Nvidia‘s shares are experiencing another surge. The chip giant traded as high as $189.67 Thursday, Jan. 15, last changing hands for $187, after opening at $186.51 and hitting a low of $184.16 on roughly 206 million shares.

The sharp stock movement comes after the Trump administration officially approved the sale of Nvidia’s H200 (its second-most powerful AI chip) to China, according to Reuters. I’ve spent years covering Nvidia and chip stocks, but you don’t need significant experience to understand why NVDA stock is surging now.

The market is reacting to a basic “Wall Street” idea: a new policy door to China. This means Nvidia may be able to sell more high-margin data-center CPUs in an industry where most exports are limited.

However, the decision is also prompting condemnation from both sides of the aisle in Washington, including one Democrat.

It’s easy to see the business logic: Chips are the product, but access is what makes them worth more. Chinese tech companies ordered more than 2 million H200 chips, each costing about $27,000. This is a big enough demand signal that even a partial reopening can change people’s minds quickly, especially for a stock that’s already priced for long-term AI infrastructure growth.

The problem is that both governments still have the final say, which is why this rally can change so quickly.

The U.S. rule requires third-party testing, and China can sell only 50% of the chips it sells to American consumers. Chinese customs officials notified agents that the H200 cannot enter China, Reuters reported, meaning that Beijing might still slow down (or stop) the sale.

The Nvidia rally is easy. The rules aren’t.

The Nvidia rally is easy. The rules aren’t.

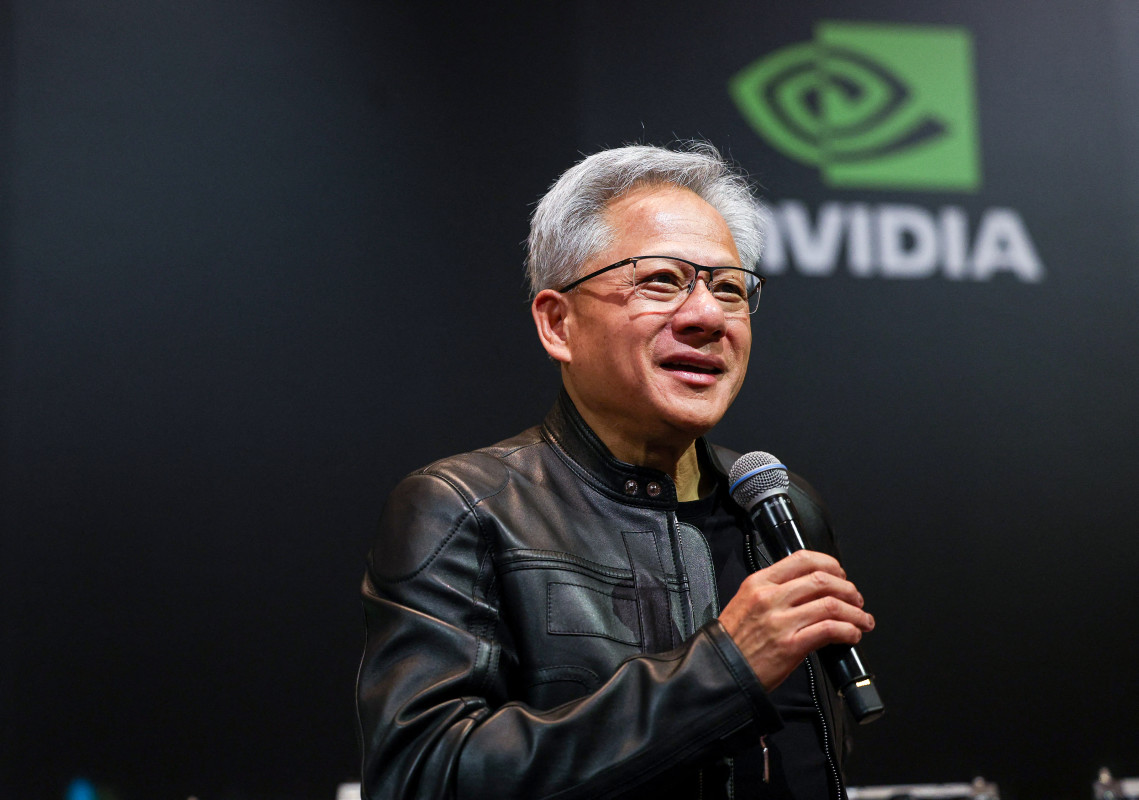

Photo by I-HWA CHENG on Getty Images

Wall Street sees an H200 chip revenue door crack open, with a quota sign on it

U.S. guidelines say that the H200’s AI capabilities must be tested by a third party before it can be sent to China, and that China can only buy half of the total chips sold to American customers, according to Reuters.

The dollar math is what got traders excited: Reuters claimed earlier that Chinese IT companies had ordered more than 2 million H200 chips, each costing about $27,000.

More Nvidia:

- Nvidia’s China chip problem isn’t what most investors think

- Jim Cramer issues blunt 5-word verdict on Nvidia stock

- This is how Nvidia keeps customers from switching

- Bank of America makes a surprise call on Nvidia-backed stock

This would mean that there is a lot of demand if the supplies do come through.

But Washington is also getting a share. According to Reuters, President Donald Trump linked the policy to a 25% charge for the U.S. government, which adds another layer of politics (and uncertainty) to what investors want to be a clear sales story.

Washington is fighting about national security, and it’s not subtle

At a congressional hearing, Matt Pottinger, a former advisor to Trump on Asia, said supplying H200s may “supercharge Beijing’s military modernization.” The opposition saying something is one thing, but a former advisor like Pottinger saying it makes headlines and is worth noting.

The Trump administration contends that allowing exports could make Chinese competitors such as Huawei less likely to accelerate their efforts to catch up. However, Pottinger labeled this idea a “fantasy,” according to Reuters.

For investors, the lesson is that when a stock catalyst turns into a fight on Capitol Hill, the rules can change quickly, and that’s the kind of headline risk that can shock NVDA from week to week.

Beijing may decide the whole AI chip trade, and China is already moving

Chinese customs officials warned agents that Nvidia’s H200 chips can’t come into China, and they told Chinese IT companies not to buy them unless they have to, a tit-for-tat response from Chinese officials to President Trump.

At the same time, Reuters cited a Nikkei Asia report that China is writing guidelines to limit the number of advanced AI chips Chinese companies can import, seeming less like a one-time “ban” and more like a quota system with considerable power.

Related: Wall Street sends message on Tesla after Nvidia self-driving move

For NVDA stockholders, this is a stark reality.

The company is risking its profitability in China, but Washington and Beijing hold significant influence, with the latter potentially imposing restrictions.

The “man on the street” angle: Your 401(k) might be riding NVDA already

Nvidia is the largest holding in SPY, making up 7.53% of the fund as of Jan. 14, which means that many regular investors own NVDA, even if they didn’t mean to.

In short, having $10,000 in an S&P 500 fund that matches SPY means that around $753 of that amount is invested in Nvidia. This demonstrates that policy headlines are more than just noise on cable news and can significantly impact retirement savings.

The ripple can also damage “semis baskets.” On Jan. 15, SOXX traded at about $337.22, and several public holdings breakdowns show that Nvidia is a big position (usually around 7% or more, depending on the source and time).

Investors: Trade the “two-government gate” into Nvidia earnings

- Keep an eye on Nvidia’s next big event:On Feb. 25, it releases its Q4 FY26 financial results, according to Nvidia’s investor events calendar. Look for commentary on China in Nvidia’s latest report.

- Long-term holders: Treat China as an upside option until there is definitive proof that chips are getting through customs and that any quotas are real. The reason? Reuters is already reporting problems on China’s side.

- Traders: Use the $184.16 to $189.67 range from Jan. 15 as a “headline channel.” If Beijing clarifies its stance on imports or Washington clarifies its stance on enforcement, this range could quickly break.

Related: GM may have found a simpler way to deliver a ‘premium car’ feel