The Dow Jones Industrial Average has been around for a long time — 130 years, to be exact. It’s America’s original stock index, and despite its eccentricities (such as its inclusion of only 30 stocks), it remains one of the most-followed financial benchmarks in the world — in part due to the Dow divisor, a key number used to keep the index steady.

The Dow is price-weighted, meaning price changes in higher-priced component stocks affect the index’s value more than price moves in lower-priced stocks. This means that events such as stock splits, reverse splits, spinoffs, mergers, and acquisitions (all of which can suddenly change a stock’s price) could easily lead to artificial volatility in the DJIA, detracting from its continuity as a bellwether index and making it a less effective benchmark for comparisons.

To mitigate this, the Dow’s value is calculated using a number known as the Dow divisor.

What is the Dow divisor?

The Dow divisor is a constant used to calculate the value of the Dow Jones Industrial Average. Despite being a constant, the Dow divisor is dynamic — it is adjusted whenever one of the Dow’s component stocks experiences an “artificial” price change. It’s also adjusted whenever a stock is added or removed from the index. The Dow divisor serves as the denominator in the calculation of the DJIA’s value.

By adjusting the Dow divisor, the index’s oversight committee (comprising representatives from S&P Global and the Wall Street Journal) can keep the Dow’s value steady amid sudden changes in its component stocks.

Here’s everything you need to know about the Dow divisor, including how it’s calculated, what sorts of events prompt adjustments, and where it stands currently.

To understand the Dow divisor, let’s take a look at how the Dow was calculated originally when it was launched in 1896:

How was the Dow calculated originally?

When the Dow was created, it only included 12 stocks, and its calculation was very straightforward. The stock prices of each component company were added together, and the result was divided by 12 (the number of component companies) to produce a simple average.

Twelve, therefore, was the original Dow divisor. Since then, the Dow divisor has been adjusted countless times to account for changes to the index’s composition and artificial price moves in the shares of its component companies.

According to S&P Global, “the divisor has been adjusted a number of times, mostly downward, which means that it has become, in effect, a multiplier.” The divisor has become a multiplier because it is less than 1. It first fell into decimal territory in 1986.

How is the Dow divisor used to calculate the value of the DJIA?

Fast-forward to the modern day. The Dow now includes 30 stocks, but it’s still calculated in a similar way. The only difference is that, instead of dividing the sum of the Dow’s component stock prices by the number of included stocks, the sum is divided by the Dow divisor.

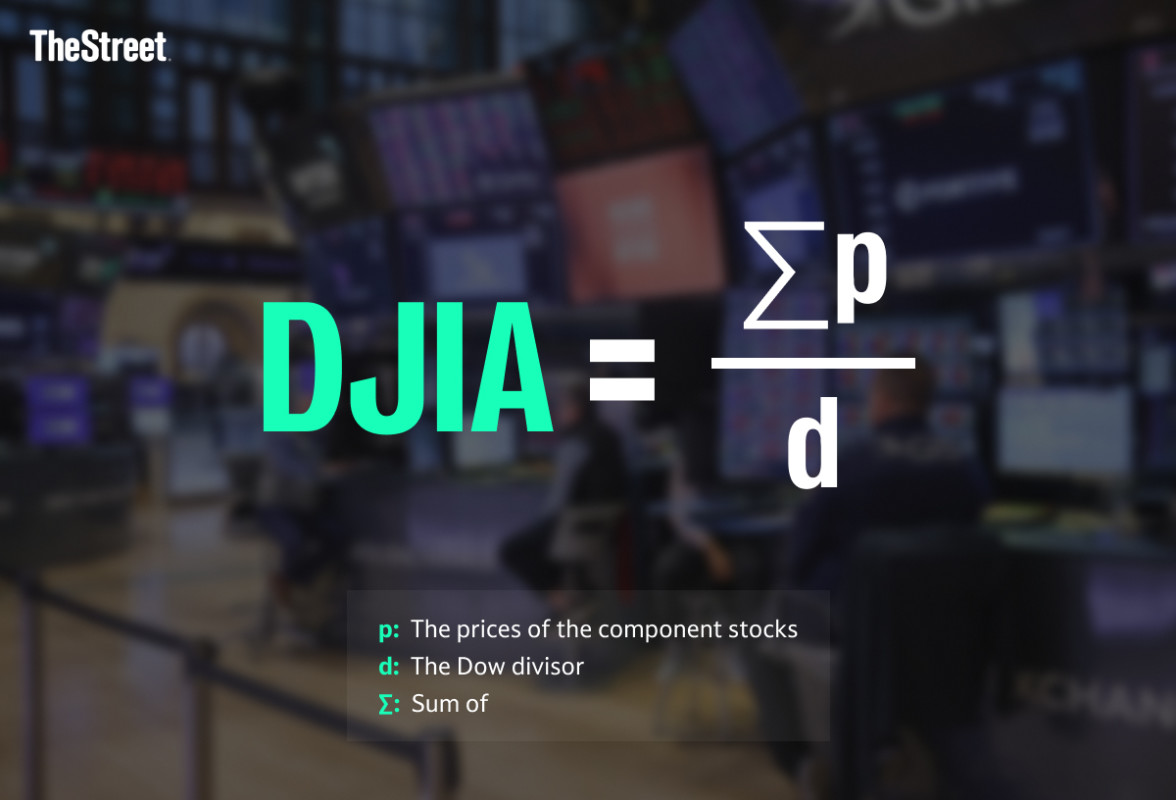

Here’s what that looks like:

