When inflation surged in 2022, the Federal Reserve raised the federal funds rate to increase the cost of borrowing, deterring consumer spending. Interest rates and mortgage rates remained elevated for years while the Fed worked to suppress inflation, until Fed chairman Jerome Powell unveiled plans for consistent rate cuts last September.

Economists and housing analysts expected mortgage rates to fall as interest rates decreased, but economic uncertainty, volatile financial markets, and a precarious political climate have kept rates stubbornly high.

🏦 🏡 Don’t miss the move: SIGN UP for TheStreet’s FREE daily newsletter 🏦 🏡

Although the federal funds rate influences most consumer lending interest rates, mortgage rates are more complex and are strongly tied to the bond market and 10-year treasury yield.

The treasury yield is dependent on economic performance and investor sentiment, meaning that a few key factors must work together for the yield to bring down mortgage rates.

Homebuyers hoping to see a drop in mortgage rates ought to keep an eye on treasury bonds, investor sentiment, and macroeconomic conditions.

Fed Chairman Jerome Powell is seen answering questions from the press. Powell has received criticism for not implementing more rate cuts to relieve the housing market, but mortgage rates are tied more closely to the 10-year treasury yield than the federal funds rate.

Fed Chairman Jerome Powell is seen answering questions from the press. Powell has received criticism for not implementing more rate cuts to relieve the housing market, but mortgage rates are tied more closely to the 10-year treasury yield than the federal funds rate.

Image source: Getty Images

Fed policy can’t set mortgage rates, but it does influence investor sentiment and treasury yields

The Federal Reserve’s dual mandate is to reach maximum employment while ensuring stable prices. Each policy decision is rooted in fostering economic growth without denting the labor market or increasing inflation.

Fed chair Powell’s ‘wait and see’ approach to interest rates has drawn criticism from the Trump administration, which insists that they be slashed to increase homebuyer demand and relieve the housing market. However, the Fed isn’t directly responsible for mortgage rates.

Tu-Uyen Tran, Senior Writer at the Federal Reserve Bank of Minneapolis, explains how the Fed’s actions have a marginal impact on mortgage rates, and why the treasury yield is a better indicator of mortgage performance.

“The Fed, through “forward guidance”—announcements about monetary policies it expects to undertake—can shape investor sentiment. These sentiments then affect auctions of the benchmark 10-year treasuries,” Tran wrote.

“The base rate for mortgages is usually benchmarked to the yield on 10-year Treasury notes. Government bonds are considered the safest investments and thus useful benchmarks for investors,” he continued. “The yield on Treasuries, which is determined through a public auction, also represents investor expectations of future economic conditions.”

More on homebuying:

- The White House will take surprising approach to curb mortgage rates

- Housing expert reveals surprising ways to reduce your mortgage rate

- Dave Ramsey predicts major mortgage rate changes are coming soon

- Warren Buffett’s Berkshire Hathaway sounds the alarm on the 2025 housing market

The 10-year treasury yield is the interest rate the federal government pays to borrow money over a ten-year period, and mortgages are benchmarked to this metric since most homes are refinanced or sold within ten years of purchase.

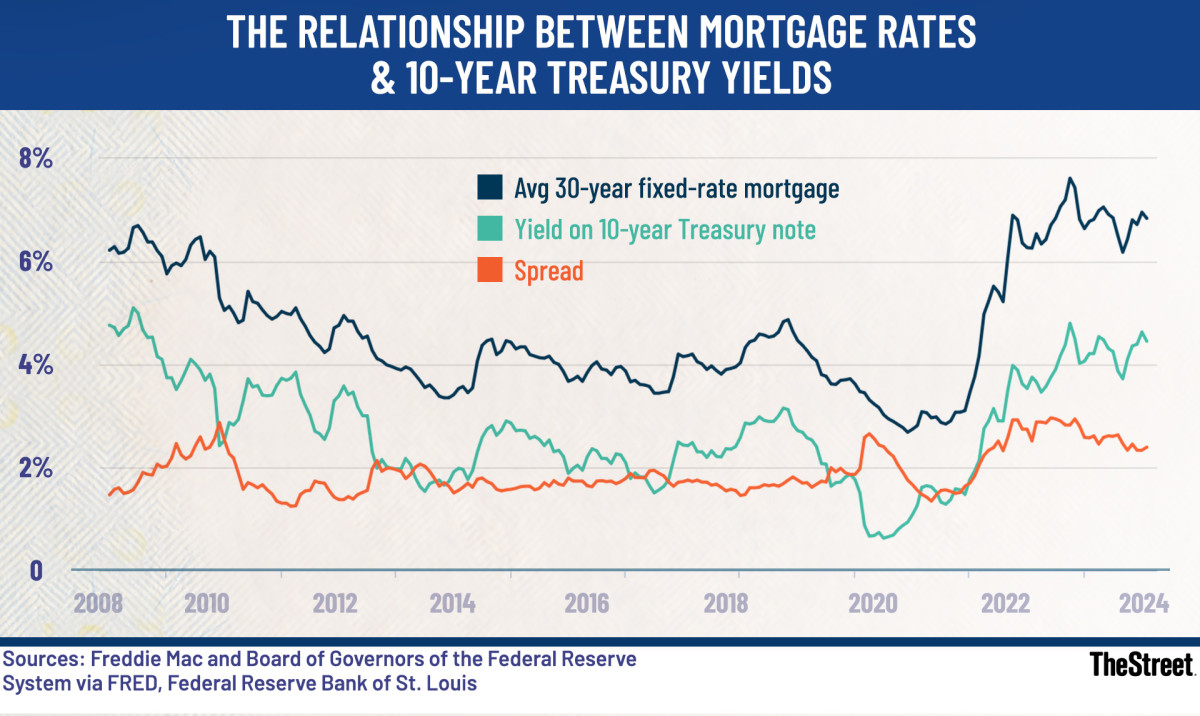

Mortgage rates are generally set with a “cost-plus” model, using the treasury yield as the base plus a marginal cost added by the mortgage lender. The 10-year treasury yield stood at 4.38% as of July 21st, indicating that lenders offering mortgage rates close to 7% tack on a 2.5% margin.

Margins help lenders pay for overhead costs, offset risk, and earn profits on returns. Though margins typically land between 2% and 3%, they can increase alongside treasury yields during periods of economic uncertainty and financial volatility.

Treasury yields and margins increase during times of economic uncertainty, driving up mortgage rates

Since treasury bonds are viewed as one of the lowest risk financial instruments, investors flock to bonds when financial markets are volatile, driving up prices, and bringing down the overall yield.

Mortgage loan margins fluctuate during times of economic uncertainty, as lenders and investors attempt to hedge their bets against increased risk.

Related: Bank of America predicts major housing market changes are coming soon

Per Federal Reserve Economic Data, or FRED, mortgage loan margins—shown as the spread between mortgage rates and treasury yields— have increased during most economic downturns over the past twenty years.

Margins rose during the years surrounding the 2008 financial crisis, the COVID-19 recession, and surging inflation and GDP decline in 2022. Loan delinquencies, defaults and house foreclosures rise during recessions, promoting lenders to offset risk with higher mortgage margins.

The Relationship Between Mortgage Rates & 10-Year Treasury Yields Chart

The Relationship Between Mortgage Rates & 10-Year Treasury Yields Chart

Freddie Mac/Federal Reserve/TheStreet

The Fed estimates that 3.8 million homes were foreclosed on between 2007 and 2010, and 25 banks failures in 2008 alone. In an uncertain economy, lenders perceive mortgage loans as higher risk, and higher margins help offset the risk of potential losses from late payments, delinquency, defaults, and foreclosure.

Rising inflation can also hurt a bank’s bottom line, as it diminishes the real value of loan returns. Lenders often raise mortgage loan margins to preserve the purchasing power of their investments.

While an unpredictable economy drives down treasury yields, most lenders raise margins on mortgage loans to counteract the increased risk. However, homebuyers could see lower mortgage rates soon if inflation expectations fall or if the federal government reduces its budget deficit.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast