Suppose a million “ghost’’ jobs were missing from the U.S. economy that headline data didn’t pick up earlier this year.

Some economists are betting on it.

- This summer’s labor-market slump already persauded market watchers to expect the Federal Reserve to cut interest rates next week.

- Some say the initial weak jobs reports for July and August could spark a jumbo cut in September.

- A downward shift in jobs growth would indicate the labor market started tanking earlier than thought.

- An upcoming revision of Q1 labor market data this week could give the Fed the green light to cut the benchmark interest rate several times before year’s end.

Hiring slows to a crawl in July and August

- August job growth slowed while the unemployment rate rose to its highest level since fall 2021, during the Covid-19 pandemic.

- The unemployment rate increased to 4.3%, as expected, from 4.2% in July.

- Nonfarm-payroll jobs increased by only 22,000 in August, far below the estimate of 75,000.

- The revised June number showed a net loss of 13,000 jobs

An upcoming revision of Q1 2025 labor market data this week could give the green light to the Federal Reserve to cut the benchmark Federal Funds Rate several times before the end of the year.

An upcoming revision of Q1 2025 labor market data this week could give the green light to the Federal Reserve to cut the benchmark Federal Funds Rate several times before the end of the year.

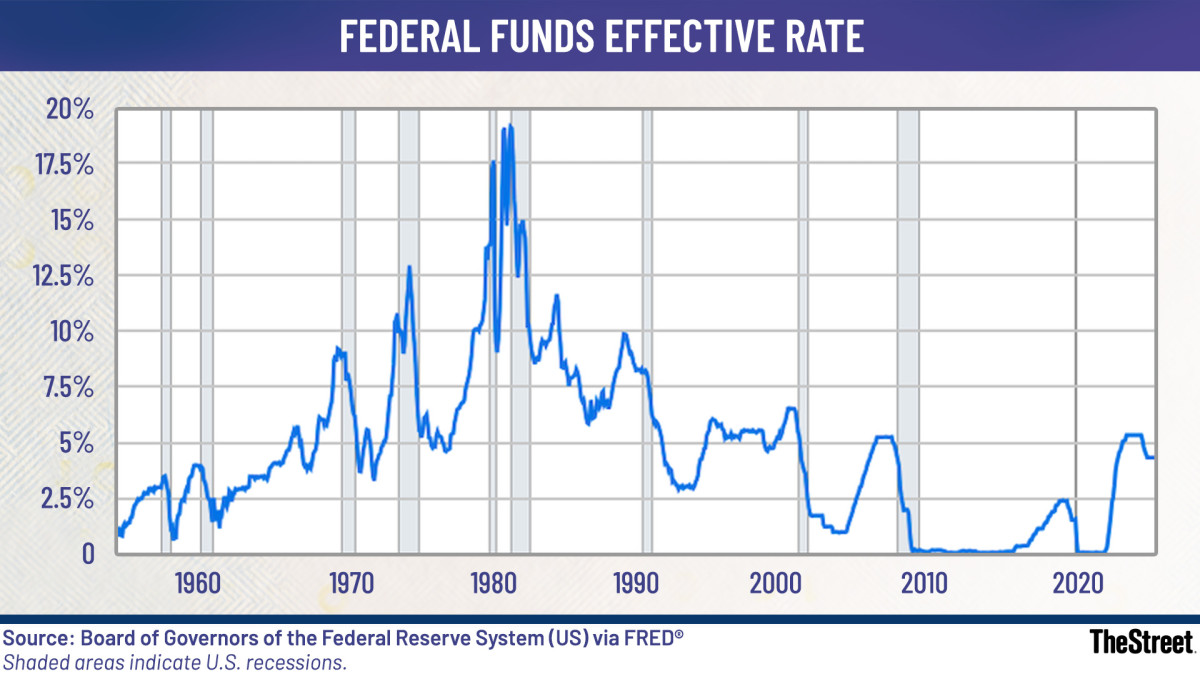

Source: Board of Governors of the Federal Reserve System

The Fed’s dual mandate guides interest rate cuts

- The Fed has a dual mandate from Congress to execute monetary policy that ensures maximum employment and price stability.

- The independent central bank can raise interest rates to slow inflation, which can cause unemployment.

- Or it can cut rates to boost job growth, but that can cause prices to rise.

- The Fed has held the benchmark Federal Funds Rate steady since December 2024 at 4.25% to 4.5% in a “wait-and-see” approach for the impact of the Trump administration’s tariffs on the supply chain.

- Fed Chairman Jerome Powell in late August opened the door to a rate cut in the near future amid a “shifting balance of risks.”

White House wants an immediate interest rate cut

President Donald Trump is demanding a three-percentage-point cut to the funds rate.

Related: Mortgage rates react as bets rise on Fed interest rate cut

Trump and his allies maintain this would:

- Boost the stagnant housing market.

- Reduce the interest rate on the national debt.

- Prevent the economy from falling into stagnation or recession.

The president has ratcheted up his personal and professional criticism of Powell (“Too Late’’) for failing to lower rates this year.

Quarterly jobs revision looming

The Bureau of Labor Statistics conducts annual benchmark revisions to improve accuracy.

- It anchors its estimates using the more comprehensive Quarterly Census of Employment and Wages.

- This draws from state unemployment insurance tax records covering more than 95% of U.S. jobs.

- That’s in addition to the revisions it conducts in each month’s jobs report, all of which ultimately make the data more accurate.

Critical Fed rate-cut decision just days away

“A big downward revision to job growth through March 2025 would have less implications for monetary policy than a downward revision to job growth in the most recent months, but it does set the stage for the broader context of how the economy has been doing,’’ Comerica Chief Economist Bill Adams told Bloomberg.

“And all things equal, downward revisions to job growth increase pressure on the Fed to ease policy,” Adams said.

More Federal Reserve:

- Fresh labor market data fuel Fed interest rate cut chatter

- Fed official sends bold 5-word message on September rate cuts

- Morgan Stanley makes major change to Fed interest rate cut forecast

In simple terms:

- If hundreds of thousands of jobs don’t actually exist, then the labor market isn’t as strong as early data suggest.

- The Fed’s policy-making Federal Open Market Committee might adjust its economic outlook accordingly when it meets Sept. 17.

The widely watched CME Group FedWatch Tool estimates an: 88.2% chance of a 0.25-percentage-point rate cut in September and an 11.8% chance of a half-point cut.

Complicating the FOMC decision is the July Core Personal Consumption Expenditures report (excluding food and energy), which showed persistent inflation ticking up:

- 0.3% month-over-month.

- 2.9% year-over-year.

Related: Fed interest rate cuts hinge on looming inflation report