When one door closes, another one opens.

We all have heard of that saying, commonly attributed to Alexander Graham Bell, the inventor, scientist, and engineer credited with patenting the first practical telephone.

It essentially means that when we lose one opportunity, another, and perhaps better, one is waiting for us. The trouble is, we usually focus more on what is lost, instead of what could be gained.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

For example, when I lost my previous job, where I was miserable for years but didn’t the guts to quit, I felt both devastated and relieved. About three months later, I got this amazing opportunity, which I would never have sought if the previous door wasn’t closed.

With new technological advancements, many businesses are shutting down. A few examples include print media being replaced by online journalism, many brick-and-mortar bookstores closing after online bookstore giant Amazon launched, and Uber, Lyft, and other ride-sharing apps affecting traditional taxi businesses.

Technology has been and will continue to change the world. For some, this might sound scary because of undesired consequences.

Klarna CEO Sebastian Siemiatkowski raised these fears when he sounded the alarm on possible concerns with AI development.

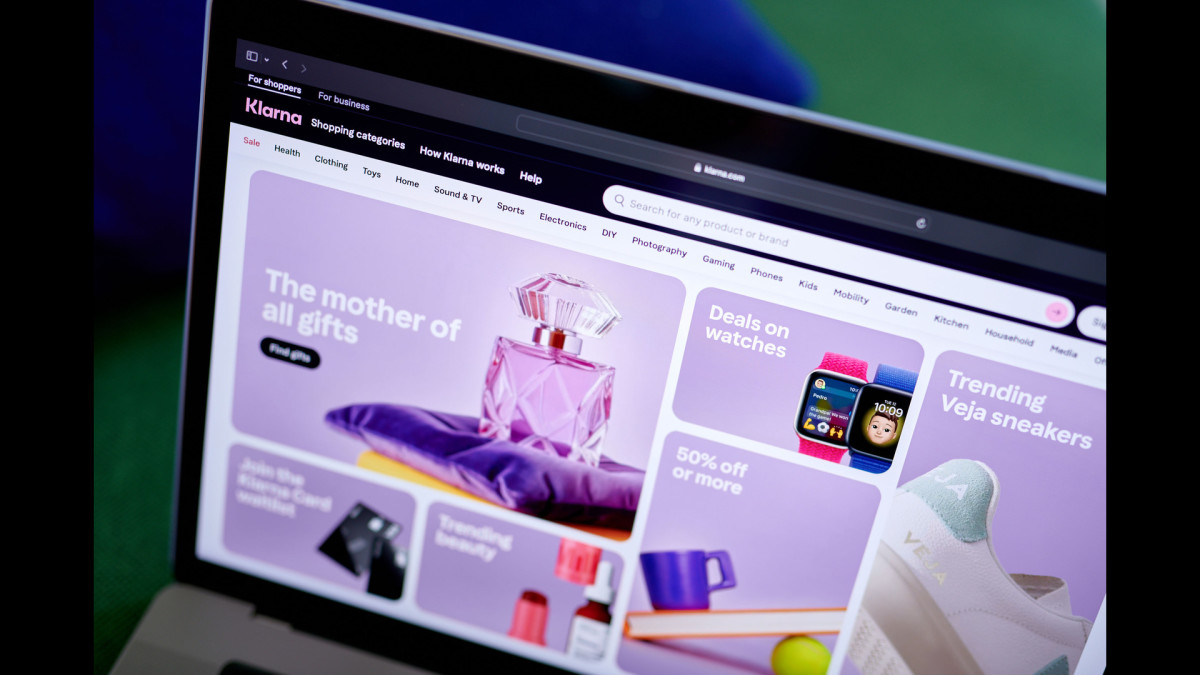

In 2024, the “buy now, pay later” provider Klarna saw revenue of $2.81 billion.

In 2024, the “buy now, pay later” provider Klarna saw revenue of $2.81 billion.

Image source: Jones/Bloomberg via Getty Images

Klarna CEO says an AI-induced recession may be unavoidable

Klarna Group is a Swedish fintech company that provides online financial services, popularly known as “buy now, pay later” (BNPL). Since its launch in 2005, the company expanded into banking, marketing, and commerce infrastructure.

Siemiatkowski, as a recent guest on The Times Tech podcast, revealed that AI development will mean huge changes for certain roles.

“There will be an implication for white-collar jobs,” he said, adding that advancements like AI may lead to at least a recession in the short term. “Unfortunately, I don’t see how we could avoid that, with what’s happening from a technology perspective.”

Related: Nvidia’s latest project may supercharge quantum computing

Siemiatkowski has always openly shared his thoughts, often speaking more candidly than other tech leaders regarding AI’s potential to kill some jobs.

“I want to be honest, I want to be fair, and I want to tell what I see so that society can start [making] preparations,” he said.

However, the CEO believes in the long run, the change won’t necessarily be bad. He also stressed that the reduction in white-collar jobs should lead to better pay and more appreciation for blue-collar jobs.

He explained that “if you look at the factory workers today, lorry drivers, waiters, chefs, salaries are going up at a pretty good rate.” Siemiatkowski predicts that the demand for those positions will increase.

More technology:

- Palantir gets great news from the Pentagon

- Analyst has blunt words on Trump’s iPhone tariff plans

- OpenAI teams up with legendary Apple exec

Klarna also recently started hiring more human workers, which sparked a debate on whether the company is walking back claims that AI will eliminate positions.

However, Siemiatkowski told the crowd at London SXSW that “two things can be true at the same time.” He pointed out that AI doesn’t mean there won’t be opportunities for real people to work at Klarna.

“We think offering human customer service is always going to be a VIP thing,” he said, noting that people are now paying more for clothing stitching by hand rather than by machine.

Klarna’s ups and downs and big bet on AI

In 2024, Klarna’s revenue reached $2.81 billion with a net profit of $21 million, marking its first profitable year after heavy losses in previous periods.

In 2022, Klarna’s valuation dropped from $45.6 billion to $6.7 billion but has since rebounded to $14.6 billion. In March, the tech powerhouse revealed it is preparing for an Initial Public Offering (IPO), targeting a valuation of $15 billion, reported CNBC.

Related: Google resolves major privacy issue

In April 2025, the company postponed its IPO plans in response to U.S. tariff developments. The following month it disclosed disappointing earnings results for the first quarter of the year with a net loss of $99 million, two times the $47 million loss from the same period the year before.

Klarna attributed the loss to restructuring, depreciation, and share-based payments. The company made a big bet on AI, replacing 700 humans with a chatbot.

Over the last two years, it reduced the number of employees from 5,500 to 3,000, boosting revenue per employee and lowering costs.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast