If you think Medicare is a set-it-and-forget-it program, think again — especially if you’ve saved well for retirement.

A growing number of retirees will soon face sharply higher Medicare Part B premiums, with some paying more than $1,100 per month, $13,200 per individual per year, or $26,400 per couple per year by 2034.

The culprit? A combination of rising health care costs and the slow creep of income thresholds that trigger something called IRMAA — the Income-Related Monthly Adjustment Amount.

🏦 🏡 Don’t miss the move: SIGN UP for TheStreet’s FREE daily newsletter 🏦 🏡

Currently, 5.1 million Medicare beneficiaries pay more than the standard Part B premium today, but that number is expected to balloon to over 8.6 million people in the next decade. For those caught unaware, the financial hit can be surprising and steep.

More Medicare beneficiaries face higher premiums: IRMAA shock is coming

More Medicare beneficiaries face higher premiums: IRMAA shock is coming

Image source: Shutterstock

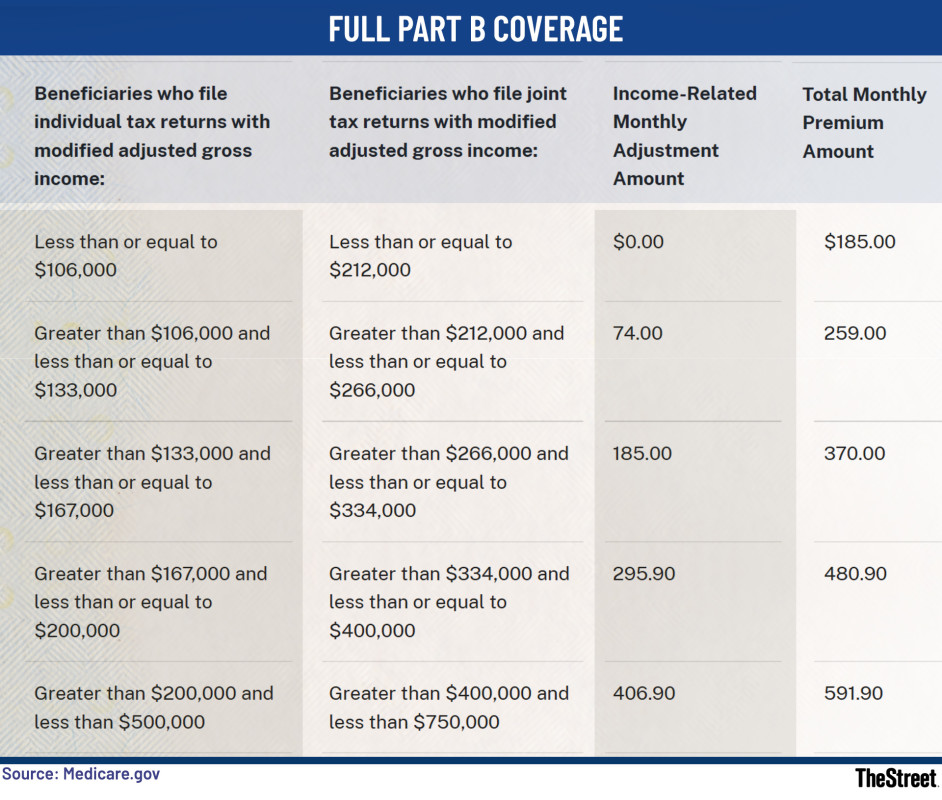

Medicare Part B premiums and IRMAA surcharges in 2025

Medicare Part B covers outpatient medical services, including doctor visits, preventive care, durable medical equipment, and more. In 2025, the standard monthly premium is $184.90 — a modest $10.30 increase from 2024.

But for higher-income retirees, that’s just the starting point.

Thanks to a law passed back in 2007 and expanded by the Bipartisan Budget Act of 2018, individuals with modified adjusted gross incomes (MAGI) above certain thresholds must pay an IRMAA surcharge.

These thresholds begin at $106,000 for single filers and $212,000 for joint filers in 2025.

Related: Retired workers to see frustrating change to Medicare in 2026

Depending on how high your income climbs, you’ll pay a larger share of the program’s cost — up to 85% of the total, compared to the 25% share paid by those at the standard level.

2025 Medicare Part B IRMAA amounts

2025 Medicare Part B IRMAA amounts

Currently, about 8% of Medicare beneficiaries pay IRMAA, according to the Medicare Trustees Report.

