When people talk about computing speed today, they think of Nvidia’s (NVDA) powerful GPUs, the gold standard for accelerating artificial intelligence.

But there could be another quieter revolution gaining traction: quantum computing.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

Quantum computing’s potential applications include portfolio optimization in finance and simulating complex chemical systems, tasks that today’s most powerful supercomputers still struggle to solve. Still, the technology is years away from mass adoption.

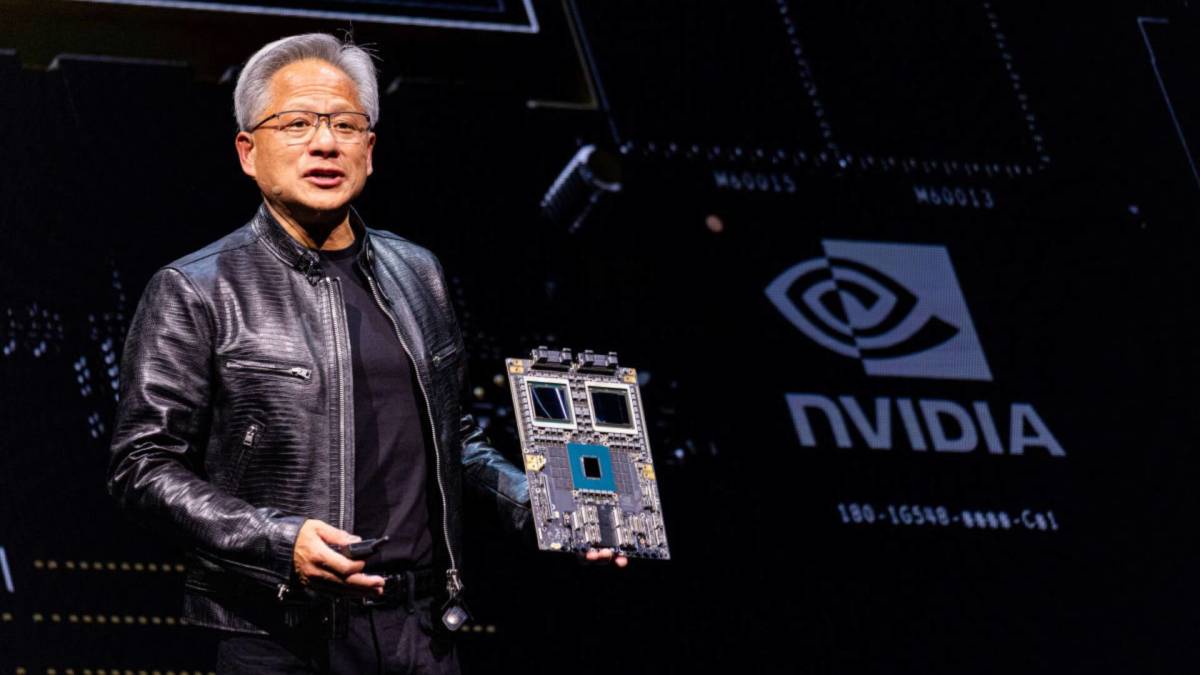

But Nvidia CEO Jensen Huang has recently struck a more optimistic tone on quantum computing. “Quantum computing is reaching an inflection point,” he said at a conference on June 11.

Jensen Huang had previously said that a 15-year timeline for useful quantum computing was “on the early side.” Now he’s turning more bullish.

Jensen Huang had previously said that a 15-year timeline for useful quantum computing was “on the early side.” Now he’s turning more bullish.

Image source: Chih/Bloomberg via Getty Images

Are quantum computing stocks a buy?

Classical computers process information in bits, and each bit is either a 0 or a 1. Quantum computers use qubits (quantum bits), which can be both 0 and 1 at the same time. This allows quantum computers to process vastly more possibilities at once.

Think of a regular computer as a librarian, looking through books one by one to find the answer. Quantum computers, on the other hand, can look through all the books at once. “This means quantum computing may revolutionize our ability to solve problems that are hard to address with even the largest supercomputers,” the U.S. Department of Energy said.

Related: Analyst unveils surprising Nvidia stock price target after nearing record high

Huang noted that “we are within reach” of applying quantum computers “in areas that can solve some interesting problems in the coming years.”

This is a notable shift from Huang’s earlier skepticism. He had previously said that a 15-year timeline for useful quantum computing was “on the early side,” and that a 20-year horizon was more realistic. Those remarks triggered sharp declines in shares of quantum-focused companies like Quantum Computing Inc. (QUBT) , IonQ (IONQ) , and D-Wave Quantum (QBTS) .

This week, shares of Quantum Computing Inc. lost more than 11% as the firm sold approximately 14 million shares of common stock at $14.25 per share to institutional investors. The deal was announced on June 23 and closed on June 24, bringing the firm about $200 million.

The firm said it intends to use the net proceeds from the sale to accelerate commercialization efforts, to engage in strategic acquisitions, and for working capital and general corporate purposes.

The stock dropped after the dilution, but one Wall Street veteran is buying more shares on that dip.

Analyst sets bold price target for quantum computing stocks

Stephen Guilfoyle, Wall Street’s 30-year veteran analyst, said he added positions in Quantum Computing Inc. and D-Wave Quantum this week. He also unveils bold price targets for the two stocks, according to his note published on TheStreet Pro.

“In response to the sale and the diluted share price, on Monday morning ahead of the opening bell, I had added small to my existing long position and had also re-initiated a long position in key competitor D-Wave Quantum,” Guilfoyle wrote. “Neither firm will report for almost two months.”

Related: Analyst sends bold message on AMD stock

Guilfoyle noted that Quantum Computing Inc. has burned through more than $65 million in cash over the past three years, and its latest $200 million capital raise — done at $14.25 per share — was priced well above where the stock traded just months ago.

“Apparently, despite the cash burn, and despite the fact that the shares traded $4.37 this year, some institutional investors are willing to pay for the shares,” he wrote.

He now sees a new technical pivot for QUBT at $21.80 and has raised his price target to $27, citing healthy relative strength and a bullish technical setup.

“Investors will have to digest the extra shares. That said, quantum computing stocks are momentum driven and do not trade on fundamentals,” he added.

More Nvidia:

- Analysts revamp forecast for Nvidia-backed AI stock

- Nvidia stock could surge after surprising Taiwan Semi news

- Nvidia CEO sends blunt 7-word message on quantum computing

As for D-Wave, Guilfoyle believes the chart looks even better. He sees a pivot at $18.30, with a target of $23 if the rally continues.

Both stocks have more than tripled from their March lows. On June 26, Quantum Computing Inc. closed at $16.79, and D-Wave Quantum finished at $14.06.