Tesla’s tale about cars that drive themselves is going in circles.

A significant new announcement reaches the press, and investors start to fear that the “moat” is narrowing. Then the talk turns back to the laborious process of getting the cars on the road, and Tesla is back to square one.

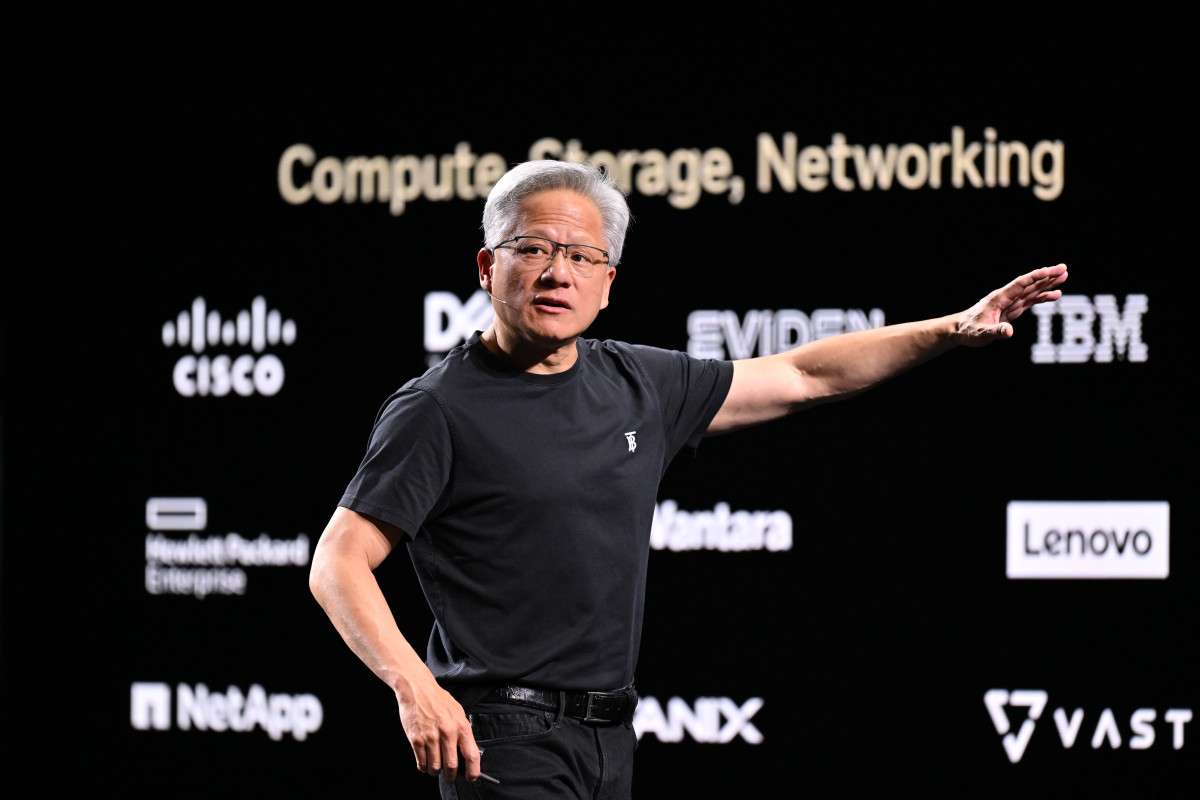

That cycle began again after CES 2026, where a lot of top tech players, such as Nvidia, made comments with major implications for the coming year.

Nvidia pushed hard into “physical AI,” saying that self-driving cars and robots were the next big thing after data centers, which helped Nvidia generate $115.2 billion for the full fiscal year 2025.

Morgan Stanley is basically telling investors that the announcement isn’t a short-term change in how things work.

Andrew Percoco, an analyst at Morgan Stanley, put it simply.

When I write about chip and EV companies, I often notice that investors become confused. While new tools can make a keynote speech seem like a “reset,” the true winners are those that can manage integration, validation, and cost.

