Editor’s Note: Todd Campbell, TheStreet’s co-editor-in-chief, a 30-year Wall Street veteran and former Series 7/65 licensed advisor, analyzes 2025’s biggest stock market stories.

Throughout my nearly 30-year career navigating the stock market, I’ve experienced more than my fair share of both good and bad times. I can honestly say, 2025 ranks right up there with the Internet boom bust, Great Recession, and Covid-laden 2020 as among the most dynamic for investors.

It was truly a tale of two tapes: A tariff tantrum-driven, nearly bear market early on, followed by a no-holds-barred, good old-fashioned rip-roaring rally.

If you were among the millions of investors who struggled to make sense of it all, know that you’re not alone. The weight of President Donald Trump’s tariff strategy certainly dominated the landscape, but it was far from the only needle-moving news that shook things up in 2025.

S&P 500 returns by year (since 2020):

- 2025: 16.9% (as of intraday 12/31/2025), according to Marketwatch.

- 2024: 23.3%

- 2023: 24.2%

- 2022: -19.4%

- 2021: 26.9% Source: MacroTrends.

We had a Fed boxed into a corner by policy and politics, a major shift marking a significant transformation in the artificial intelligence movement, and more than one battle royale in Washington, D.C., including Elon Musk‘s in-and-out-of-favor role at DOGE, the One Big Beautiful Bill Act, and the longest shutdown in history as politicians warred over budgets. Perhaps, unsurprisingly in hindsight, the uncertainty of it all made gold, the yellow metal safe haven, one of the best-performing assets of the year.

Through it all, the stock market proved, much as it has over my career, to surprise the investing masses, looking past seemingly major roadblocks to the promise of revenue and profit growth.

Federal Reserve Chairman Jerome Powell was on the hot seat over interest rate policy in 2025.

Federal Reserve Chairman Jerome Powell was on the hot seat over interest rate policy in 2025.

Bloomberg/Getty Images.

No. 1: Fed falls behind curve as Chair Powell suffers body blows

The Federal Reserve has never had it easy. Its dual mandate of low unemploymentand low inflationsounds simple enough. However, those goals often conflict with one another. Raising rates slows inflation, but it also causes job losses, and the opposite is true when the Fed cuts rates. The contradiction was on full display in 2025, and nobody took the brunt of it all worse than Fed Chairman Jerome Powell.

Powell came into 2025 on the heels of three end-of-year rate cuts in 2024, leading many to hope more cuts were coming. Instead, he pressed pause for fear that further rate cuts, as President Trump’s higher-than-expected tariffs took effect, would lead to runaway inflation similar to that of 2021.

It was a risky move, given cracks in the economic armor were forming. Unemployment had been ticking higher (rising to 4.6% in November from 3.4% in 2023) because of 2022 and 2023 rate hikes, and sitting on its hands raised the risk of the Fed falling behind the curve, unable to orchestrate a soft landing if the economy went into stagflation, a period of slow growth and inflation, or worse, outright recession.

Given CPIinflation climbed to 3% in September from 2.3% in April, before falling to 2.7% in November, Powell wasn’t wrong to worry. Still, the Fed’s hesitancy took a toll on investor psyche in the spring, and coupled with White House combative trade policy, Wall Street’s outlook soured, contributing to a stark 19% sell-off in theS&P 500 from all-time highs in February through early April, when President Trump opened the door to trade negotiations, correctly kindling hopes the worse of tariff proposals would be walked back.

The fear of an unfriendly Fed eventually shifted back from hawkish to dovish as layoffs surged. Despite rising inflation, Powell acquiesced, too late to save his job (senior Fed writer Mary Helen Gillespie kept us all up to date on that drama). He eventually lowered rates in September, October, and December, thereby contributing to a resurgence in animal spirits.

Hopes that lower rates would boost sales and profits helped catapult the S&P 500 higher, especially as S&P 500 earnings came in better than expected. According to my review of Factset data, S&P 500 companies are “predicted to report year-over-year growth in earnings of 12.3% and year-over-year growth in revenues of 7.0%” in calendar 2025.

Given that backdrop, it’s easier to understand why the S&P 500 rallied 42% from its April lows, leading the benchmark index to a 17.3% year-to-date gain — its third consecutive annual double-digit return.

Truly impressive.

No. 2: AI goes from virtual to reality

In 2024, the AI story was all Nvidia (NVDA), whose hyper-fast semiconductor chips were the de facto picks-and-shovels of the AI gold rush. In 2025, however, the AI hype associated with developing apps and chatbots turned to reality, as hundreds of millions of users flocked to ChatGPT, Gemini, and others, and businesses, both big and small, shifted their IT budgets toward building agentic AI workers to assist and automate.

