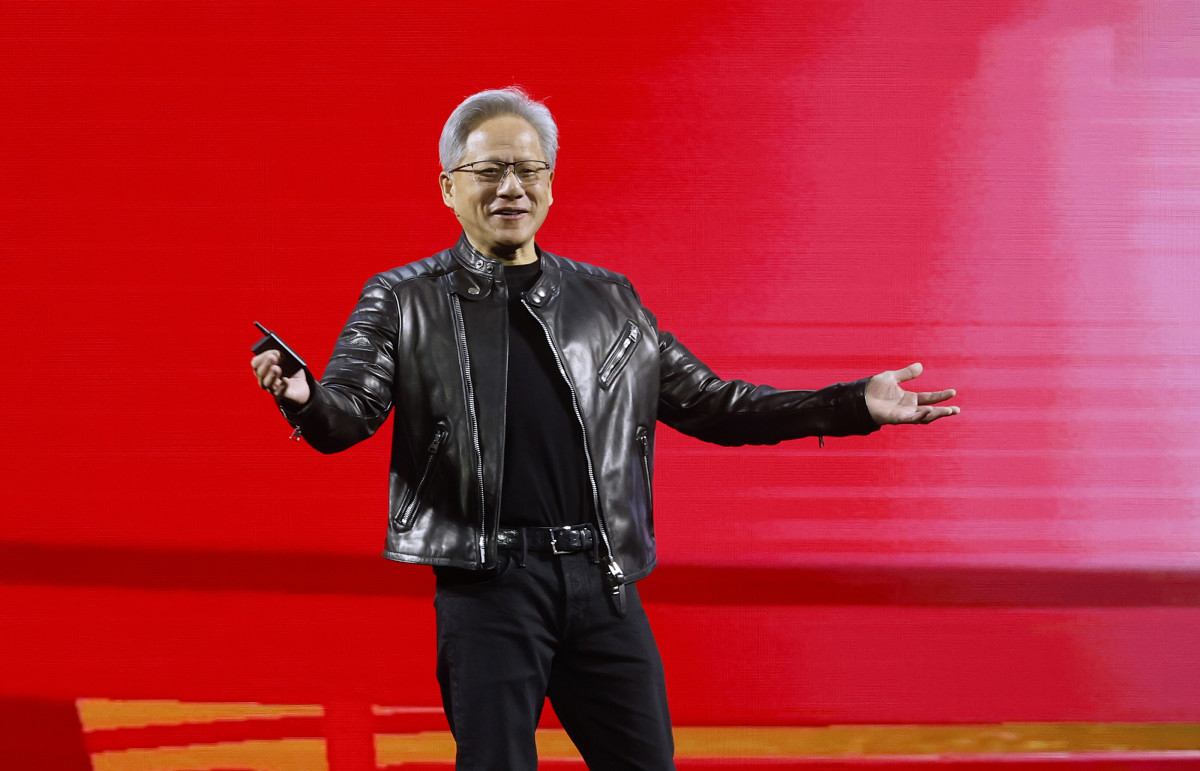

A brutal global sell-off in software is causing headaches the world over. The question is very simple. Is AI about to eat the application layer or turbocharge it? Nvidia’s (NVDA) Jensen Huang came to the rescue, yet again.

And the timing could not be better.

Friday was yet another reminder for Wall Street that AI is turning into a two-speed market.

The Dow closed above 50,000 for the first time. The reason? Investors leaned into one of the clearest “picks-and-shovels” trades, leading to a sharp increase in chip stocks.

Nvidia shot up 7.8% and finished around $185 a share, while the PHLX semiconductor index rose 5.7%.

But the backdrop to this activity is anything but calm. Traders instantly dubbed this “software-mageddon. “ The drop was caused by a new wave of fear that AI models are moving up the value chain and threatening established companies where profits are highest.

Huang is allaying those fears, stating:

Nvidia CEO drops a 1-word verdict on Wall Street’s AI panic

Nvidia CEO drops a 1-word verdict on Wall Street’s AI panic

Photo by Justin Sullivan on Getty Images

Why the panic hit software so hard

The latest spark came from Anthropic’s recent releases and enterprise push. The market’s fear is real.

More Nvidia:

- Nvidia stock gets major reality check on ‘$100B’ number

- Veteran analyst delivers surprise verdict on Tesla, Nvidia

- NVDA, PLTR, small cap stock bets reset after U-turn

AI tools will disintermediate traditional software, especially in legal, finance, and other “knowledge work” categories; that’s the narrative causing shivers in the markets.

