This live blog is refreshed periodically throughout the day with the latest updates from the market.To find the latest Stock Market Today threads, click here.

Happy Friday. This is TheStreet’s Stock Market Today for Feb. 6, 2025. You can follow the latest updates on the market here in our daily live blog.

Update: 10:00 a.m. ET

Consumer Sentiment Ticks Up

University of Michigan’s U.S. Consumer Sentiment data for February is just out, with the index rising to 57.3 (from 56.4). Current conditions saw the most rapid increase, rising to 58.3 from 55.4. On the flip-side, expectations fell modestly, hitting 56.6 (from 57).

Update: 9:34 a.m. ET

Opening Bell

Earlier this morning, U.S. equity futures were lining up for a fourth consecutive day of declines. This morning, it’s a different story. Investors are turning the risk back up, with stocks, commodities, and crypto all rallying.

The Russell 2000 has added over 2.3% in the opening minutes of trading, trailed by the Dow (+1.26%), S&P 500(+0.96%), and Nasdaq (+0.93%). It offers some evidence that investors are ready to embrace the recent pullback in equities, even if the indication is that they might be more skeptical about buying the tech dip.

In Focus: S&P 500 Heatmap

It’s a sea of green, so long as you haven’t recently touted your big plans for AI capex this week. Amazon (-9.15%) is off nearly double-digits after its earnings revealed it would blow past analysts’ spending expectations this year, then followed that revelation with a new S-3 Mixed Shelf filing, which will allow the firm to offer a mix of stock and debt. That puts the stock at an 8-month low. Meta (-1.05%) and Alphabet (-1%) are also in decline after strong earnings, but similar sentiments on the spending situation.

The rest of the market kind of speaks for itself. Here’s the S&P 500 after the market opened (15 minutes delayed):

In Alternative(s) News

In alternative assets, continuous futures for gold and silver sat at $4,952 and $75, recovering steep losses from yesterday and today. Crypto assets also roared back, with Bitcoin recovering to $68,500 and Ethereum sitting just below $2,000.

Update: 3:03 a.m. ET

A.M. Update

Good morning. Thank God it’s Friday, but we still have to make it through it — and if the last three days on the markets have been any indication, it could be a tough last few hours of the trading week.

This morning, U.S. equity benchmarks are biased to the downside yet again, continuing a nearly week-long trend of declines. The Nasdaq is worst-situated, down 0.33% in futures. The S&P 500 and Dow are off just a few bips total.

A continuation of the recent swing lower wouldn’t be particularly surprising. In recent days, U.S. equities have declined from all-time highs amid a dramatic ‘vibe shift’ in the markets. A rotation away from tech, which has taken software stocks down as collateral, has been one of the persistent themes. Most affected has been the Nasdaq and Russell 2000, which have fallen to year lows amid the pivot away from growth stocks.

However, it’s not enough to look at the single-digit declines in major indexes. Zooming out further, all sorts of trades that are loosely attached to growth, speculation, or the retail crowd have been facing much steeper declines. Many of these recent declines seem to have been accelerated by fresh jitters about artificial intelligence (AI), namely its financial impacts and social impacts.

On one hand, there’s frustration at AI. Spendthrifts like Microsoft, Amazon, and Alphabet said they spent much more money in the fourth quarter on capital expenditures than analysts expected, and likely will continue to do that. Separately, there are the worries about AI, namely the worries about creative destruction. Ironically, many of the investors worries about the spending equation are also taken by the disruptive potential of the technology.

Separately, myriad of negative data points have also persisted in the investor psyche. On Friday, a trifecta of labor market reports added to the recent row of worries. Layoffs rose in January, initial and continuing claims rose, job openings declined, and quits rose.

The reactions have by no means been restricted to equities, either. The reactions can also be seen in commodities like silver and gold, which have retreated from recent all-time highs in short order, just like U.S. equities. And separately, cryptocurrencies like bitcoin and ethereum have also made big swings lower, too. (We’ll check in on how they’re all doing in a few hours, but for what it’s worth, they are all down over the last 24 hours as of the time of this writing.)

Before we get this show on the road in a few short hours, we also wanted to catch up on what is on the docket for today:

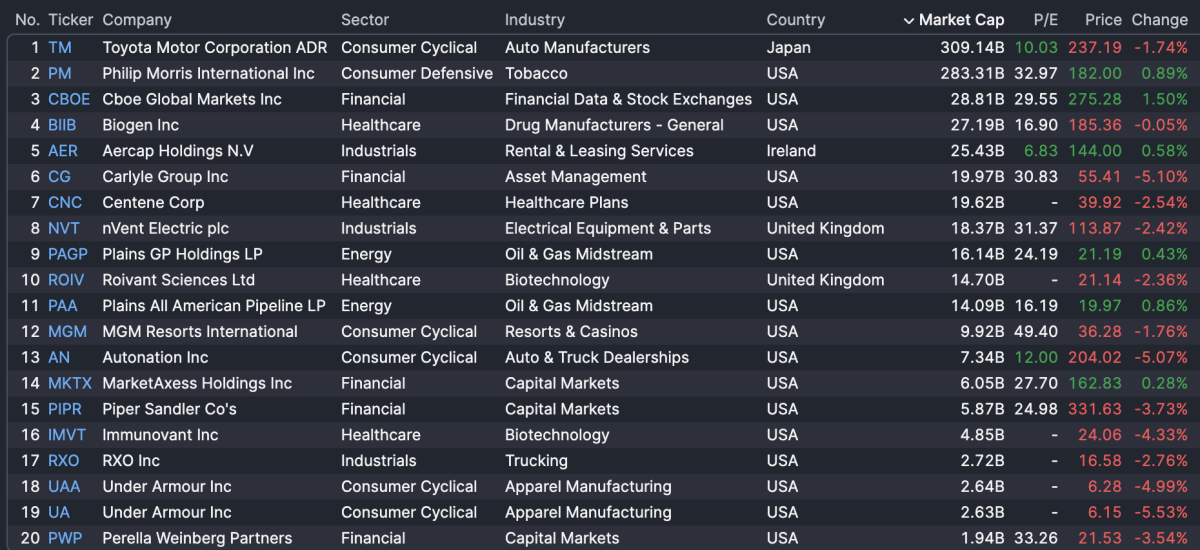

Earnings Today: Toyota, Philip Morris, Cboe Global

This morning, we’ll have a handful of reports to close out the week. Toyota Motor will report in the A.M. hours today, just hours after the company promoted its Chief Financial Officer to the Chief Executive position in its second major shakeup at the top within three years.

It’ll also be joined by Philip Morris, Cboe Global, and Biogen Inc, among others. Here’s a list of the reports, along with their stock’s performance on the tepid Thursday we all just experienced:

And seeing how it’s Friday, we’ll have no after hour reports to look forward to. Enjoy the weekend!

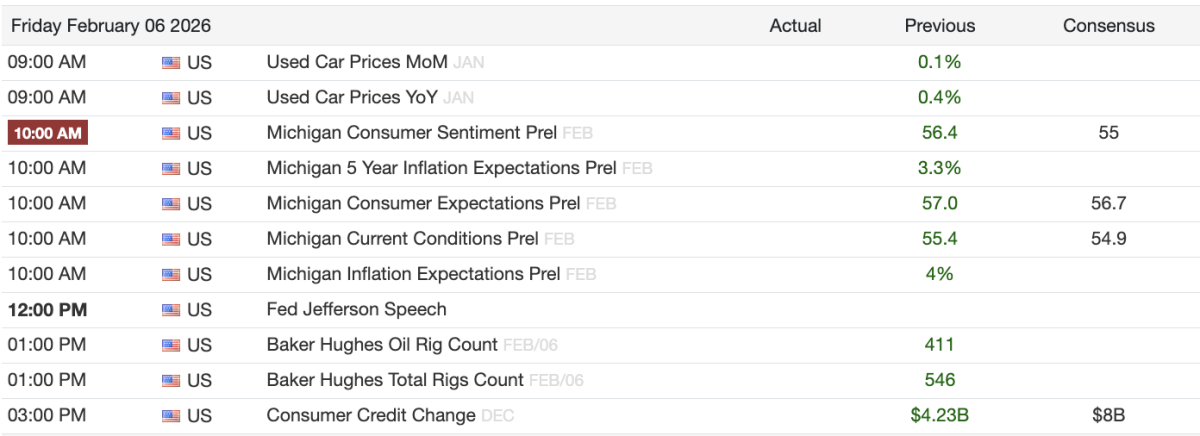

Economic Events: Michigan Consumer Sentiment, Used Car Prices, Consumer Credit Change

In the background, we’ll also have the preliminary results for the Michigan Consumer Sentiment this month. It’ll be the biggest economic report on this quiet Friday, but don’t mistake that light schedule to mean it won’t be uneventful. As recent earnings and economic data has shown, investors’ reactions have been more nuclear as of late. Here’s the full slate: