Veteran tech analyst Gene Munster, managing partner at Deepwater Asset Management, issued a curt verdict after Intel’s (INTC) earnings left investors wanting more.

Intel posted a so-so Q4 earnings report on Jan. 22, with revenue of $13.7 billion, down 4% year over year, a $0.6 billion GAAP net loss, and a GAAP loss of $0.12 per share, capped by lackluster guidance and sluggish gross margins.

However, even without fundamental backing, Intel stock is up 24% over the past month and almost 92% over the past six months alone.

Though Intel has been in soul-searching mode for years, I never thought I’d see the day when the words “meme stock” and Intel were used in the same sentence.

For the most part, meme-stock mania typically targets heavily shorted names or struggling businesses with cult followings, not exactly a legacy chipmaker that has defined Silicon Valley.

However, Intel stock is now showing similar tendencies, moving sharply on the back of flashy headlines and big-name endorsements rather than top-and-bottom-line expansion.

Munster believes Intel is the clear laggard among AI stocks, and its stock continues to run on hopes of its lofty foundry plans and outside backing, while earnings keep failing to validate that optimism.

Intel’s stock surge collides with weak earnings, margin pressure, and lingering doubts over its turnaround.

Intel’s stock surge collides with weak earnings, margin pressure, and lingering doubts over its turnaround.

Photo by Bloomberg on Getty Images

Intel’s rally looks like a meme trade

The “meme stock” label stings a lot more when Munster ties it to fundamentals.

He notes that Intel is expected to grow just 3% next year, paling in comparison to Nvidia, which is forecasted to grow 50% to 65%.

Despite the discrepancy, Intel stock has jumped anyway, which Munster links to “some massive endorsements.”

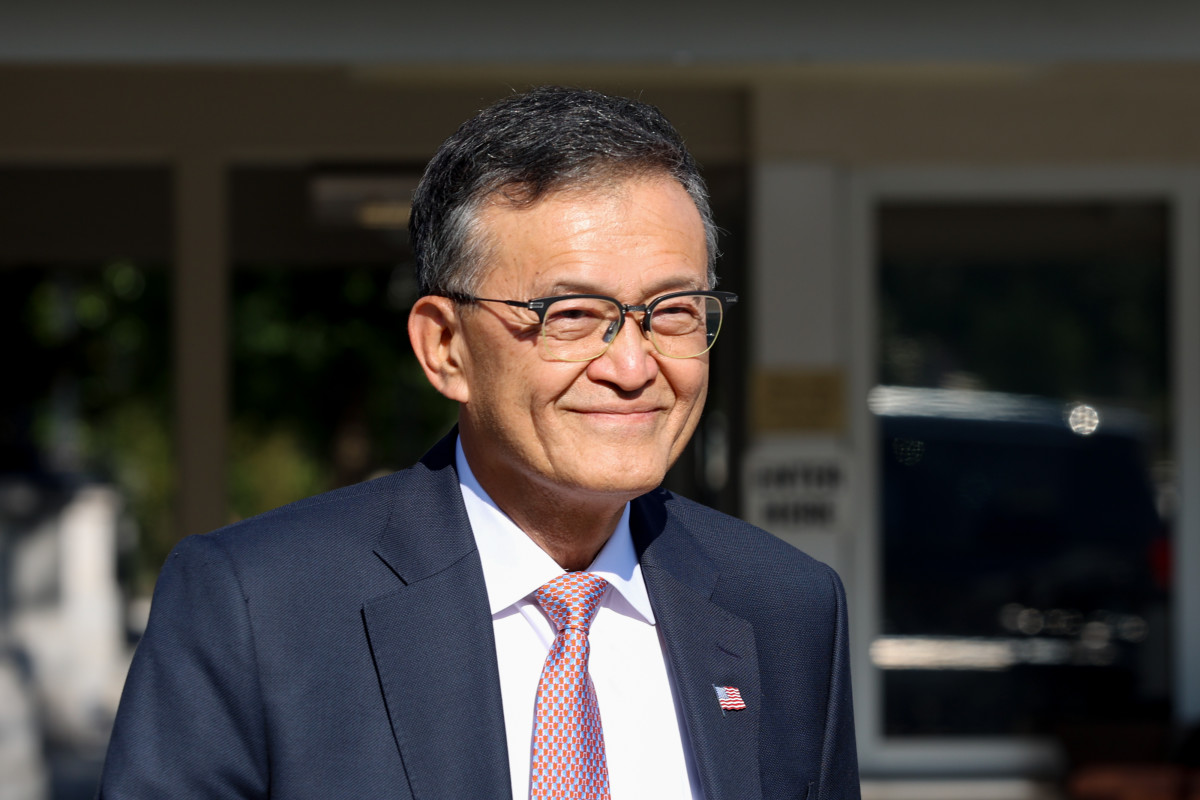

Related: Lip-Bu Tan’s net worth: The Intel CEO’s wealth & income

Intel’s stock got a boost from heavyweight endorsements

Munster told CNBC that Wall Street just re-priced Intel’s story on validation.