Related: Veteran analysts drop shock call on Micron stock after historic run

Anthropic’s new capabilities have the potential to disrupt white-collar jobs. Claude Opus 4.6, more reliable and able to handle long-running operations better, shows off “agent” processes that can separate jobs into smaller parts and speed them up. With that kind of firepower, it comes as no surprise why markets are spooked.

The numbers got ugly fast:

- The S&P 500 software and services index fell 4.6% on Feb. 5 and had shed about $1 trillion in market value since Jan. 28.

- By Feb. 4, the group was down about 13% over six straight sessions and off 26% from its October peak.

- In Europe, Reuters noted sharp drops in data and professional-services names such as RELX and Wolters Kluwer, alongside big declines in FactSet, Morningstar, and LegalZoom.

The shockwaves extend beyond the confines of the U.S. Instead, they are reverberating across Asia, with India’s IT exporters hit particularly hard.

Huang’s argument: AI doesn’t replace tools it uses them

Nvidia CEO Jensen Huang is offering a direct rebuttal amid the volatility.

Huang spoke at an AI conference in San Francisco organized by Cisco (CSCO), stating that the concept that AI will lead to software tools being useless is “illogical,” and that current AI successes rely more and more on exploiting existing tools instead of starting from scratch.

Related: Wall Street urgently warns software stocks after Anthropic AI move

Huang sees AI as less of a competition to software makers and more of a force multiplier. It makes existing products more useful by automating the operations that happen within them.

Anthropic’s own marketing has hinted at a similar direction: linking AI to current business tools instead of tearing them out and replacing them.

Big Tech’s AI bill is exploding

It takes a brave man to argue with Huang. Software isn’t “dead,” not by a long shot. However, the cost of winning AI is becoming too large; at least that is an argument that is being made.

Big Tech firms are planning a $600 billion AI spending surge in 2026, with some estimates pegging outlays to come at $630 billion.

Related: Bank of America delivers blunt warning on dollars next move

Amazon (AMZN) is the latest lightning rod. The tech giant is outlining a planned $200 billion capital outlay. The number is a large enough figure to jolt investors already on edge about return on investment. AMZN fell 9% Friday and closed down about 5.6%, around $210 a share.

Some experts are already making an unpleasant analogy to the dot-com era, when huge amounts of money were spent on infrastructure that eventually created the modern internet, but not every firm that paid for it got a return.

So the market is splitting the baby:

- AI infrastructure winners (chips, networking, data centers) get the benefit of the doubt.

- AI-exposed software and data names get stress-tested for whether their moats are real.

Deals and money flows that matter right now

To comprehend why Nvidia consistently finds itself at the forefront of this narrative, it is crucial to track the financial flows.

Nvidia and OpenAI: a potential $20B check

Nvidia is close to sealing a deal to invest roughly $20 billion in OpenAI, according to Reuters, as part of a financing round, raising up to $100 billion and valuing the ChatGPT maker around $830 billion.

Huang says Nvidia will consider investing in OpenAI’s eventual IPO and described the planned fundraising as the largest private round ever.

Wall Street adoption: Goldman + Anthropic

Meanwhile, Goldman Sachs (GS) is collaborating with Anthropic on “AI agents” to automate tasks like bookkeeping, due diligence, and onboarding inside the firm.

Hardware challengers: SambaNova’s new funding

Vista Equity Partners and Intel are heading a fundraising round of more than $350 million for AI chip firm SambaNova in the hopes of finding “the next Nvidia” as demand for inference chips and other chips that are not Nvidia chips rises.

The broader theme: AI runs on capital

The broader deal coverage is pointing toward a pattern. Valuations are wobbling. However, instead of valuations causing companies to stay on the sidelines, they are going all in as far as the compute stack and the ecosystems.

What to watch next

If I am an investor, whether in Nvidia or anything else, the next catalysts are pretty clear:

- Software earnings and guidance: I am tracking paid upgrades, not just demos. I am also looking for retention and pricing power.

- Capex discipline from hyperscalers: I do not want to see spending outrunning demand.

- Deal terms in mega-rounds: OpenAI, Anthropic, and other companies are fundraising at levels that might change the way companies compete and decide who has the best access to computing power.

For me, Huang’s message is clear. AI isn’t the end of software. Instead, it’s the next interface layer on top of it. But the market is still figuring out which current companies will collect the tolls and which ones will not.

Related: Goldman Sachs revamps Nvidia stock forecast ahead of earnings