Nvidia has this capability, but the real test will occur in 2026.

Wall Street is watching Nvidia’s latest push.

Wall Street is watching Nvidia’s latest push.

Photo by Anadolu on Getty Images

What Nvidia’s autonomy tools actually do

Nvidia’s main focus is on Alpamayo, which the company calls an “open portfolio” that will make “reasoning-based” self-driving cars go faster.

This means not just matching patterns, but also systems that can more reliably resolve rare, messy edge cases.

The package includes:

- Alpamayo 1, a vision-language-action (VLA) model that focuses on reasoning and addresses “long tail” driving problems

- AlpaSim, a framework that anyone can use to simulate the development of AVs

- Open datasets for physical AI that have more than 1,700 hours of driving data

Here’s what it means in simple terms, without “autonomous jargon”:

- The VLA model is a program that can see the road, understand the situation and instructions, and choose what to do (brake, change lanes, or yield).

- “Long tail” situations are ones that arise infrequently (such as strange construction, unpredictable drivers, or unusual crossroads), but can impact safety.

- Simulation is a way to teach and test faster, but it’s still only one step toward autonomous driving that’s reliable in the real world.

Nvidia is also connecting this work to actual OEM installations. Several sources at CES said the stack will be available in Mercedes-Benz cars on a specific schedule, which means this isn’t just a research display.

Wall Street sees an edge, but not a leap

Percoco thinks Nvidia’s way of doing things is not relevant. It’s additive, which means it’s a faster way for carmakers to add more advanced driving assistance without having to make their cars fully autonomous right away.

The reason is what really slows down autonomy:

- Putting together sensors, computers, wiring, heat management, and backups

- Validation: proving that it is safe to drive in many different situations

- Economics: finding a price that works for a lot of people who buy cars

- Time: putting together a full stack and getting it ready for production cycles

Related: A big Wall Street flip just changed the Regeneron narrative

Morgan Stanley thinks this is more of a “faster follower” story than a leapfrog event for this reason. Nvidia can speed up some of the early work, but it still takes years to finish the whole thing.

Percoco also says that Nvidia’s comments don’t change his opinion of Tesla much because his base case already assumes that features like those in self-driving cars will become common in the industry over time.

Tesla’s fleet data still gives it a moat

Morgan Stanley’s argument is based on a well-known but important edge: having a lot of real-world data.

Every day, a lot of Tesla cars are on the road collecting driving signals. You can use this data to speed up the process of making changes, find failure modes faster, and improve performance in situations where autonomous systems have trouble.

More Nvidia:

- Nvidia’s China chip problem isn’t what most investors think

- Jim Cramer issues blunt 5-word verdict on Nvidia stock

- This is how Nvidia keeps customers from switching

- Bank of America makes a surprise call on Nvidia-backed stock

This is also why investors might not understand autonomy. Nvidia can give you great tools, but tools don’t automatically make miles. Miles are important, because edge cases happen on real roads.

To put it another way, Nvidia may help car companies build better foundations, but Tesla has an advantage, since it has been collecting the raw material (driving data from a fleet) for years.

Nvidia wants to standardize the autonomy stack

Nvidia’s plan is clear. It aims not just to power the future, but also to level the playing field.

Nvidia could do the following by making models and tools open source:

- Get more OEMs and suppliers to use it.

- Build an ecosystem that helps Nvidia-first autonomous development.

- Sell more of the “full stack,” which includes software, semiconductors, and simulation.

At CES, Huang’s comments made Alpamayo seem like a “reasoning” leap that focused on the hardest parts of autonomy. Robotaxis were one of the first big winners.

That’s why people who own Tesla stock pay attention to it. If Nvidia becomes the standard autonomy toolkit for many car companies, the difference could shrink. Morgan Stanley doesn’t think this will happen right away, though.

In the end, Nvidia might help carmakers catch up faster, but Tesla’s edge in road-tested data is something that no keynote can change quickly.

Related: Brad Gerstner breaks from the crowd on one AI stock