Have you been enjoying the ride?

Markets have spent the last six weeks bidding up stocks and bonds on expectations that the Federal Reserve will cut interest rates this week.

Investors, businesses, and consumers are eyeing the Fed’s expected rate cut as another welcome move to lower short-term borrowing costs.

But it may be the last cut to hit the U.S. economy for a while.

That’s because prices are still too damn high.

The Fed can cut more aggressively later if inflation continues falling, but reopening the door to rate hikes after a premature easing would be politically and economically costly.

T

Sticky inflation raises concerns for 2026 easing

Stubborn inflation and firmer wage data suggest the Federal Open Market Committee will take a cautious, hawkish approach to future easing of monetary policy.

The FOMC’s expected quarter-percentage point cut to the Federal Funds Rate Dec. 10 comes as divisive policymakers appear increasingly likely to signal concern, and while inflation pressures linger and the cooling labor market shows pockets of resilience.

That’s because, despite meaningful progress from the Covid-era highs of 2022 and 2023, the underlying data remain mixed enough to give rate-setters pause.

Inflation has been above the Fed’s annual 2% target rate for five years now.

Matthew Pallai, chief investment officer at Nomura Capital Management, said it has become clear that the current committee “is more divided than it has been in a very long time with respect to how to handle the path of monetary policy.”

Fed’s dual mandate requires a delicate balance

The Fed’s dual congressional mandate requires it to balance inflation and job growth via interest rates.

- Lower interest rates support hiring but can fuel inflation.

- Higher rates cool prices but can weaken the job market.

The two goals often conflict, operate on different timelines and are influenced by unpredictable global events.

“Ultimately, the Fed’s policy over the next few meetings will come down to a risk management exercise where one risk is considered more significant than the other – perhaps a choice in favor of the least bad decision – and will be heavily data-dependent,’’ Pallai said.

The Fed cut interest rates twice this year

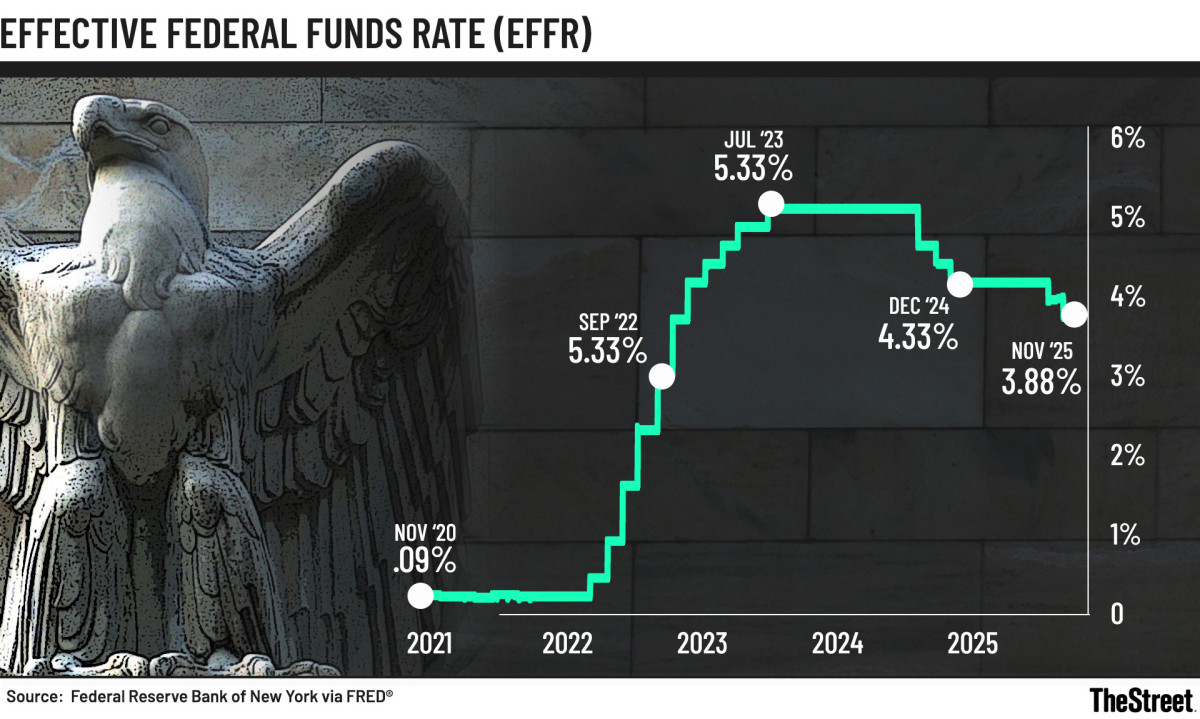

The benchmark Federal Funds Rate, which controls the cost of short-term borrowing like credit cards and auto loans, currently is 3.75% to 4%.

The FOMC held the rate steady for most of the year.

This “wait-and-see” approach was driven by caution over tariff inflation and trade policy.

It then lowered it by a quarter percentage point in both September and October over labor market concerns.

President repeats demand for slashing interest rates

President Donald Trump and his allies this year repeatedly called on Fed Chair Jerome Powell to slash rates to 2% or lower to prevent the risk of recession and/or stagflation.

In a Dec. 9 interview with Politico, Trump said support for immediate rate cuts is effectively a litmus test for picking the next Fed chair.

The president berated Powell as “not a smart person.”

Related: Markets eager for Fed ‘dot plot’ as rate cut bet looms

(The president also gave himself an “A-plus-plus-plus-plus-plus” grade on the economy since coming to office in January.)

Powell’s term as chair expires in May, and the White House has said a decision will be announced in January.

Kevin Hassett, the director of Council of Economic Advisers, is reported to be in the lead for the nomination.

Post-shutdown data emerges on inflation, jobs

The New York Fed’s latest consumer-expectations report, released Dec. 8, showed that American consumers are expecting worsening financial situations, especially rising medical costs.

Elevated expectations can fuel wage demands, which in turn can keep service-sector inflation sticky.

Then there’s the labor market.

Job growth has cooled from the booming pace seen early in the post-pandemic recovery, but unemployment remains low by historical standards.

Initial jobless claims remain near multi-year lows, reinforcing a message that employers continue to try to avoid layoffs, even as overall hiring slows.

A single “hawkish cut,” as several analysts have dubbed it, would allow the central bank to modestly ease financial conditions while preserving the option to pause for months if the data fails to align with its 2% goal.

Nomura’s Pallai said the Fed is split on which side of the mandate carries more short- and medium-term risk for the economy “where managing towards lower inflation requires a slower path of easing, versus managing towards a better labor market environment, which requires a faster pace of lowering rates.

“Although there are certainly some politics involved, there are reasonable arguments to be made for both approaches,’’ Pallai said.

Market uncertainty spreads beyond the Fed

“Although we discuss the Fed out of habit, the real uncertainty for the markets is now related to a more serious factor: the tariff war,” said Mind Money CEO Julia Khandoshko.

“This is a thing that can change the rules of the game much more than a single meeting of the regulator. It is also unpredictable, unlike the other political or economic events,’’ she said.

It is important to monitor “the Fed, but building a strategy solely around its decisions is no longer always justified. That’s why I think the rest of the information, like the speed of rate cut, only confuses,’’ she added.

Related: White House claims it has decided on a new Fed chair