In recent years, U.S. consumers have become painfully aware of the toll inflation can take. Although inflation has cooled substantially since peaking in 2022, in February, it was still going strong at 2.8% annually, per that month’s Consumer Price Index.

Meanwhile, Americans remain frustrated by inflation, according to a February 2025 Wells Fargo survey, with 90% saying they’re still surprised by the high prices of items like bottled water, gasoline, and dining out. The survey also found that 76% of U.S. consumers have cut back on spending to cope with higher costs across the board.

Inflation picked up in 2021 when Americans found themselves loaded with stimulus cash at a time when supply chains were bottlenecked. Any time there’s a situation where consumer demand outpaces supply, prices have a tendency to soar.

Related: Costco CFO sounds alarm on consumer trend

What’s surprising about today’s economic conditions is that stimulus funds are, at this point, long gone, and supply chain issues have largely been resolved. But factors like global unrest and higher labor costs are forcing retailers and service providers to raise prices, trapping consumers in a seemingly endless cycle of elevated expenses.

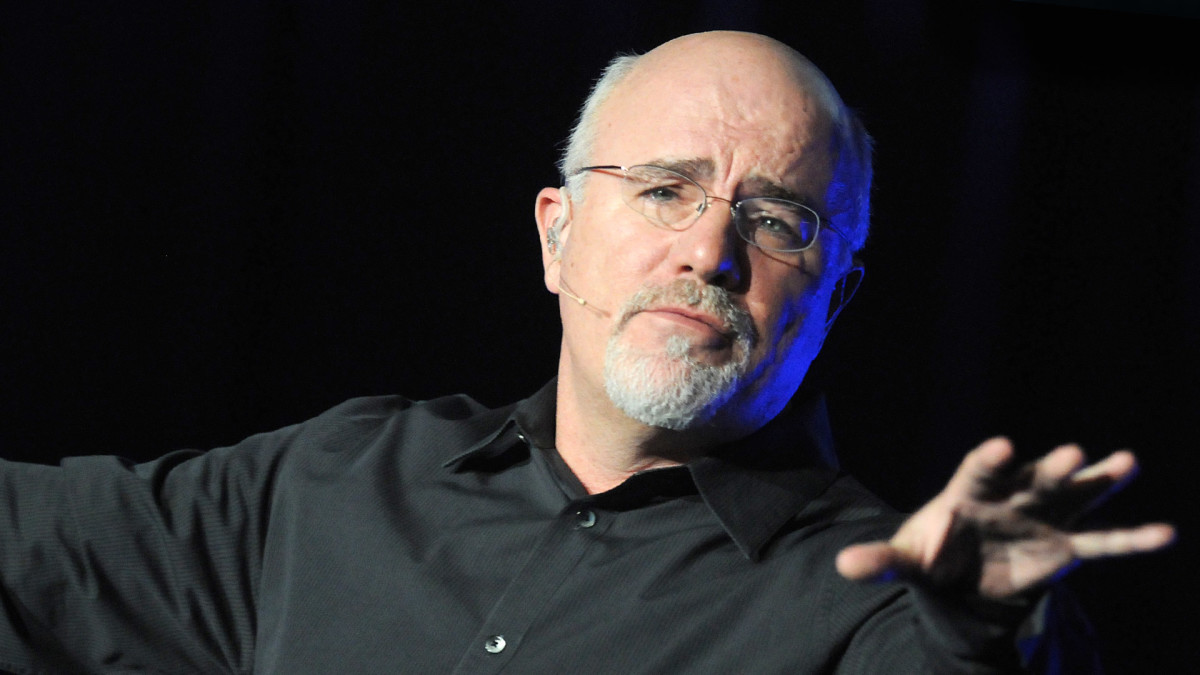

Dave Ramsey issues warning consumers should hear.

Dave Ramsey issues warning consumers should hear.

Getty

Dave Ramsey warns consumers on inflation

When inflation results in higher costs, it’s usually pretty obvious. You might see that your favorite menu item at your go-to restaurant now costs $19.99, whereas it used to cost $18.99. Or, you might find that the cereal you buy each week now costs $5.99 per box instead of $4.99.

But Dave Ramsey says consumers need to be on the lookout for a less obvious but equally damaging trend – shrinkflation.

Related: Dave Ramsey raises red flag over Social Security

As he writes, “If you’ve walked around the grocery store lately and thought items looked smaller than they used to, you’re not going crazy. Say hello to a little thing called shrinkflation.”

Shrinkflation occurs when the items you buy get smaller in size but not in price. It’s a tactic that’s commonly employed by retailers and manufacturers because often, they’re able to get away with it.

If the cost of the cereal box you buy each week rises from $4.99 to $5.99, you’re going to notice that change. If the size of the box shrinks by two ounces, you’re less likely to pay attention.

Product-makers commonly use this tactic to trick consumers into thinking they’re getting the same good deal they always did, when in reality, they’re getting less product for their money.

In fact, Ramsey says, “It should really be called sneakflation, because that’s exactly what this is – sneaky.”

Dave Ramsey says consumers need to be careful with debt

The danger of a prolonged period of inflation is that it could drive a growing number of consumers into debt. And anyone who’s at all familiar with Dave Ramsey’s financial philosophy knows full well that debt is the worst kind of four-letter word in his book.

As he says, “Debt always equals risk, and it’s always dumb.”

Related: Mark Cuban sends blunt message on becoming rich

Ramsey is so extremely opposed to taking on debt that he’s even gone as far as suggesting that Americans pay for their homes in cash instead of signing mortgages.

The problem, though, is that as products get smaller, consumers will inevitably be forced to replace them more often, leading to higher costs and bills. Those who are already stretched thin could end up with debt as a result of shrinkflation without being any the wiser.

More on personal finance:

- Tony Robbins has blunt words on IRAs, 401(k)s and a tax fact

- Scott Galloway warns U.S. workers on Social Security, retirement flaw

- Dave Ramsey explains a Roth IRA, 401(k) blunt truth

As it is, roughly 25% of U.S. adults live paycheck to paycheck with no financial cushion in the form of savings, per Bank of America. So it’s important to be vigilant at the store if money is already exceedingly tight.

That means paying attention to labels and keeping track of not just prices, but product sizes. And it’s not a bad idea to go off-brand if it results in savings.

In this time, inflation should gradually creep down toward normal levels. Until then, consumers need to keep a close eye on retail shelves to avoid getting duped.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast