Many cheered the January CPIinflation report, which showed the lowest headline inflation since May 2025. But lurking under the surface, some Wall Street economists have noticed price stickiness that could mean the Fed’s preferred inflation gauge — the Personal Consumption Expenditures (PCE) index — tells a different story.

The CPI data is undeniably positive, suggesting that — on the surface — tariff-driven price hikes are proving, dare I say, transitory.

Dig into the data and consider differences in how CPI and PCE are calculated, though, and it’s unlikely that PCE will show the same level of progress.

January core CPI, which excludes oil and food because they’re highly volatile, was 2.5%, but, as I previously discussed, Goldman Sachs spotted a disconnect in the data and calculation methods that suggests January core PCE will be 3.05% — a full percentage point plus higher than the Fed’s inflation target and above the 2.8% inflation in November.

Goldman Sachs isn’t alone in highlighting the disconnect.

Economists at BNP Paribas also crunched the data and came to a similar conclusion in a report shared with TheStreet:

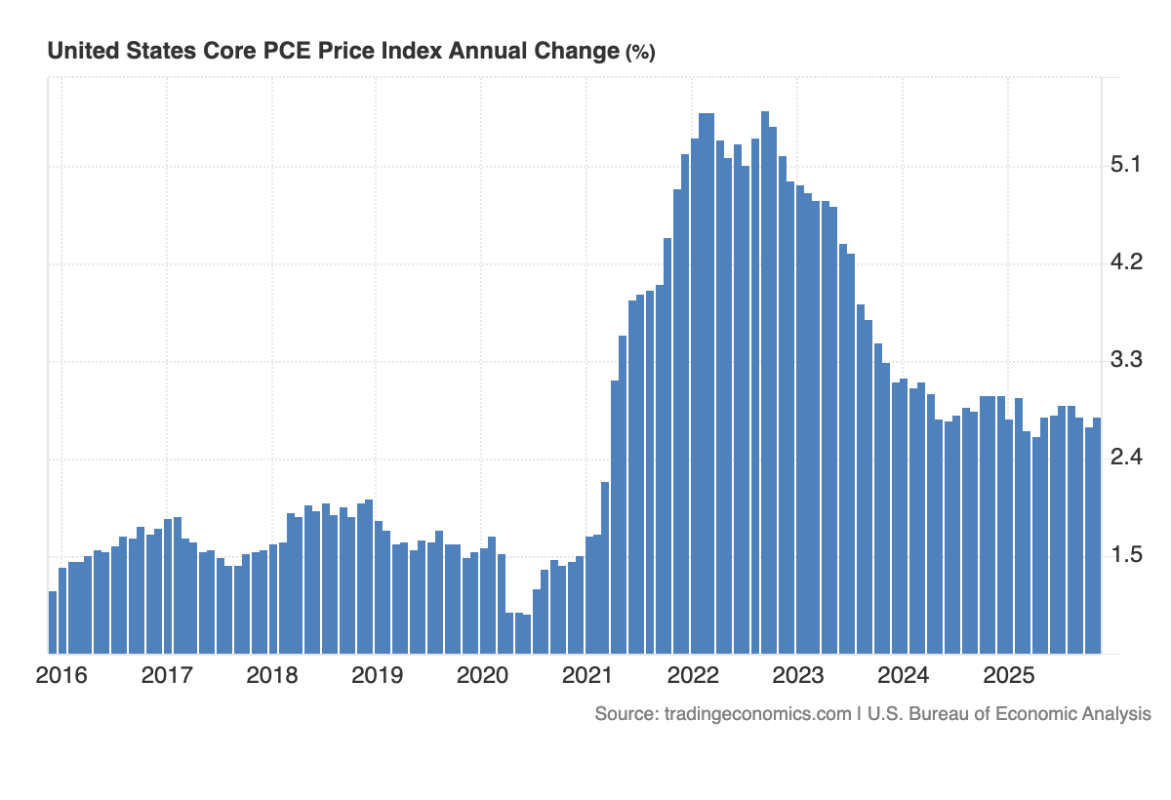

Core PCE inflation has tracked well above the Federal Reserve’s 2% target since 2021.

Core PCE inflation has tracked well above the Federal Reserve’s 2% target since 2021.

Spencer Platt / Getty Images.

Fed 2% inflation target remains out of reach

The Federal Reserve‘s mandate is twofold: low unemployment and low inflation.

To achieve these contradictory goals, the Federal Open Market Committee (FOMC) meets eight times per year to set the Fed Funds Rate, the rate at which banks lend each other overnight reserves.

Tweaks to the FFR influence business and household bank lending rates, so the Fed’s monetary policy has major implications for the economy. Cut rates too much, and the economy overheats, causing inflation. Raise them too much and inflation tumbles, but unemployment soars.

Related: Goldman Sachs delivers contrarian take on the economy

It’s an economic tightrope that’s difficult to walk, as we witnessed firsthand last year. Despite unemployment rising, the Fed sat on its hands until September, refusing to cut interest rates, for fear that doing so would fan inflation, even as tariffs pushed prices higher.

Now that the Fed’s cut rates three times to help shore up the jobs market, it has once again hit the sidelines to keep an eye out for any worrisome inflation signals.

The Fed pays attention to CPI, but core PCE is its favorite inflation measure.

The target: Core PCE inflation rate of 2%. They argue that’s a sweet spot that allows economic growth, supporting jobs, without crimping budgets.

It’s been a particularly elusive goal. The last time we saw a core PCE of 2% was in early 2021, according to Tradingeconomics, before inflation skyrocketed in the wake of government stimulus checks and supply chain bottlenecks.

In 2025, the lowest core PCE reading was 2.6% in April. Since then, prices have been stubbornly sticky, ranging from 2.7% to 2.9%.

BNP Paribas pours cold water on inflation progress argument

The CPI data for January was heavily impacted by a drop in used car prices and lower shelter costs.

However, BNP Paribas says we shouldn’t get overly excited about the lower CPI numbers, because those tailwinds don’t provide much long-term conviction that prices will continue falling.

“The components we view as most informative for the inflation trajectory surprised to the upside. Core goods ex. vehicles was nearly double our forecast, notching its second-fastest pace since the Trump administration imposed tariffs, suggesting that tariff pass-through outside the auto sector remains active,” wrote the economists.

More Federal Reserve:

- Billionaire Dalio sends 2-words on Fed pick Warsh

- Fed Chair Powell sends frustrating message on future interest-rate cuts

- Warsh nomination stirs Fed independence fears on Wall Street

Remove the price drop in used cars, and CPI told a different story, and BNP Paribas doesn’t think that the car price tailwinds will last.

“The softness in core was overwhelmingly concentrated in used vehicles, which fell 1.84% m/m – a sharp miss against our expectation for a 0.25% and knocking 7bp off the core compared to our forecast,” wrote BNP Paribas. “Used vehicles tend to be volatile month to month, so we take little signal from the downside. Moreover, a pop in wholesale prices in January should transmit to a corresponding rise in retail prices in the coming months.”

Higher wholesale auto prices will likely flow into future inflation reports, increasing the pressure on shelter to do the heavy lifting to offset higher core product prices.

“Shelter can be noisy month to month, and the January reading is well within the range of normal volatility,” said the economists. “We see shelter only slowly decelerating into year end.”

BNP Paribas analysis shows the details matter. Lower inflation would clear the way for a friendlier Fed and lower borrowing rates for households and businesses. However, given the under-the-hood takeaways on CPI and upward risk to core PCE, Main Street and Wall Street may not want to draw too many conclusions from January’s CPI report.

“One month does not make a trend,” BNP Paribas reminds us.