Do you know how much Social Security will actually pay you in retirement?

If not, a new report from the Social Security Administration, Recurring Actuarial Note #4: Illustrative Benefits for Retired Workers, Disabled Workers, and Survivors, offers a useful guide.

By way of background, Social Security pays monthly benefits not only to retirees, but also to disabled workers and to the families and survivors of workers who die.

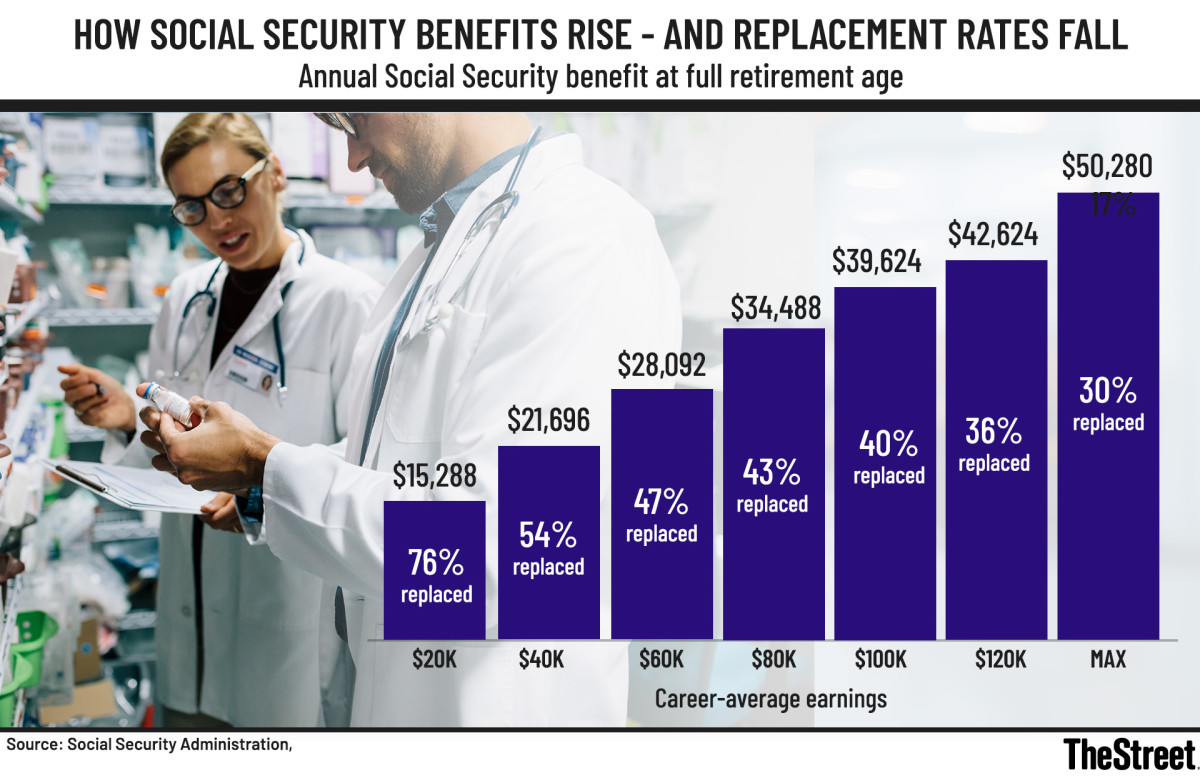

The program is progressive by design. Workers with lower lifetime earnings receive benefits that replace a larger share of their past pay than higher earners do.

The SSA’s report illustrates that design by modeling a set of hypothetical workers at different ages and income levels. It shows three things: what they were earning recently, what they earned on average over their working lives, and how much Social Security they would likely receive when they become eligible for benefits.

SSA

How age and earnings shape Social Security benefits

The SSA’s estimates show that while a worker’s age can affect recent earnings, lifetime earnings matter far more than age in determining benefits at full retirement age. Consider three workers — one age 25, one age 45, and one age 65 in 2025 — all planning to claim benefits at full retirement age, which for each is 67.

For a 25-year-old in 2025, a worker who earned $10,423 in 2024 would receive an annual benefit of $15,288 at full retirement age, replacing about 76% of career-average earnings. At the taxable maximum of $168,600, the annual benefit would rise to $49,908, but the replacement rate would fall to about 30%.

For a 45-year-old in 2025, the pattern is nearly identical. A worker earning $21,591 in 2024 would receive $15,288 a year at full retirement age, again replacing about 76% of career-average earnings. A worker earning the taxable maximum would receive $50,280, replacing roughly 30% of career-average earnings.

