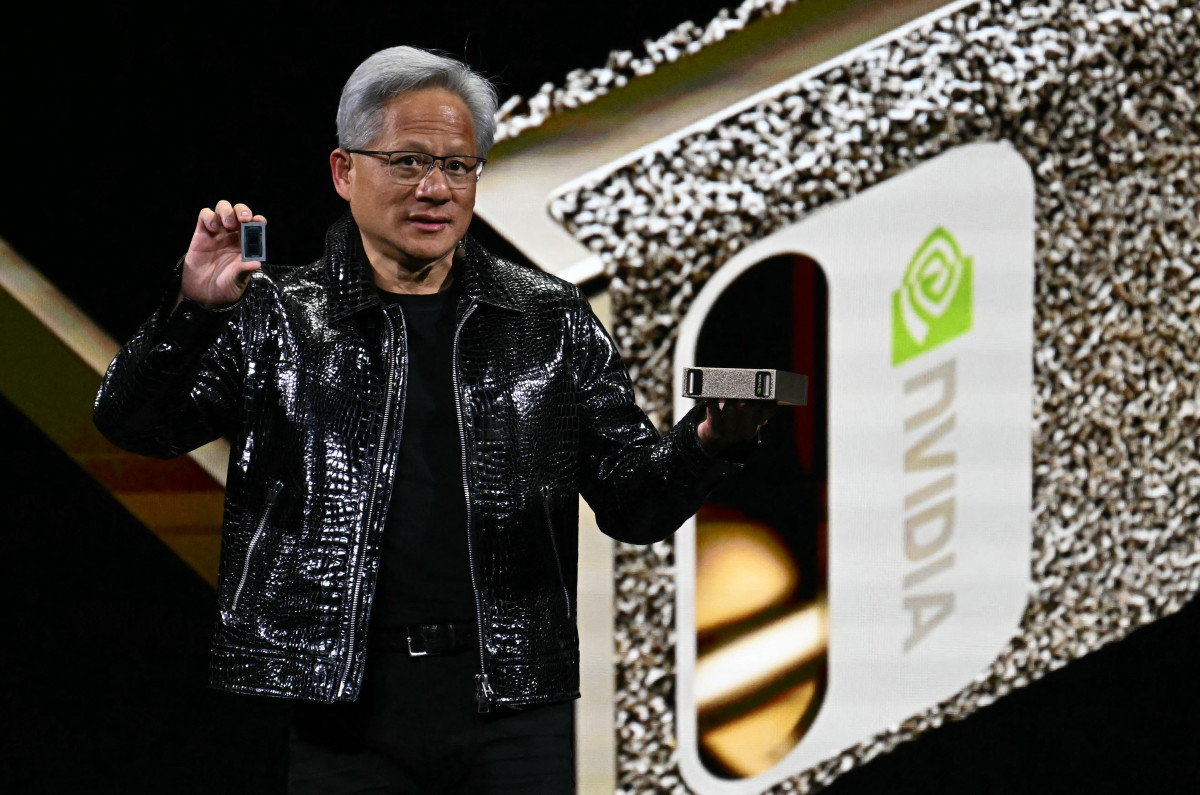

For the better part of the past couple of years, the AI trade has felt like a one-stock story. Clearly, Nvidia (NVDA) has dominated the headlines and the conversation, with Wall Street analysts like Wedbush being the most consistent bulls.

For perspective, if someone had invested $10,000 in Nvidia’s stock three years ago, it would be worth about $123,800 now.

However, that doesn’t mean the rest of the market is done playing catch-up.

Wedbush believes the next phase of the lucrative AI trade will be less about how the chips are made and more about how the technology is actually deployed.

As businesses transition from their experimentation phase to execution, the greatest gains will likely come from platforms that layer AI cloud infrastructure, enterprise software, and consumer ecosystems.

On CNBC‘s “Fast Money,” Wedbush’s veteran tech analyst Dan Ives said investors are underestimating just how massive that shift could be.

Zooming out, Ives feels there is something even bigger taking shape.

That belief is shaping Wedbush’s outlook as we head into 2026.

Although Nvidia is still AI’s “godfather,” Wedbush believes the upcoming acts are even more compelling, setting the stage for five AI stocks that the firm believes investors will be watching next.

As Nvidia’s rally matures, attention is shifting toward AI platforms poised for the next wave.

As Nvidia’s rally matures, attention is shifting toward AI platforms poised for the next wave.

Photo by PATRICK T. FALLON on Getty Images

Wedbush’s five AI stocks to watch as the next phase of the boom takes shape

Wedbush has just laid out five AI picks that approach the opportunity in very different ways.

Collectively, they demonstrate how AI is transitioning from hardware to platforms and from hype to profitability.

These picks cover a variety of tech verticals, including cloud infrastructure, enterprise software, cybersecurity, and consumer ecosystems, each positioned to benefit immensely from the acceleration in AI adoption in 2026.

Here are the picks with their respective latest price targets from Wedbush:

- Microsoft (MSFT): $625 price target (+28% upside) — outperform (reiterated December 22, 2025); YTD gains (15.6%)

- Palantir (PLTR): $230 price target (+25% upside) — outperform (reiterated December 5, 2025; target previously raised to $230 on Nov. 3); YTD gains (144%)

- Apple (AAPL): $350 price target (+28% upside)— outperform (raised from $320 on December 8, 2025); YTD gains (9.3%)

- Tesla (TSLA): $600 price target (30.5%) — outperform (reiterated December 15, 2025); YTD gains (13.9%)

- CrowdStrike (CRWD): $600 price target (+26% upside) — outperform (reiterated December 26, 2025)

Microsoft is turning AI into infrastructure

Microsoft’s 2025 AI story has everything to do with scale.

The tech giant spent the bulk of last year transforming its Azure cloud service into an AI factory, growing data-center capacity, layering Copilot across key products, and racing to keep up with breakneck demand.

That momentum showed up in the numbers.

Related: Bank of America CEO drops unexpected view on economy

In its most recent quarter (fiscal Q1 2026), Microsoft posted a whopping $77.7 billion in sales ($2.3 billion beat), Bloomberg reported, with Microsoft Cloud sales surging to $49.1 billion.

Moreover, commercial backlog jumped to $392 billion, underscoring the durability of its long-term demand.

Additionally, its quarterly earnings per share of $4.13 beat estimates by 47 cents, its 11th consecutive bottom-line beat.

Strategically, 2025 brought a sharper focus on the AI stack.

More Nvidia:

- Nvidia’s China chip problem isn’t what most investors think

- Jim Cramer issues blunt 5-word verdict on Nvidia stock

- This is how Nvidia keeps customers from switching

- Bank of America makes a surprise call on Nvidia-backed stock

Microsoft continued to grow its fruitful partnership with OpenAI, diversifying models and reducing its dependency on a single partner.

Looking ahead to 2026, analysts are expecting more capacity to come online, along with stronger proof points around Copilot monetization, spearheaded by another capex-heavy year ($64.6 billion for FY2025).

Palantir turns AI from promise into revenue

Palantir’s 2025 was all about AIP (artificial intelligence platform) adoption, with the growth engine shifting substantially toward U.S. commercial clients.

Moreover, for Palantir, the focus was less on one-off contracts and more on repeatable enterprise scaling.

That shift was evident in the numbers.

In Q3 2025, Palantir posted sales of $1.18 billion, along with a GAAP net income of $475.6 million, or $0.18 per diluted share.

Related: AMD stock faces its next big test in 2026

In the past six quarters, Palantir has failed to post an earnings surprise in just one quarter.

The bigger signal for the defense AI giant was that its U.S. commercial revenues, as cited in Q3, showed 121% year-over-year growth.

On the government side, 2025 also delivered stellar opportunities.

Specifically, the U.S. Army’s 10-year Enterprise Agreement, valued at nearly $10 billion, according to CNBC, demonstrated Palantir’s deep entrenchment in defense software.

As we head into 2026, Wedbush expects tougher comparisons and scrutiny around the sustainability of commercial expansion, as well as ongoing pressures to maintain margins as delivery scales.

Apple’s AI story is quiet and profitable

Apple’s 2025 had everything to do with stability.

Services remained its profit shock absorber, while a steady product cycle set the stage for the hugely successful iPhone 17, even with regulators breathing down its proverbial neck on its App Store model.

That balance was apparent in its latest quarterly results.

For the fiscal fourth quarter of 2025, Apple posted revenue of $102.5 billion (beat by $216 million) while posting another earnings surprise with an earnings per share of $1.85.

Services hit a powerful new record, reinforcing their growing role.

Moreover, the latest iteration of the iPhone turned out to be a smashing success with IDC analysts forecasting Apple to ship nearly 247.4 million iPhones in 2025, up 6.1% year over year.

Looking ahead to 2026, Wedbush expects continued strength in its Services segment, along with deeper on-device AI integration, while it remains in regulatory crosshairs.

Tesla’s AI ambitions grow as the auto business gets harder

Tesla’s 2025 unfolded on a couple of tracks.

Its EV business remained under duress on the back of pricing pressure and growing competition, while energy storage and autonomy carried the bulk of the narrative weight.

Related: CoreWeave CEO delivers blunt 5-word take on AI debate

Management continued pushing the idea that Tesla’s future is more about car deliveries, despite the near-term challenges.

Quarterly performances were choppy, with it missing earnings estimates in three out of the past four quarters.

In Q3 2025, it posted a whopping $28.1 billion in revenue, largely due to consumers rushing to cash in before the federal EV subsidy expired.

Nevertheless, by late November, Visible Alpha data cited by Reuters showed Wall Street expecting full-year 2025 deliveries to fall 7%, along with a 1% drop in 2024, its second straight annual drop.

Strategically, however, the messaging has been centered on Robotaxis and Optimus, with CEO Elon Musk pushing aggressively, despite Tesla’s core business struggling. Looking ahead to 2026, the two core narratives will be key.

Musk offered additional details in Tesla’s Q1 2025 earnings call.

Crowdstrike turns security into a platform play

CrowdStrike’s 2025 story is largely about consolidation.

It continued to reposition its Falcon platform into a broader security operating layer, covering identity, cloud, and data protection.

AI was at the heart of it all, enabling customers to automate responses while reducing analyst workload, with threats becoming a lot more complex.

The financial results effectively reinforced that potent strategy.

Moreover, it posted solid quarterly results, especially in the past couple of quarters, backed by double-digit top-line growth and comfortable earnings beats.

Crowdstrike pushed deeper into next-generation SIEM (security information and event management) through major partnerships, such as the AWS partnership and acquisitions like Pangea, plus ecosystem ties with CoreWeave and Nvidia.

In 2026, CrowdStrike will need to prove whether SIEM can become a true growth driver and whether it can continue to lift ARR per customer and free cash flow.