Like the disruption I (and so many others) witnessed firsthand during the Internet boom, it was hardly a straight line for investors. Springtime recessionary worries led many to believe we were at peak IT spending, and hyperscalers like Alphabet (GOOGL), Amazon (AMZN), Meta (META) and Microsoft (MSFT) would be forced to close the spigot on hundreds of billions flowing to upgrade data centers from legacy CPUs to high-end servers powered by Nvidia’s GPUs.

The fear hit tech stocks hard during the sell-off this spring, setting the stage for outsized returns as hyperscalers not only held the line on spending but doubled down on it. In the end, a flurry of AI activity led hyperscalers to spend an estimated $394 billion in 2025, according to Goldman Sachs. For perspective, the four biggest hyperscalers spent about $210 billion in 2024.

Top AI stock performers in 2025:

- Broadcom: 50.2%

- Credo Technology: 115.6%

- Micron: 241.7%

- Nvidia: 40.6%

- Palantir: 137.3%

- Western Digital: 280.9% Source: Marketwatch, as of 1:24 pm EST on 12/31/2025

In turn, demand spread well beyond Nvidia to the agentic AI enablers, such as Palantir(PLTR), whose Gotham and Foundry platforms became favorites of Fortune 500 companies, and backbone providers, including Micron (MU), whose memory chips became must-haves.

It also led to significant growth in interconnect plays, such as Credo Technology (CRDO), and storage stocks, including Western Digital (WDC), sending their stocks soaring in 2025. It also boosted fortunes for safety-valve AI stocks, like Broadcom (BRCM), which developed specialty AI chips called Tensor Processing Units, or TPUs, for Alphabet to reduce its reliance on Nvidia.

Our dedicated team of technology stock writers, including “Moz” Farooque, Vuk Zdinjak, and Silin Chen, covered these stories at length, and you can bet they’ll be all over shifting trends again in 2026.

No. 3: Washington drama hits a high note

We all entered 2025 expecting major drama in Washington, D.C., following one of the most contentious elections in recent memory. I remember the Bush vs. Gore debacle well, and the Trump vs. Biden/Harris drama was arguably worse. Nobody on Wall Street, including me, expected roses, daisies, or a “Kumbaya” moment.

Things got real quickly in D.C., punctuated by Elon Musk’s surprising role at the top of the Department of Government Efficiency (DOGE). Musk was tasked with the seemingly impossible yet plausible goal of rooting out excess spending in government, a task that turned into a battle of wills over everything from EV credits (shout out to our excellent automotive writer, Tony Owusu, for his EV coverage in 2025) to pink slips.

Most on Wall Street agree — the government’s deficit and mounting debt pile isn’t a good thing, and perhaps, Ray Dalio, the billionaire founder of Bridgewater, one of the most successful hedge funds of all time, pounded the table loudest on risks that the world may one day balk at financing our bills.

After Musk departed from D.C., we saw policy take center stage as President Trump’s One Big Beautiful Bill Act staggered to the finish line, ultimately getting signed into law on July 4, and fueling investors’ optimism that tariff economic headwinds could be offset by tax cut-driven stimulus from a higher standard deduction, SALT tax cap, and child tax credits, as our veteran personal finance editor Robert Powell noted at the time.

Never a dull moment, Congress ground to a halt on October 1 and remained shut down for 43 days until November 12 — marking the most extended budget-driven shutdown battle on record. The uncertainty and lost paychecks for government workers, yet again, reset bets on GDP growth and corporate profit risks, contributing to a 6% S&P 500 sell-off.

An eventual deal to end the shutdown helped kick off a healthy year-end rally that saw the S&P 500 and tech-heavy Nasdaq climb 5% and 6%, respectively, from the lows on November 21 through intraday on December 31.

2025’s other big stock market trends

Those major stories set the backdrop for investors, but they weren’t the only important trends impacting portfolios.

Gold, silver surge to all-time highs: Uncertainty caused Treasury yields and the U.S. Dollar to fall and foreign Central Bank nervousness — all of which were tailwinds for precious metals. Gold, a favorite safe haven, took off as central banks shifted reserves, increasing purchases, and retail investors sought diversification. Silver similarly caught retail investors’ attention even as industrial demand increased. As a result, Gold and Silver surged 64% and 141% in 2025 to all-time highs, despite a sharp one-day drop earlier this week due to changes in CME margin requirements.

Foreign stocks outpace the U.S.: Diversification was a key theme in 2025, and foreign stocks were a major beneficiary. After years of lagging returns, emerging markets and European stocks had there best years in recent memory. The Vanguard FTSE Developed Markets ETF (VEA) and Vanguard FTSE Emerging Markets ETF (VWO) jumped 35.86% and 25.7% year-to-date through December 30.

