The January jobs report delivered a sharp upside surprise, complicating expectations for Federal Reserveinterest-rate cuts and reinforcing the view that the U.S. labor market remains more resilient than policymakers anticipated.

Payrolls rose by the most in more than a year to 130,000, beating estimates of 55,000.

Theunemployment rate unexpectedly fell to 4.3% from 4.4%.

“The surprisingly robust payrolls reading and falling unemployment rate suggest the labor market may be turning a corner,” Bloomberg Economics’ Anna Wong said.

As for an interest-rate cut this year? Wong couched her forecast by noting the effect of the payrolls report. “The January payrolls report lessens the urgency for the Fed to cut rates,” she said.

Wong then shared an outlook for Fed rate cuts for the rest of the year.

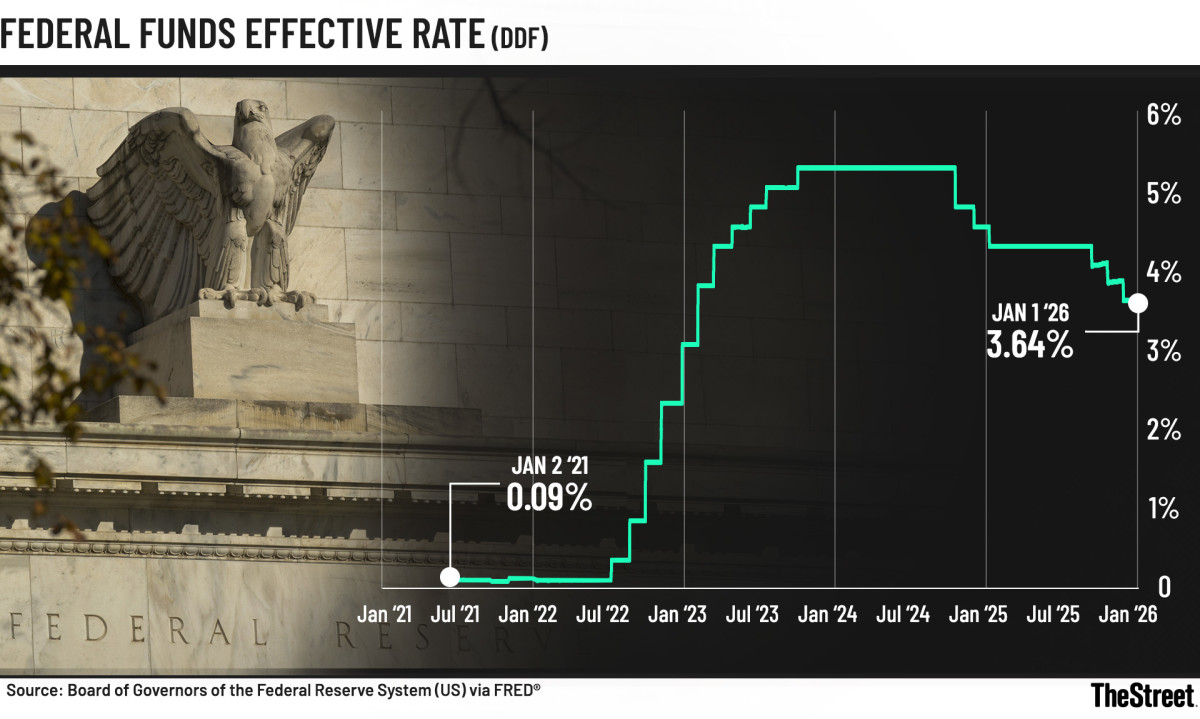

Federal Funds Effective Rate Chart

Federal Funds Effective Rate Chart

Board of Governors of the Federal Reserve System

FOMC January meeting holds rates steady

The Federal Open Market Committee voted 10-2 to hold interest rates steady at 3.50% to 3.75% in January on the benchmark Federal Funds Rate after three consecutive quarter-point cuts in its last three meetings of 2025.

The Federal Funds Rate guides interest rates for investors and consumers on auto and student loans, home-equity loans, and credit cards.

For consumers, a delayed rate cut could mean higher borrowing costs that remain in place longer than expected.

Fed Governors Stephen Miran and Christopher Waller dissented, saying they would have preferred a quarter-point cut due to softening in the labor market.

It was the FOMC’s first pause since July 2025.

How the Fed manages interest rates

The Fed’s dual congressional mandate requires it to balance inflation and job growth via interest rates.

- Lower interest rates support hiring but can fuel inflation.

- Higher rates cool prices but can weaken the job market.

The two goals often conflict, operate on different timelines and are influenced by unpredictable global events.

More Federal Reserve:

After the December rate cut, Fed Chair Jerome Powell said that the lowering of rates brought monetary policy “within a broad range of neutral.”

A neutral rate neither stimulates nor restrains economic growth.

Related: What is the neutral rate of interest? The Fed’s theoretical rate benchmark

When the Federal Reserve last paused interest rates

The Fed last paused interest rates in September 2023, holding the funds rate at 5.25% to 5.50% after a rapid tightening cycle aimed at curbing post-pandemic inflation.

The pause lasted nearly a year as policymakers wanted to see if the higher borrowing costs would tame inflation without dipping the economy into a recession.

During that pause, inflation gradually cooled and the labor market remained resilient.

The central bank resumed cutting rates in September 2025 once Fed officials became confident that inflation was moving sustainably toward the Fed’s 2% target.

January jobs report includes the benchmark annual revision

The jobs report was delayed by the brief, partial federal shutdown, but last fall’s prolonged government shutdown — the longest in history — disrupted data releases much more significantly and complicated efforts to gauge the labor market’s activities.

The Bureau of Labor Statistics’ Feb. 11 release also included final benchmark revisions to the year prior to March 2025. Those initial counts were revised lower by a total of 898,000.

Once again, the health care sector led job gains, adding 82,000 posts.

- Ambulatory health care services: 50,000

- Hospitals: 18,000

- Nursing and residential care facilities: 13,000

Job growth in health care averaged 33,000 per month in 2025.

Job gains also occurred in social assistance and construction, while federal government and financial activities lost jobs.

The January payrolls are notable, given the structural pressures that are facing the workforce, Seema Shah of Principal Asset Management told Bloomberg.

“Against a backdrop of powerful structural forces that are suppressing headline job creation — retirements, shifting immigration dynamics, and AI‑driven productivity gains — the payrolls figure points to a labour market that remains firmly intact,’’ Shah said.

So when is the next Fed interest-rate cut?

At the end of last year, the FOMC penciled in one further rate cut in 2026.

Wall Street traders don’t anticipate seeing more Fed easing until later in the year, as reflected by their bets in interest-rate futures markets.

The blockbuster January jobs report boosted traders’ expectations.

The CME Group FedWatch tool reports the likelihood of a quarter-percentage-point rate cut at each FOMC meeting in the first half of 2026.

- March 18: 7.9%

- April 29: 21.9%

- June 17: 48.1%

Note: There is still a month of economic data including the February jobs and CPI report to be released before the March FOMC meeting.

White House applauds jobs report

The June meeting comes after Powell’s term as chair ends May 15.

Kevin Warsh, President Donald Trump’s nominee to replace Powell, faces stiff challenges in his March Senate confirmation hearings.

Outgoing Senator Thom Tillis (R-N.C.), a key vote on the Senate Banking Committee, has said he will not confirm any nominee until the unprecedented Department of Justice criminal investigation into Powell over the cost of the renovations of the Fed’s headquarters is closed.

Related: Federal Reserve official blasts latest interest-rate pause

President Trump has repeatedly called for aggressive interest-rate cuts over the last year, attacking Powell personally and professionally for not slashing rates to 1% or lower.

He also voiced that he would not nominate a candidate to head the world’s most influential central bank without total loyalty to the president’s economic agenda.

The president lauded the January jobs report, which came in better than the White House was expecting publicly earlier this week.

“We are again the strongest Country in the World, and should therefore be paying the LOWEST INTEREST RATE, by far. This would be an INTEREST COST SAVINGS OF AT LEAST ONE TRILLION DOLLARS PER YEAR – BALANCED BUDGET, PLUS. WOW!” Trump wrote in a TruthSocial post on Feb. 11.

Economists, investors talk future rate cuts

Wong said she expected inflation to ease in the coming months.

“In particular, we expect a more subdued reading on January CPI, due Feb. 13, than the consensus forecast — we think policymakers have room to cut rates to support the labor-market recovery,’’ Wong said.

“In all, we expect the Fed to cut rates by 100 basis points this year,” she added.

In the three months to January 2026, payroll gains averaged 73,000, “which is a pretty healthy number once we allow for the slowdown in labor supply,” Brian Coulton of Fitch Ratings told Bloomberg.

That is the fastest three-month average gain since February 2025, Coulton said.

“This contrasts with some recent lurid headlines following other data points on job cuts and falling vacancies,’’ he said.

“The downside risks to the labour market the Fed was fretting about late last year have not evaporated, but they definitely look to be receding,” Coulton said.

Fed officials eye inflation, not jobs, on interest-rate cut bets

The Federal Reserve’s holding pattern is likely to continue in the short term, as the newest job numbers make it challenging for many Fed officials to justify a retreat from its current “wait-and-see” position.

The role of monetary policy due to its mandate is to keep inflation near 2% and the labor market at full employment.

Kansas City Fed President Jeff Schmid said in prepared remarks Feb. 11 that the central bank needs to keep rates at a restrictive level to continue to push downward pressure on inflation.

Schmid added that he’s not seeing indications of restraint in the economic data.

“I therefore supported the Federal Open Market Committee’s decision to hold rates steady in January,’’ he said.

“In my view, further rate cuts risk allowing high inflation to persist even longer,’’ Schmid added.

Interest rates could be on an extended hold while officials evaluate incoming economic data, Federal Reserve Bank of Cleveland President Beth Hammack said in prepared remarks on Feb. 10.

“Rather than trying to fine tune the funds rate, I’d prefer to err on the side of patience as we assess the impact of recent rate reductions and monitor how the economy performs,” Hammack said.

“Based on my forecast, we could be on hold for quite some time,” she added.

The Cleveland Fed chief, a voting member this year on the FOMC, has repeatedly urged her peers to be cautious with rate cuts to avoid pumping inflation higher.

She supported last month’s decision to pause interest rates after the three consecutive reductions at the end of 2025.

“We feel the costs of elevated inflation with every shopping trip. The longer that inflation remains at these levels, the greater the risk that it becomes entrenched in the economy,’’ she said.

Federal Reserve Bank of Dallas President Lorie Logan, also a voting member of the 12-member FOMC, said she’s hopeful inflation will continue to come down.

But added that it would take “material” weakness in the labor market for her to support more interest-rate cuts.

“We will learn in coming months whether inflation is coming down to our target and whether the labor market will remain stable,’’ Logan said in prepared remarks Feb. 10.

“If so, this would tell me that our current policy stance is appropriate and no further rate cuts are needed to achieve our dual mandate goals,’’ she added.

Related: Fed Chair Powell sends frustrating message on future interest-rate cuts