This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Tuesday. This is TheStreet’s Stock Market Today for Dec. 23, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 6:55 a.m ET

A.M. Update

Good morning. Futures this morning are essentially flat. The Nasdaq and S&P 500are up 2 and 1 basis point a pop, while the Dow and Russell 2000 are seen down 1 and 7 basis points each. up just 1 basis point and the Dow down bip. That said, we have a long way to go before the sun rises and the opening bell tolls. In the meantime, we reflect on some of the stories of the defining stories as America wakes up:

Taking Your Medicine (GLP-1 Pills)

This morning, shares of Novo Nordisk (+8%) are up nearly ten percent after the Food & Drug Administration OKed a pill version of blockbuster ‘weight loss drug’ Wegovy, marking the agency’s first approval of a GLP-1 pill. The starting dose of the drug will become available in early January from as little as $149/months with discounts or incentives.

The approval will put the Danish drugmaker ahead of competitor Eli Lilly, which creates the competing Zepbound and is seeking its own foray into oral GLP-1 meds. Its oral GLP-1 pill orforglipron is expected to hit the market next year. The first mover advantage appreciated by Novo might be short-lived as the forthcoming med has been shown to work roughly as well as injectables.

Warner Bros. Bidding War Continues

Warner Bros. Discovery has made up its mind. After a month-long auction for the HBO parent, its future lies with Netflix…

However, Paramount Skydance is not going down without a fight. Despite losing to its streaming competitor in the hefty bidding war, Paramount’s Ellison family is making personal guarantees to try and win over investors. The effort means that Oracle CEO Larry Ellison will put up over $40 billion of his own money to assuage investors’ skepticism about the reliability of the bid.

As it stands, Paramount Skydance would be shotgun for a proposed takeout of the entertainment giant if Netflix were unable to nab regulatory approval, making these recent events a worthy watch.

Economic Data + Events

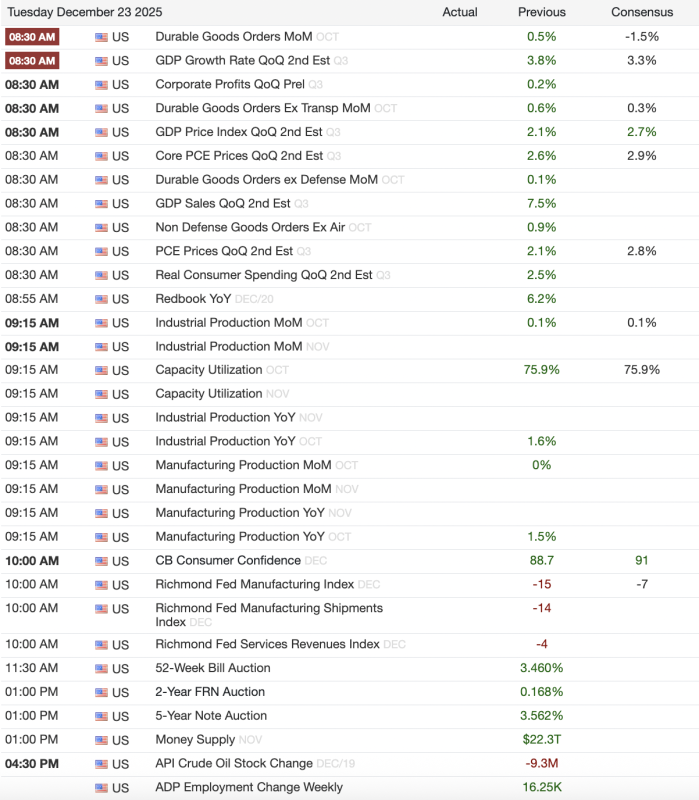

Today will mark the last full market day before the Christmas holiday. Tomorrow, the market is slated to close early; then, remain shut on Thursday. With a full trading day on the docket, substantially all of this week’s big economic data and events are due out today — with a smaller slate tomorrow.

Among the bigger reports today will be the October Durable Goods, Q3 GDP Growth Rate 2nd Estimate, and Oct. and Nov. Industrial Production data. We’ll also be getting the Conference Board’s Consumer Confidence drop for December, just a few short days after the UM report showed a small uptick in the index.

Here’s everything due out today, per tradingeconomics.com:

All That Glitters Is…

It might not be as exciting as quantum computing or space stocks, but the metals market is pedal to the mettle right now. Overnight, LME Three-Month Copper surpassed a record $12,000 as supply pressures continued to bolster the critical commodity. It is by no means singular in its recent rally; continuous futures of gold and silver have also eclipsed records in recent days, surpassing records of $4,500 and $70.

The recent excitement in the land of metals stands in contrast with energy commodities like oil and natural gas, which have been plummeting and weighing on the S&P 500’s energy sector. WTI Crude has seen a small recovery in recent days, but its front-month price still remains about $58. Meanwhile, natural gas on NYMex is struggling to keep its $4 support.