So in a market obsessed with AI winners, perhaps Intel’s biggest tailwind has been who’s willing to back it.

- Nvidia’s $5 billion equity check: The AI giant agreed to drop $5 billion in Intel’s common stock, which instantly added credibility behind its growth story.

- SoftBank’s $2 billion vote of confidence:SoftBank’s $2 billion investment reinforced the “smart money is back” narrative.

- U.S. government’s 9.9% stake and warrant: The Commerce-linked deal effectively converted its funding into a 9.9% equity stake along with a five-year warrant for an additional 5% under certain conditions, Reuters reported.

That’s exactly why Munster has been blunt about valuation.

“If you’re gonna just look at the fundamentals here,” he said, Intel stock “should be down, like, 15% right now.”

Hence, for now, Munster says, Intel remains primarily a turnaround story that’s moving much more slowly than its competitors.

Analysts reset Intel price targets after the post-earnings plunge

Per Intel stock’s last closing price of $45.07, analysts made the following calls.

- Bank of America: $40 target (underperform), 11.2% downside

- Morgan Stanley: Raised to $41 (equal weight), 9.0% downside

- Evercore ISI: Raised to $45 (in line), 0.2% downside (basically flat)

- RBC Capital: Cut to $48 (sector perform), 6.5% upside

- Mizuho: Raised to $48 (neutral), 6.5% upside

Intel’s margins are shrinking, and 18A yields are still the culprit

On paper, Intel’s Q4 gross margins felt like a win (37.9% versus 36.5% guided), but investors didn’t buy into the headline.

That’s because the apparent upside actually came from lower inventory reserves, and not an expected scale-up in manufacturing efficiency.

Essentially, an inventory reserve is an accounting write-down for chips Intel expects to potentially sell at a lower price, or might not sell at all.

Related: Cathie Wood quietly buys $7.27 million of popular tech stock

So if the cushion is much smaller than expected, Intel ends up booking a lower expense as cost of sales, which makes its gross margins look a lot better.

Perhaps the bigger downer was Intel’s Q1 non-GAAP gross margin guidance of 34.5%, a 340-basis-point (3.4%) sequential decline that shows the troubles of ongoing ramp costs and yield friction.

CEO Lip Bu Tan noted his disappointment with yield friction in Intel’s Q4 earnings call.

So, despite the strong demand and momentum for Panther Lake, if 18A yields don’t rise quickly enough, gross margins will continue to remain a pressure point.

Intel’s foundry ambitions are real, and so are the losses

Clearly, if 18A (Intel’s next-gen manufacturing chipmaking process) delivers at scale, it could prove to be a game-changer for the business over time.

The metrics support those claims.

More Tech Stocks:

- Morgan Stanley sets jaw-dropping Micron price target after event

- Nvidia’s China chip problem isn’t what most investors think

- Quantum Computing makes $110 million move nobody saw coming

- Morgan Stanley drops eye-popping Broadcom price target

- Apple analyst sets bold stock target for 2026

For perspective, Tom’s Hardware reports Intel’s benchmarks show up to a 25% higher performance or 36% lower power compared to the Intel 3 (depending on the test conditions), along with nearly 30% higher transistor density.

It all ties up with Intel’s ambitions of becoming a powerhouse in the foundry space, and for it to be a second engine of growth.

18A is meant to be the node that convinces customers that the tech giant can go toe-to-toe with the biggest contract chipmakers.

Clearly, Intel Foundry is bringing in some serious sales ($4–$4.7 billion a quarter), but it’s still deep in investment mode, and continues to lose nearly $2–$3 billion a quarter as it scales up 18A.

- Q1 2025: $4.667 billion revenue, –$2.320 billion operating loss

- Q2 2025: $4.417 billion revenue, –$3.168 billion operating loss (the quarter included impairment/one-time charges)

- Q3 2025: $4.235 billion revenue, –$2.321 billion operating loss

- Q4 2025: $4.5 billion revenue, –$2.249 billion operating loss

Related: Bank of America delivers blunt stock market warning investors can’t ignore