Even for someone age 65 in 2025, just two years from claiming benefits, the same relationship holds. A worker earning $15,724 in 2024 would receive $14,172 annually at full retirement age, replacing about 71% of career-average earnings. At the taxable maximum, the annual benefit would be $47,064, replacing roughly 28% of career-average earnings.

Also worth reading

- Retirees may want to rebalance as markets broaden, volatility rises

- The $83,250 secret every solo entrepreneur needs to know for 2026

- Medicare mistakes seniors wish they’d known sooner

The takeaway is consistent across ages. Social Security benefits rise as lifetime earnings increase, but they replace a shrinking share of income at higher earnings levels.

And while earnings can fluctuate late in a career, especially as work tapers off, benefits at full retirement age are driven largely by long-term earnings history rather than what a worker earns in the final years before retirement.

The chart above visualizes this pattern, showing how Social Security benefits increase with lifetime earnings, even as replacement rates steadily decline.

How survivor benefits vary by age and earnings

Social Security survivor benefits can play a critical role when a worker dies young or in mid-career. The SSA’s report also shows how annual survivor benefits vary for a surviving spouse and one child, depending on the worker’s age at death and lifetime earnings.

Consider first a worker who dies at age 25 in 2025. If that worker earned $10,423 in 2024, the surviving spouse and one child would receive $12,648 a year in Social Security survivor benefits. If the worker earned the taxable maximum of $168,600, the annual survivor benefit would rise to $72,384.

Related: Why ‘breaking even’ on Social Security is the wrong goal

For a worker who dies at age 45, survivor benefits are higher, reflecting a longer earnings history. At $21,591 in 2024 earnings, the surviving spouse and one child would receive $21,528 annually. At the taxable maximum, survivor benefits would total $72,912 a year.

Even when a worker dies at age 60, survivor benefits remain substantial. If the worker earned $19,235 in 2024, the surviving spouse and one child would receive $10,488 annually. At the taxable maximum, the annual survivor benefit would be $34,524.

Across ages, the pattern is consistent. Survivor benefits rise with the deceased worker’s lifetime earnings, but they are also shaped by when in a career the death occurs. Workers who die later tend to leave behind higher survivor benefits because they have accumulated longer earnings histories, while deaths earlier in life can still trigger meaningful benefits that provide financial support to surviving families.

What this means for families

Social Security survivor benefits can provide a crucial financial backstop when a working parent dies. Even when a worker dies young or before reaching retirement, eligible spouses and children may receive ongoing benefits based on the worker’s earnings history.

Those benefits can help replace lost income, cover basic living expenses and provide stability during an otherwise disruptive period. The amounts vary widely, however, depending on how long and how much the worker earned before death, underscoring the importance of Social Security as both a retirement and family-protection program.

Advisers offer actionable advice

The report illustrates that Social Security replaces a lower percentage of income for higher income workers, said Mike Piper, who operates a free, open-source Social Security strategy calculator.

“This is one reason why ‘save x% of your income’ rules of thumb don’t work as well as personal projections, using your own actual facts and circumstances,” he said.

For anybody interested in getting an estimate of what their monthly Social Security benefit would be at different ages and with different assumptions as to future earnings, Piper said ssa.tools is an excellent, free calculator that’s easy to use.

For her part, Marcia Mantell, president of Mantell Retirement Consulting, offered the following advice.

- Even if you are young (age 18-30), make sure to set up your “my Social Security account” online and start tracking your future benefits.

- Don’t be disappointed in the benefit estimates. Social Security was never designed to replace your income. However, if you are a lower-wage worker throughout your career, a much larger percentage of your income will be replaced with Social Security.

- If you are a consistently high wage earner, that’s great. But you only contribute into Social Security up to the taxable wage base. So, you can expect about a 29% to 30% replacement of the taxable wage base as a retirement benefit, but not 30% of your real income. If your ending income is $500,000, you still only get about $47,000 in this example. That’s a 9.4% income replacement.

- None of these figures in the SSA report address your real cash flow. Medicare Part B premiums will automatically reduce the amount that is deposited into your accounts, so plan accordingly.

- Congress has still not addressed the future shortfall coming in 2032 when the reserve account is fully expended. Make a plan to frequently call your members of Congress to voice any concerns, emphasizing that you need them to make fixing Social Security a priority.

Related: Elon Musk says stop retirement saving: Experts call it ‘nonsense’