Formula for calculating the Dow

DJIA = ∑p / d

In this formula, “∑” means sum of, “p” represents the prices of the component stocks, and “d” represents the Dow divisor.

How is the new Dow divisor updated when a Dow stock’s price changes artificially?

When a stock in the Dow suddenly changes price for reasons other than market sentiment, the Dow divisor is adjusted so that the value of the index doesn’t change drastically. When a component stock’s price drops suddenly (like during a stock split), the Dow divisor is lowered. When a component stock’s price increases suddenly (like during a reverse stock split), the Dow divisor is increased.

To determine the new Dow divisor after a price change, the above equation can simply be rearranged. Here’s how that looks:

New Dow divisor = (Sum of each component company’s stock price immediatelyafter the price change) / (DJIA value immediately before the price change)

So, for example, if one of the stocks in the Dow performed a 2-for-1 stock split, its share price would fall by 50%, which would artificially reduce the value of the Dow if not properly accounted for.

To avoid this, the Dow divisor would immediately be recalculated by dividing the sum of all of the stock prices immediately after the stock split by the value of the DJIA immediately before the stock split.

The resultant number becomes the new Dow divisor, and when the Dow is recalculated using this updated divisor, its value comes out the same as before the stock split.

What events cause a change in the Dow divisor?

Stocks’ prices change every day — sometimes drastically. When the stocks in the Dow fluctuate in value naturally due to trading, the Dow moves up and down as well. That’s what it was designed to do.

When a stock’s price changes artificially, however, the Dow divisor is adjusted to avoid artificial volatility in the index. Here are some of the more common events that result in an adjustment to the Dow divisor.

Component company additions & deletions

The committee that manages the Dow occasionally adds and removes companies from the index to ensure the 30 included businesses are a good representation of the American economy.

When a stock is removed from the index (perhaps because it’s no longer seen as a leader in its industry), it must be replaced immediately. Since the new stock typically trades at a different price than the stock it’s replacing, this change must be accounted for by adjusting the Dow divisor.

If the new stock has a higher price than the old stock, the new Dow divisor will be higher; conversely, if the new stock has a lower price, the new Dow divisor will be lower.

Stock splits & reverse splits

When a company performs a stock split, each existing share becomes two, three, or even ten shares, and the stock’s per-share price is reduced accordingly. In other words, stock splits lower a stock’s price and increase its number of outstanding shares without affecting the overall market value of the company.

Businesses perform stock splits to keep their share prices accessible and to signal confidence to investors, as splits are typically performed after a stock’s price has risen significantly over time.

Conversely, companies can perform reverse splits, combining existing shares to reduce the number of outstanding shares and increase the per-share price. Companies usually perform reverse splits when their share prices have fallen so low that they risk being delisted from stock exchanges.

If a company in the Dow performs a stock split, its share price goes down, and the Dow divisor is lowered accordingly. If a company in the Dow performs a reverse split, its share price goes up, and the Dow divisor is increased.

Mergers & acquisitions

Public companies occasionally purchase other companies, taking on their assets. In other cases, two public companies merge, creating a new entity. When these sorts of events occur to a stock in the Dow, the Dow divisor must be adjusted to account for the sudden change in share price that occurs as a result.

Spinoffs

Sometimes, companies “spin off” one of their divisions or subsidiaries, creating a new, independent corporation. As a result, the stock of the parent company usually goes down in price, as the business it represents now has fewer assets.

If a company in the Dow performs a spinoff that results in a dramatic drop in its share price, the Dow divisor is lowered accordingly.

Special dividend payments

Many stocks pay dividends — small, periodic cash payments to shareholders — on an annual or quarterly basis. Occasionally, however, a company with excess cash due to strong performance may pay a special dividend, which is a large, one-time cash payment to shareholders. When a company pays a special dividend, its stock price typically drops significantly as the market accounts for the assets it gave away.

If a Dow stock pays a special dividend and its price drops as a result, the Dow divisor is lowered accordingly.

What is the current Dow divisor?

The current Dow divisor is 0.16242563904928, according to Barrons, which means that for every dollar change in a component stock’s price, a 6.156663 “point” change occurs in the value of the DJIA.

When was the last time the Dow divisor was adjusted?

The Dow divisor has remained unchanged since Oct. 30, 2025, according to Wikipedia, although the linked sources for this claim do not discuss the event that prompted the change.