiring has cooled, and wage growth has slowed, yet unemployment remains low by historical standards.

Some officials see this as evidence that the economy is cooling in a controlled manner, but others worry that deterioration could accelerate quickly if borrowing costs stay elevated for too long.

Plus missing data from the government shutdown means leading economic indicators for October and November won’t be released until after the FOMC meeting.

The quarterly SEP will be closely scrutinized by investors for clues about the Fed’s broader strategy.

Then there’s politics to consider

Fed Chair Jerome Powell steps down in May, and President Donald Trump has said he will nominate someone who will push for more aggressive rate cuts.

If the median dot continues to show only a small number of cuts for the year, it will signal to markets that policymakers remain wary of moving too fast to keep its dual mandate of stable prices and low unemployment in balance.

Related: White House claims it has decided on a new Fed chair

But a wider spread of dots could indicate deeper disagreement inside the 12-member committee.

At the October meeting, Fed Governor Stephen Miran dissented from the vote in favor of a jumbo rate cut to boost growth, while Kansas City Fed President Jeffrey Schmid dissented due to inflation concerns.

Five voting FOMC members have expressed concerns about rising prices, especially in the food, rent, energy, and healthcare sectors.

Former New York Fed President William Dudley told CNBC Dec. 8 that he expected both Miran and Schmid to repeat their dissents this week, with the possibility that “one or two bank presidents might join Schmid’’ on the inflation front.

This doesn’t mean the FOMC will descend into a volatile economic free-for-all.

“Don’t overweigh the chatter…the consequences are pretty small,’’ Dudley said.

Inflation split could mean serious business

Robert Conzo, CEO & managing director of The Wealth Alliance, said the political context is amplifying internal disagreement.

“Some view this as evidence of independent thinking and a sign that officials are weighing data without uniform bias,’’ Conzo said Dec. 8.

“Others interpret the split as strategic positioning, with some leaning dovish in anticipation of a future chair who may favor a more accommodative policy stance,’’ he added.

Conzo said inflation concerns are playing heavily into the hawkish approaches.

“The St. Louis Fed estimates that removing tariffs would have reduced annualized headline PCE by ~0.5% from June-August 2025 and taken core PCE from 2.9% to ~2.5%,’’ he said. “Lower pricing pressure would support an argument for easing into 2026.

Yet the source of disinflation matters.

“AI-driven efficiency could reduce labor needs and lower payroll costs, but potentially slow hiring and wage growth,’’ Conzo said. “A cooling job market could weaken demand even as inflation falls.’’