Over the past six months, AMD stock gained a whopping 164%. The deal with OpenAI for 6 GW of power for OpenAI’s AI infrastructure across multiple generations of AMD Instinct GPUs managed to give a great boost to the stock.

Another good news for the stock was that Oracle and AMD were expanding their collaboration. The first publicly available AI supercluster powered by AMD Instinct MI450 Series GPUs will have its initial deployment of 50,000 GPUs in Oracle Cloud Infrastructure, starting in calendar Q3 2026 and expanding in 2027 and beyond.

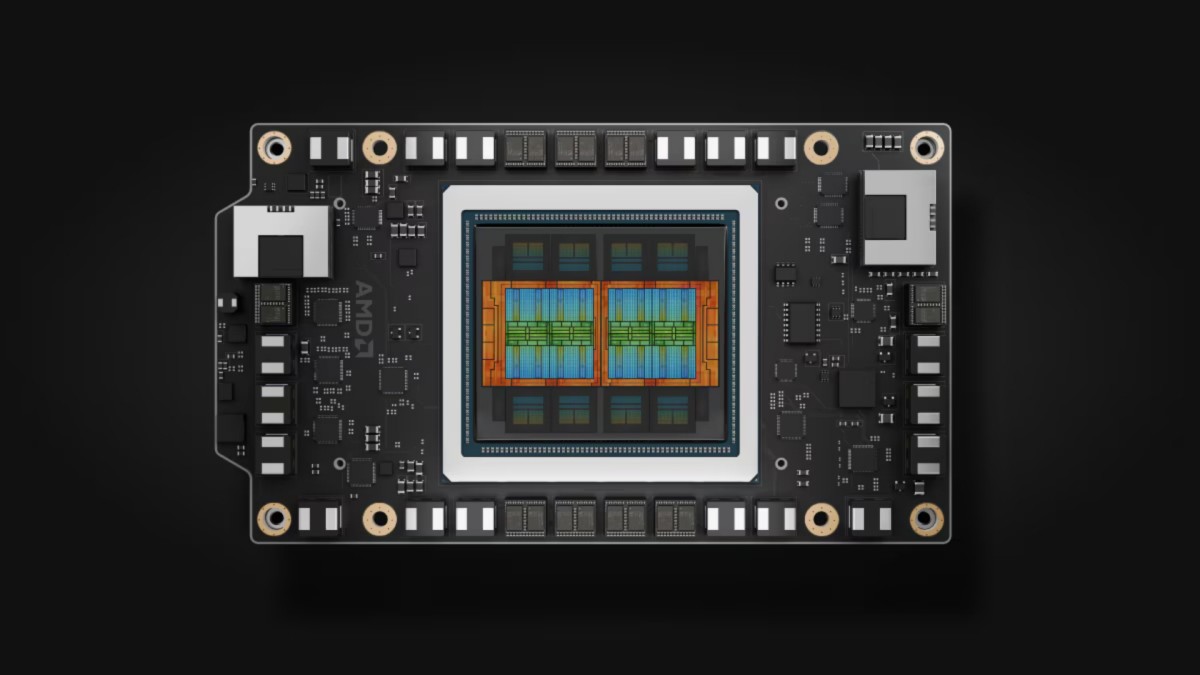

The company also showcased its “Helios” rack-scale design, based on the new Open Rack Wide specification, introduced by Meta, at the Open Compute Project (OCP) Global Summit in San Jose.

The company is pushing forward with the latest news, driving the stock even higher.

AMD’s Instinct accelerators will be used to build two new supercomputers.

AMD’s Instinct accelerators will be used to build two new supercomputers.

AMD partners with U.S. Department of Energy in a $1 billion supercomputer deal

The U.S. Department of Energy has entered into a $1 billion partnership with Advanced Micro Devices (AMD) to construct two supercomputers. The supercomputers’ primary purpose is to solve large-scale scientific problems, ranging from nuclear power to cancer treatments to national security.

Energy Secretary Wright said the systems would “supercharge” advances in nuclear power and fusion energy, as well as technologies for defense and national security, and the development of new drugs.

“We’ve made great progress, but plasmas are unstable, and we need to recreate the center of the sun on Earth,” Wright told Reuters.

Lux, the first supercomputer in this project, is co-developed by AMD, Hewlett Packard Enterprise (HPE), Oracle Cloud Infrastructure, and Oak Ridge National Laboratory (ORNL) and is expected to be built and to come online within the next six months. It will be based on AMD’s MI355X artificial intelligence chips, as well as CPUs and networking chips also made by AMD.

ORNL, HPE, and AMD will build the second, more advanced computer, called Discovery, based on AMD’s MI430 series of AI chips. Discovery is expected to be ready for use in 2029.

According to the Department of Energy, it will host the computers, while companies will provide the machines and capital expenditures, and both parties will share the computing power.

Following the news, AMD stock rose, closing 2.67% higher at $259.67.

These are not the only big moves AMD has made lately, however.

AMD helps IBM’s quantum efforts

AMD recently helped IBM get closer to its quantum goals.

The primary challenge in quantum computing is that quantum computers are prone to errors. IBM will release a new research paper on October 27 that demonstrates running an error correction algorithm on “normal” (non-quantum) hardware.

According to the company, it is able to run such an algorithm in real time on AMD’s field-programmable gate arrays.

More AI Stocks:

- More police agencies adopt AI, raising efficiency — and concern

- How AI Could Monitor Brain Health and Find Dementia Sooner

- ChatGPT latest user perk sparks controversy

- Bezos’s AI bubble warning backed by big names in banking

This huge breakthrough news sent AMD stock soaring nearly 7%.

AMD and IBM have a strong partnership, and they recently announced that they entered into a multi-year agreement with Zyphra, an open-source AI research and product company.

IBM will deliver a large cluster of AMD Instinct MI300X GPUs on IBM Cloud for Zyphra to use for training frontier multimodal foundation models. The initial deployment was made available to Zyphra in September, with planned expansion in 2026.

With all the great moves AMD is making, it is not surprising that Bank of America analysts have recently raised their price target for AMD stock.

Bank of America raises AMD stock price target to $300

Bank of America analyst Vivek Arya and his team updated their opinions on AMD shares after the company showcased the Helios rack-scale platform at the OCP Conference.

Arya reiterated a buy rating and raised the target price from $250 to $300, based on 33 multiple of his estimate for non-GAAP EPS for fiscal year 2027, which is toward the middle of AMD’s historical range of 14 to 55.

He added that the increase was justified by AI growth and CPU share gains, offset by slower growth in cyclical embedded/console markets.

Analysts noted downside risk factors for AMD:

- Execution on first rack-scale product (MI400 Series)

- Timing/magnitude of Middle East AI projects

- Uneven nature of consumer and enterprise spending that could delay the success of new products

- High reliance on one outsourced manufacturing partner

- Maturity of current game console cycle

Related: Bank of America resets Intel stock forecast after earnings