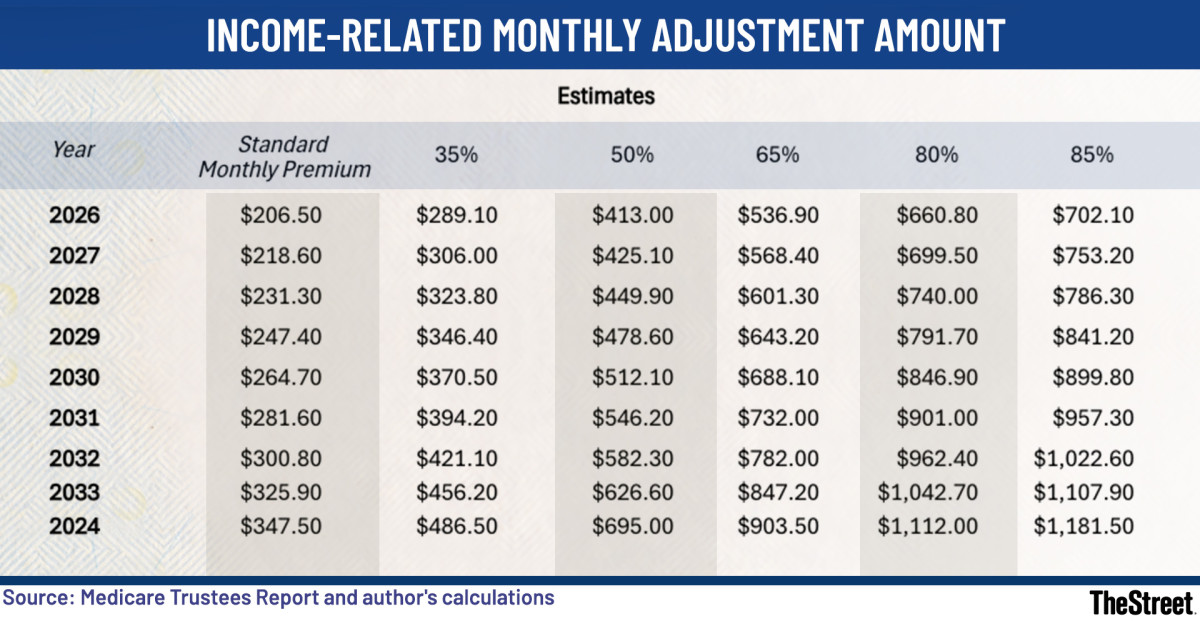

But due to unindexed income thresholds, a surge in Required Minimum Distributions (RMDs), and record-setting intergenerational wealth transfers, the number of IRMAA payers is expected to rise dramatically — to 8.6 million by 2034.

Some of those retirees will pay as much as $1,181.50 per person per month — an 88% increase over today’s top-tier rate.

And don’t count on inflation-adjusted relief anytime soon. While standard premiums rise with health care cost projections, the income brackets that determine IRMAA tiers are increasing at a snail’s pace — essentially at the general rate of inflation, and in some cases, not at all until 2028.

Why this Medicare cost surge matters

Why does this matter? Because many affluent retirees — especially those waiting until age 73 or older to take RMDs — will find themselves suddenly hit with four- or even five-figure annual Medicare surcharges. And for those who assumed that their careful savings strategy would provide peace of mind in retirement, IRMAA can come as a rude awakening.

As Mantell Retirement Consulting President Marcia Mantell put it: “There’s no way there is any balance between all the numbers. More and more retirees are going to fall into the IRMAA tiers. When they make the transition, it is a total shock. And they are unhappy — to say the least.”

Estimated Medicare Part B Income-related monthly adjustment amounts

Estimated Medicare Part B Income-related monthly adjustment amounts

TheStreet

Mantell points out the core imbalance: While Part B premiums are projected to jump by 11% or more per year, the IRMAA thresholds will only inch up modestly. This will drag more retirees into higher payment tiers, even if their real purchasing power hasn’t changed.

Related: Big Beautiful Bill Act makes Roth IRA conversions more complicated

Katy Votava, founder of Goodcare.com, agrees — with a caveat. “This forecast may be reasonable based on demographic growth in the Medicare population,” she said. “But a lot hinges on continued economic growth.” She points to the 2008-2009 recession as a cautionary tale, when the number of high-income Medicare beneficiaries dropped by 14–17% and didn’t recover for four years.

In other words, IRMAA isn’t just about income — it’s about timing, tax strategy, and market cycles. If you’re not planning for it now, you could be facing hundreds or even thousands of dollars in surprise Medicare premiums later — and smaller Social Security checks to boot.