If you listen to this hour of “The Ramsey Show” straight through, what jumps out is how often the callers are hunting for a workaround.

Someone wants to know if letting a card be “charged off” is a clever move, another wonders if a free cruise is OK while they’re in Baby Step 2, and another is trying to make an Airbnb investment work, even though the numbers clearly don’t.

Ramsey’s answer is basically the same every time: You’re not going to outsmart math.

When a pregnant caller who recently lost her baby worries that a $10,000 credit card about to be charged off will wreck her life, Ramsey cuts through her fear in one sentence: Her credit is already wrecked; “charged off” is just the bank admitting they probably won’t collect.

From there, Ramsey moves her away from the fantasy that the right timing or negotiation script will fix this, and toward the only lever she actually controls: her income and behavior over the next few months.

I’ve seen this from the personal finance reporting side too. Debt “hacks” tend to be about rearranging balances, renegotiating terms, or betting on a future raise, not actually shrinking what you owe. That might make life feel lighter for a few months, but it doesn’t move you any closer to owing nothing, and it can tempt you to keep spending at the same level.

Revolving credit balances have climbed alongside rising wages, suggesting many households are using higher pay to upgrade their lifestyle rather than to reduce what they owe, according to a 2025 LendingTree analysis.

Ramsey’s blunt truth is that the only real hack is refusing to play that game at all.

What “hard work” really looks like when you’re in debt

When Ramsey talks about hard work, he isn’t saying “tighten your belt a bit and hope for the best.” He’s talking about decisions that actually hurt in the moment.

For the caller facing a charge‑off, he doesn’t recommend racing to find a personal loan or borrowing from friends. Instead, he tells her to stabilize first: keep paying the other two credit cards where she’s current, get her new therapist income ramped up, and let the collection process take its course while she gets her footing.

Ramsey points out that collection agencies often become more flexible over time and that she’ll likely be able to settle the debt later, once she’s back on her feet, for an amount similar to or better than the current $4,800 offer.

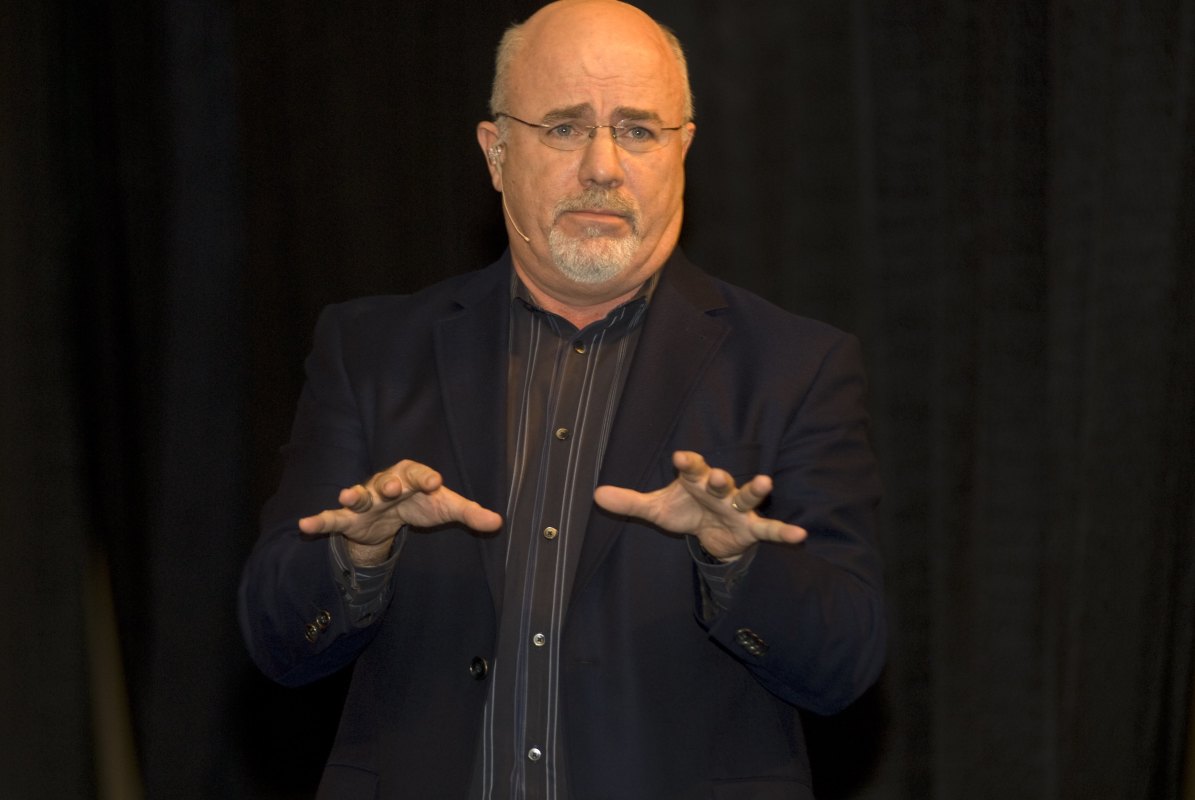

Dave Ramsey explains what hard work looks like when you’re in debt.