U.S. stock market rotates: Technology was the big winner for 2025, but it wasn’t the only gainer. While tech stocks were standouts, the State Street Health Care Select Sector SPDR ETF (XLV) outperformed the State Street Technology Select Sector SPDR ETF (XLK) since June 30, returning 15.3% compared to 14.48%.

What’s next for 2026?

Our longtime markets reporter, Charley Blaine, compiled every major Wall Street analyst’s S&P 500 target for 2026 as of late December. All of the surveyed firms expect a fourth consecutive positive return in 2026, which I find concerning.

Over the years, I’ve learned that the stock market tends to disappoint the masses. With everyone on the bullish side of the boat, I can’t help but wonder if 2026 has surprises in store for investors, especially given its history.

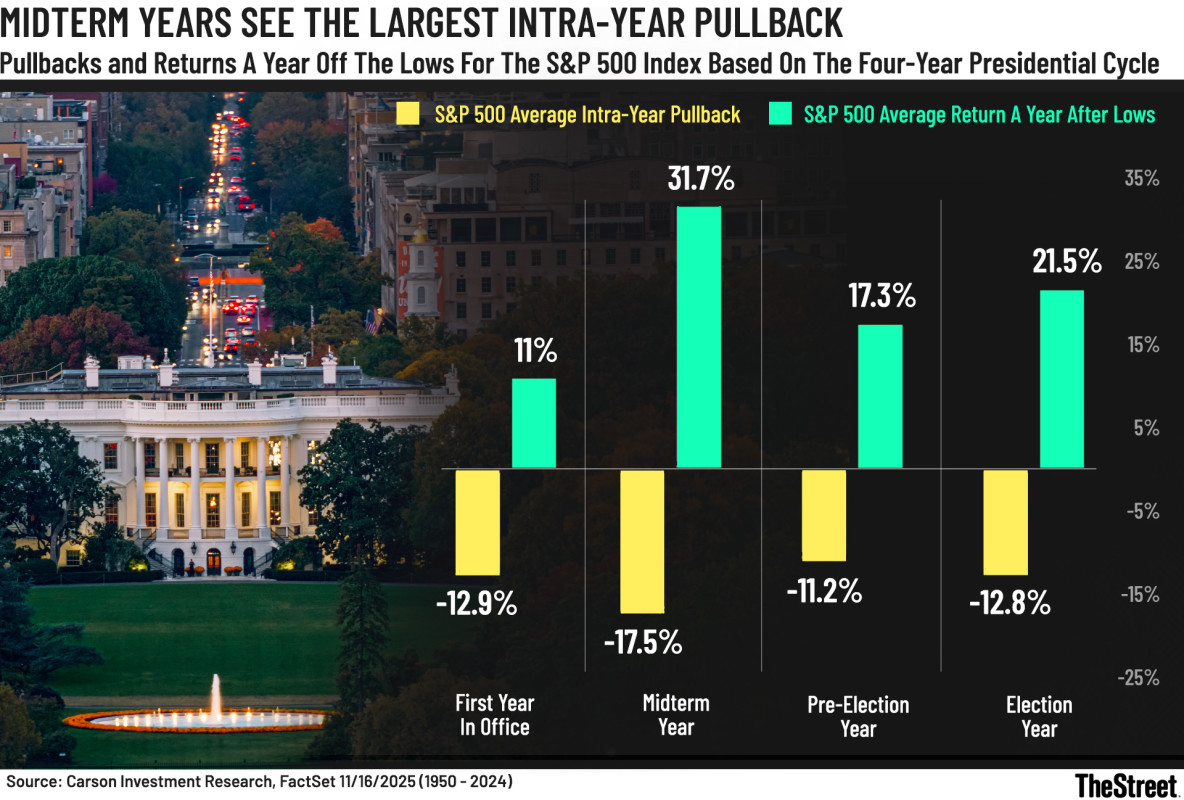

I recently wrote how the second year of the four-year Presidential cycle can be perilously prone to big sell-offs, like in 2022. It wouldn’t be surprising if stocks yet again test investors staying power at some point next year, given mid-term election uncertainty.

Midterm Years See The Largest Intra-Year Pullback.

Midterm Years See The Largest Intra-Year Pullback.

Carson Investment Research, FactSet, TheStreet

That said, stocks have gone up and to the right over time and intrayear pullbacks, and even bear markets, while scary, tend to create opportunities for long-term investors.

So sure, review your portfolio, trim some of your winners where you might feel overexposed, but don’t forget your long-term goals. Too many do every year, and pay a price in the long term because of it.