The day started on a positive note, but soon turned red, with only the Nasdaq of the three major indices showing a slight upward trend on Tuesday.

- The S&P 500 regained some of its losses in the day, but still closed 0.09% lower.

- The Nasdaq Composite was up 0.1% at the close, buoyed by positive movements in Applovin, Strategy, and Warner Bros.

- The Dow Jones closed 0.4% lower, affected by the 4% decline in JPMorgan stock today on news of expected increased expenditure in 2026.

- The small-cap Russell 2000 maintained its gains from earlier in the day and was 0.2% higher, recording a fresh 52-week high on Tuesday.

Gold was up 0.5%, and Silver crossed the $60/oz mark today, a new high for the precious metal, which was up 4.8% today.

Natural gas prices continued to dip, down 7%, offering some respite from the otherwise freezing temperatures, which typically result in increased heat usage and higher prices. However, the reason might also be the weather forecasts, which predict below-average temperatures for the coming week, according to The Wall Street Journal.

Meanwhile, this decline could also lay the groundwork for a sudden spike later this month, as temperatures soar, just as last week’s spike in Natural Gas, which is up 25% year-to-date.

In addition to the bearish market movement, Tuesday also brought the October jobs report, known as JOLTS (Job Openings and Labor Turnover Summary), and not much has changed.

Related: Popular analyst says you’re ignoring 6 reasons behind stock market’s next move

It noted that the number of quits, which refers to people who leave their jobs voluntarily, remained unchanged at 1.8%, underscoring stability; however, this is not the complete picture. There has been a decrease in the number of quits over the year, down 276,000, and these numbers are generally seen as a measure of worker confidence.

The decrease in quits over the year signals a softening labor market, weakened hiring, underscoring that people are not confident of finding a better next position.

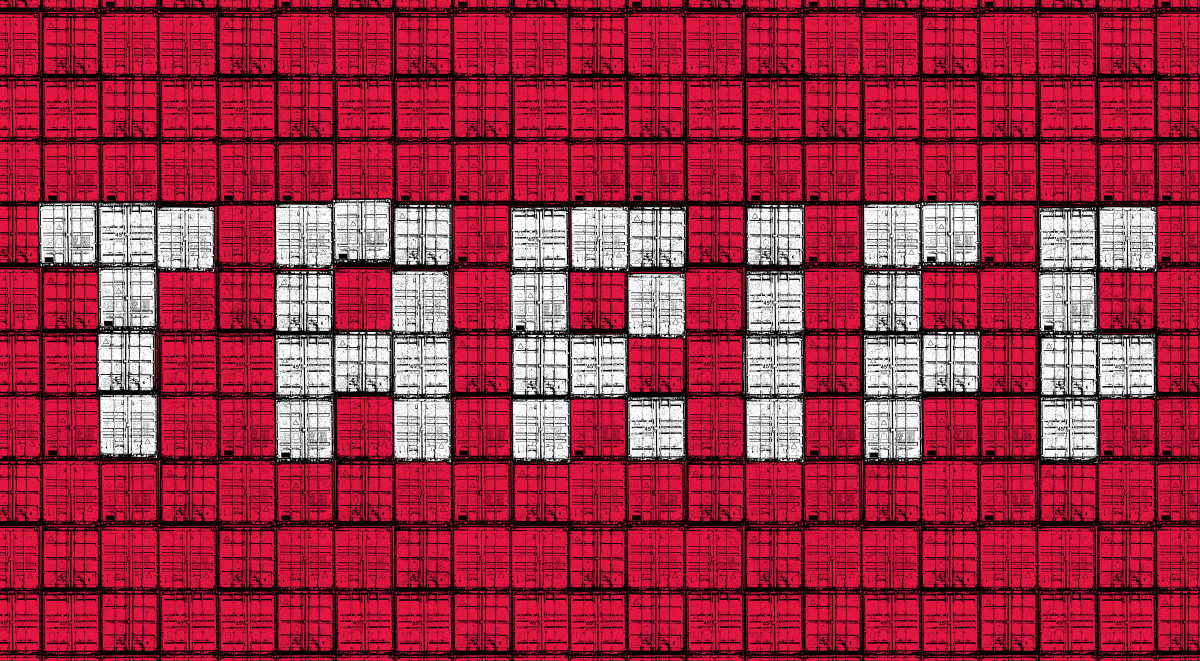

Tariffs are causing anxiety for everyday Americans, even as President Trump asserts they are vital for national security.

Tariffs are causing anxiety for everyday Americans, even as President Trump asserts they are vital for national security.

Photo by Oscar Wong on Getty Images

President Trump on tariffs

In November, the Supreme Court heard the case on the legality of President Donald Trump’s levied tariffs. While the ruling has yet to be ascertained, President Trump declared it a national threat in a Truth Social post on Tuesday.

President Trump believes tariffs have enhanced national security for the country, while also strengthening its financial position.

European Union probes Alphabet, fines X

Following numerous legal woes and antitrust issues in the US, the European Commission has decided to investigate Alphabet to determine whether Google has breached EU competition rules.

The EU is concerned that Google used web publishers’ content to provide AI services through its AI mode and Overviews without giving the content creators proper compensation or an option to refuse.

More Economic Analysis:

- Next Fed interest-rate cut could slide into 2026

- Ex-Fed official faced ethics probe on illegal stock trades

- Fed official sends strong signal on December interest-rate cut

Content creators and writers rely extensively on Google search and discovery to increase views and would not want to risk losing access; thus, the EU finds it essential to understand the extent of its usage before creators are adequately compensated.

The EU will also examine YouTube videos to determine if they were used to train Google’s generative AI models without proper compensation to creators. Now, when you upload content on the most-watched platforms like YouTube, you have to give rights to your content to be used by Google for different purposes, including training AI models.

However, “rival developers of AI models are barred by YouTube policies from using YouTube content to train their own AI models.” The EU seeks to initiate a formal antitrust investigation process to assess whether Google has complied with its competition rules.

This comes a few days after the EU issued a £120 million fine to Elon Musk’s social media company X for breaching transparency obligations under the EU’s Digital Services Act (DSA).

The EU started this probe in 2023 and now finds that X’s use of the “blue checkmark for verified accounts deceives users,” claiming that anyone being able to pay to obtain the verified status hinders users’ ability to identify authentic accounts.

Further adding that X’s ad repository does not meet the transparency and accessibility requirements of the DSA.

Elon Musk did not take kindly to the decision and wrote on his X account, “The ‘EU’ imposed this crazy fine not just on (X), but also on me personally, which is even more insane.” Adding in a post later that the “EU Commission should be disbanded in favor of an elected body and the EU President should be directly elected.”

X has around 3 months to report and take further actions before the EU gives a final decision and announces an implementation period.

Related: Cathie Wood sells $15.8 million of megacap tech stock