Dave Ramsey explains what hard work looks like when you’re in debt.

Photo by Beth Gwinn on Getty Images

Later, a woman who has been laid off and has about $16,000 saved asks whether she and her husband should start dumping that money on debt. Ramsey’s answer is no.

The hard work in her case is to sit inside the fear and uncertainty while she job hunts, use the emergency fund only to cover a small monthly shortfall, and hold off on the full Total Money Makeover plan until she’s earning again.

He tells her flatly that she and her husband need to stop arguing about whether to pay things off and focus on plugging the income gap first.

From a reporting perspective, that lines up with what I see in surveys from the Federal Reserve, such as the Fed’s “Economic Well-Being of U.S. Households in 2024” report, which shows that many debt problems start with an income shock or medical issue hitting households that have little or no emergency savings.

The hard work here is resisting the urge to throw your last safety net at debt and risk having nothing when the job search takes longer than you hoped.

More Personal Finance:

- Why selling a home to your child for a dollar can backfire

- Elon Musk says ‘universal high income’ is coming

- FTC, 21 states sue Uber over ‘shady’ subscription billing

- Trump’s bold new tax promise has families asking one big question

- SoFi Bank Shakes Up Subscription Product, Launches New Charge Card

When a young man calls about a company‑paid cruise reward while he’s in Baby Step 2, Ramsey doesn’t forbid him from going. The math is fine; the trip is covered and he’ll still get paid.

What he challenges is the mindset. He tells the caller he has to treat the side‑gig money he’s planning to earn not as “fun money” for excursions, but as fuel for the debt snowball. Ramsey warns that once you start carving out exceptions, it’s like a pan of brownies: You keep “just taking a corner” until the whole tray is gone.

For Ramsey, the only hack is committing to a season where every extra dollar has one job: attacking the smallest debt on your list until it’s gone, then rolling that payment into the next one.

Jade Warshaw and the emotional cost of escaping debt

What makes this particular “Ramsey Show” more than just a rerun of debt‑snowball basics is co-host Jade Warshaw’s voice cutting in from the emotional side.

When the caller facing collections talks about losing a pregnancy, losing her job, and feeling like the credit‑card company is “kicking them while they’re down,” Warshaw validates the pain but refuses to let the caller stay in victim mode.

She points out that collectors “don’t care about the fact that you need to buy groceries” and that giving them control over your decisions just gives them “more power” over a life they have already destabilized.

Warshaw’s new book, “What No One Tells You About Money: The Real Key to Getting Unstuck From Someone Who’s Been There,” is built around that same theme: If you don’t address the shame, anxiety, and stories you tell yourself about money, you’ll keep recreating the same situation even after the debts are paid.

Related: Warren Buffett’s Berkshire Hathaway predicts real estate shift

In a launch conversation, Warshaw told Ramsey that many people who get out of debt still feel poor because their “neural pathways” are trained on scarcity, impulse, and short‑term comfort.

From the outside, that sounds obvious. But when you layer in social media, rising prices, and the fact that average credit‑card APRs in the U.S. are north of 20%, it’s no surprise people are looking for hacks instead of a personality overhaul.

Warshaw’s point is that the only way out is through that discomfort.

How to use Dave Ramsey’s “only hack” for debt relief, without drinking the Kool‑Aid

If you’re buried in debt, Ramsey’s blunt truth can feel harsh, but there’s a practical roadmap inside it that you can use right away.

Here’s how to translate the show’s themes into your own plan.

Stop hunting for get-out-of-debt tricks

- Instead of asking whether you should let an account charge off, use your energy to build a written budget and list your debts from smallest to largest.

- Commit to no new borrowing, even if a refinance or “0%” offer looks attractive; every new loan keeps you in the hole longer.

Protect cash and prioritize stability

- When your income drops or you’re laid off, treat your emergency fund as a bridge, not a weapon against every debt on your list.

- Budget around your lowest realistic income and use any extra pay or side‑gig money to accelerate debt once your basic bills and food are secure.

Attack lifestyle debt first

- If a car payment is choking your budget, be honest about whether the vehicle is actually helping you get ahead or just helping you look ahead of where you really are.

- Consider selling expensive assets that don’t cash‑flow, like a struggling Airbnb or luxury car, and use the proceeds plus freed‑up payments to fast‑track your snowball.

In other words, the “only hack” for paying off debt is deciding you’re done with half‑measures and then backing that decision with weeks, months, and years of very unglamorous follow‑through.

Ramsey’s show makes that clear, and Warshaw’s perspective shows why the work is as much emotional as it is financial.