Something strange occurred when Nvidia (NVDA) reported its latest earnings: Wall Street shrugged.

Yes, the numbers were substantial, handily beating Wall Street expectations. And indeed, Nvidia’s AI processors continue to be in high demand.

Related: Veteran Nvidia analyst drops blunt 4-word message on its future

However, the projection failed to impress, and shares fell, leaving some to worry whether the AI revolution propelling Nvidia’s spectacular climb is slowing down.

Jensen Huang has a totally different perspective.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

The Nvidia CEO believes that what lies ahead is not a cooling-down period, but an evolution. And Nvidia isn’t simply riding the AI trend; it’s actively influencing it.

While short-term speculators focused on the top line, the business secretly unveiled its next phase, which includes high-efficiency robot processors, sovereign AI infrastructure, developer-grade supercomputers, and even synthetic training environments.

These aren’t simply side projects but the underpinnings of a larger, more tangible, and long-term AI economy.

That background makes Huang’s multi-trillion-dollar projection even more important—not just for Nvidia (NVDA) , but also for investors’ expectations of the next five years in technology.

Nvidia is pivoting from stand-alone GPUs to full “AI factory” systems built on its Blackwell platform.

Nvidia is pivoting from stand-alone GPUs to full “AI factory” systems built on its Blackwell platform.

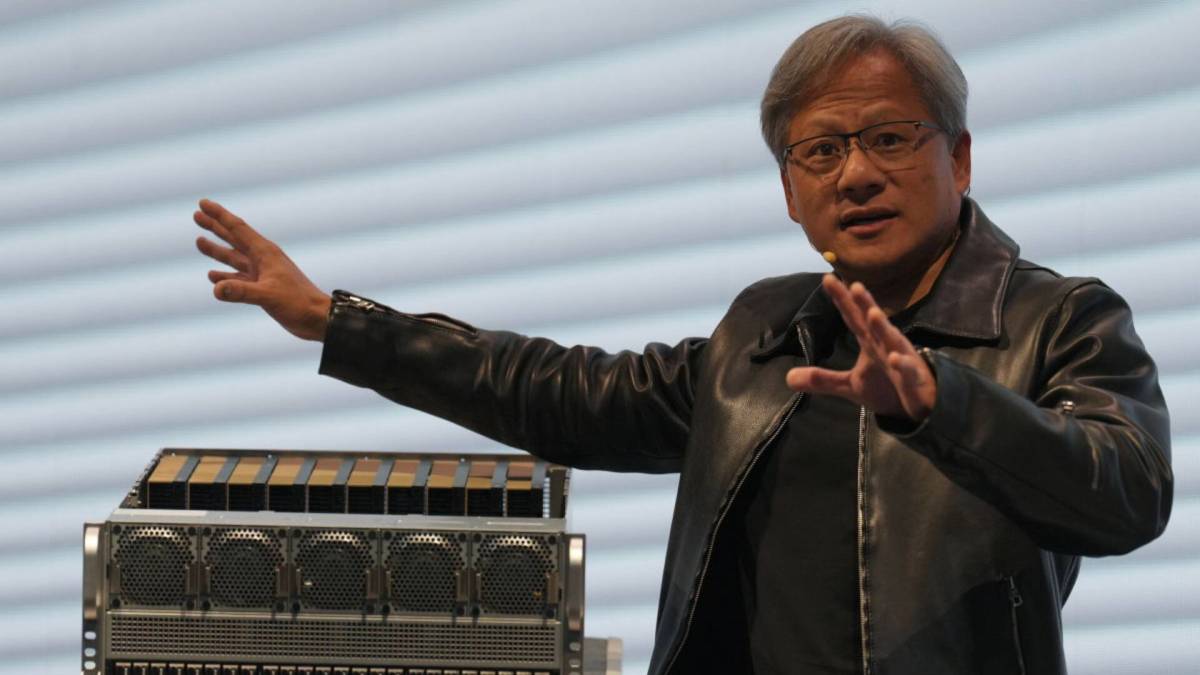

Image source: SOPA Images/Getty Images

Nvidia’s CEO brushes off Wall Street jitters, betting big on a $4 trillion AI future

Nvidia CEO Jensen Huang isn’t losing any sleep over cooling investor sentiment in AI. In fact, he’s doubling down.

Despite issuing a third-quarter forecast that underwhelmed markets — thanks partly to excluding China sales — Huang is looking ahead to what he calls a “new industrial revolution,” driven by massive demand for AI infrastructure.

His pitch? We’re not near the end of the AI boom — we’re still in the opening act. Huang sees global AI investment soaring to between $3 trillion and $4 trillion by the end of the decade, with Nvidia front and center.

Related: Veteran analyst drops surprising twist on Nvidia stock post-earnings

While Nvidia shares dipped slightly after earnings, Huang clarified that the company is still moving at full speed. He pointed to continued strong demand from Big Tech and hyperscalers, saying Nvidia’s chips help customers do more with less, processing more data while using less energy. “The buzz is: Everything sold out,” he said.

Analysts are still buying the story. At Raymond James, the AI trade is considered durable and far from over. Over at GLOBALT Investments, the takeaway is similar: We’re early in this cycle.

Bottom line: Wall Street might be slightly fatigued, but Huang isn’t blinking. To him, the AI race is on — and Nvidia is still setting the pace.

Nvidia’s AI empire keeps expanding

Investors are still unpacking Nvidia’s quarter, but the company’s already onto the next thing, far beyond GPUs and data centers.

The big idea is what Jensen Huang calls “physical AI.” Think Jetson AGX Thor, a $3,499 robot super-brain that runs real-time generative AI for warehouses, hospitals, and factories. Early names kicking the tires include Amazon Robotics, Boston Dynamics, and Meta.

And it’s not just robots. Nvidia’s ramping its Rubin platform, with a Blackwell Ultra successor targeted for 2027. The plan: build “sovereign AI” factories across Europe, starting in Germany, as part of a global AI buildout.

Related: Nvidia Makes Bold Bet on Future as Earnings Hit

China gets its own path. A dialed-back B30A chip is in development to satisfy export rules while keeping a foothold in a key market.

On the desktop, DGX Spark aims to handle 200-billion-parameter models. For training data, the Cosmos platform spins up hyper-realistic simulations for self-driving cars, robots, and more.

So Nvidia isn’t just powering AI; it’s trying to own the whole stack and the infrastructure around it.

The unique perspective makes CEO Jensen Huang’s long-term AI view even more remarkable.

Nvidia’s AI-first play: what it means for the numbers

Nvidia isn’t just selling chips anymore. It’s selling full-on “AI factories”: Blackwell GPUs, NVLink, fast networking, plus the software to run it. The pitch is straightforward — AI is infrastructure, and Blackwell is the platform.

You can see it in the numbers. Data-center sales keep climbing, and Nvidia is guiding to $54 billion next quarter with non-GAAP gross margins in the mid-70s.

The catch? More complete systems boost revenue but squeeze margins versus last year’s HGX cycle.

China is the swing factor. New export rules led to a big H20 inventory hit and essentially zero China sales last quarter, with some units rerouted to other customers.

Spending is rising to build all this out, and buybacks are still on. Big picture: The opportunity keeps getting bigger, but mix-driven margin pressure, higher costs, and export-policy risk are part of the ride.

Related: Bank of America Tweaks Snowflake Stock Price Target after Earnings