How much would you pay for “The Greatest of Them All”?

That title has been thrown around a lot over the years, but in this case, we’re talking about the Waldorf Astoria, the legendary New York City hotel, which is up for sale with a reported price tag of more than $1 billion.

The Park Avenue landmark reopened in November following an eight-year renovation from a 1,400-room hotel to 375 hotel guest rooms and 372 residences, according to the Wall Street Journal.

Dajia Insurance Group, the Chinese state-run firm that took control of Anbang Insurance Group’s assets after CEO Wu Xiaohui was prosecuted in 2018, is overseeing the sale.

The deal would include the hotel’s restaurants, retail, and other amenities at the Waldorf Astoria New York, but not the residential units, which would continue to be sold separately.

The transformation was five years behind schedule and more than $1 billion over the initial budget.

Anbang bought the Waldorf Astoria New York from Hilton Worldwide (HLT) in 2014 for $1.95 billion, making it the most expensive hotel ever sold at the time.

Hilton had previously bought the hotel from Penn Central in 1972.

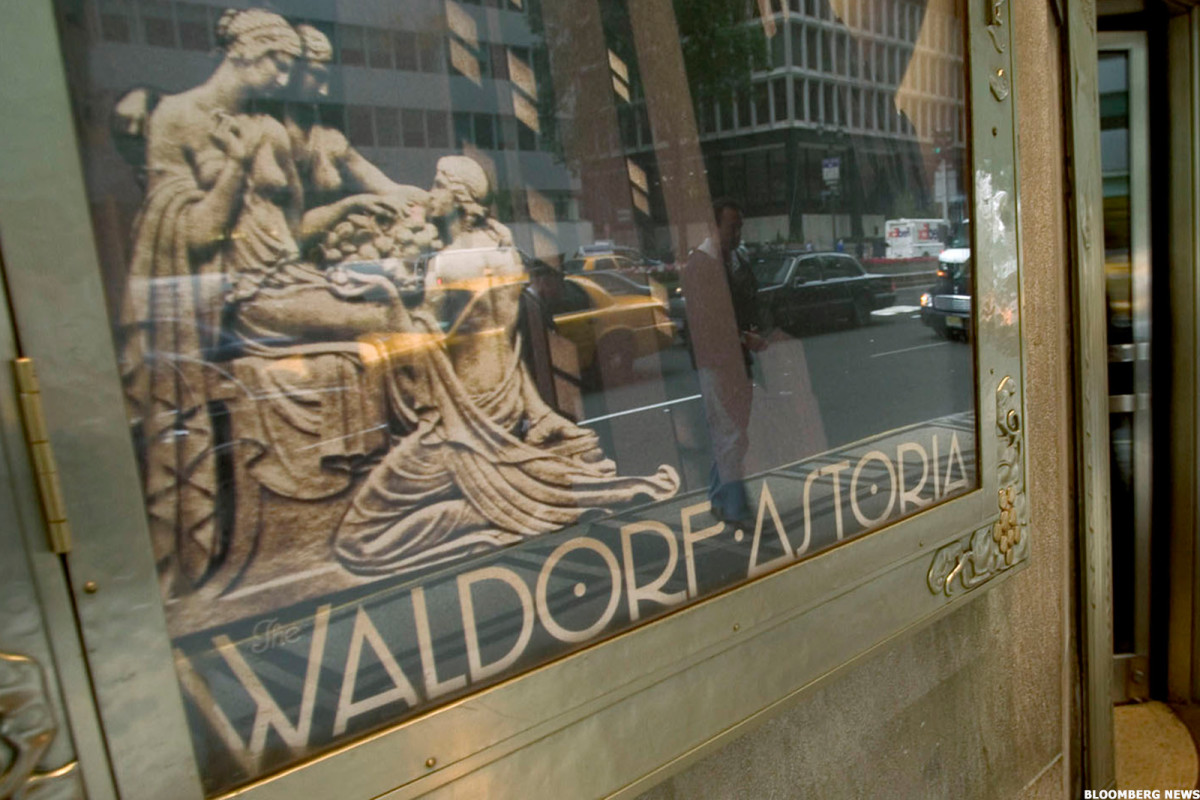

The Waldorf Astoria New York is an icon of Art Deco building design.

The Waldorf Astoria New York is an icon of Art Deco building design.

Analyst sees shift in luxury hotel market

Over its 95-year history, the Waldorf has hosted world leaders, entertainers, and U.S. presidents, and it has long served as a cultural and political gathering place in New York, even serving as the venue for Pope Paul VI’s 1965 visit with President Lyndon B. Johnson.

The hotel’s guest list includes such historic celebrity names as Marilyn Monroe, Frank Sinatra, Queen Elizabeth II, Chuck Berry, Ella Fitzgerald, and the Greatest himself, Muhammad Ali.

More economic analysis:

- Ernst & Young drops blunt reality check on the economy

- Federal Reserve official blasts latest interest-rate pause

- IMF drops blunt warning on US economy

So, what’s next for the legendary hotel? Analysts see a changing landscape in the industry.

“The planned sale of the Waldorf Astoria New York reflects a broader shift in the luxury hotel market,” said Diego Bufquin, professor of practice at Tulane University’s Freeman School of Business.

“Trophy properties are increasingly being repositioned as high-stakes mixed-use real estate assets to help offset soaring redevelopment costs.”

He said the property’s roughly $2 billion renovation shows that historic hotels are adapting to new market demands rather than losing relevance.

At the same time, Bufquin said the divestment also underscores a broader pullback of Chinese capital from the U.S. hotel sector.

While Chinese investors have sold a number of hospitality assets in recent years, he noted that capital from the Middle East, India, and South Korea remains active in the U.S. market, including groups such as the Qatar Investment Authority, OYO, and Lotte Group.

“As Dajia looks to exit, potential buyers include sovereign wealth funds or elite institutional investors like Blackstone, who view the landmark as a rare, generational asset capable of commanding record-breaking valuations in a resilient ultra-luxury market,” Bufquin added.

Steven Carvell, a professor of finance at the Cornell SC Johnson College of Business, said he doubted that a typical commercial real estate entity would buy the hotel.

Combining heritage with modern luxury

“There’s no ROI there, really,” he said. “It would have to be somebody buying this as a trophy asset. Even though it’s brand new, it was always a money pit in the making because it took so long. Getting their money back is going to be a challenge.”

Carvell said that a potential investor would likely come from the Arabian Peninsula or possibly Asia.

Related: AI investment hits new heights — and CIOs are on the hook

Richie Karaburun, a clinical associate professor at New York University’s Jonathan M. Tisch Center of Hospitality, said the potential sale of the Waldorf Astoria does not signal decline; it signals liquidity.

“Trophy hotels today function as global investment assets as much as hospitality businesses,” he said. “It is all about the bottom line at the end of the day.”

Karaburun said that iconic properties are not symbols of a bygone era, noting that when properly repositioned, “they outperform because they combine heritage with modern luxury.”

“You cannot replicate legacy, but you can modernize it,” Karaburun said. “The recent renovation was about recalibrating relevance, not preserving nostalgia.”

He added that foreign ownership of U.S. hotels is not new — what has evolved is scale and strategy.

“Global capital continues to view prime American hospitality assets as stable, long-term stores of value,” Karaburun said.

“In short, this is less about the future of grand hotels, and more about the globalization of hotel ownership and the financialization of luxury real estate.”

Related: Historic luxury hotel chains closing properties, laying off employees