Fed Chairman Jerome Powell has come under heavy fire this year over the central bank’s interest rate policy.

So far, Powell has kept his finger off the interest-rate-cut trigger in 2025 over fears that newly enacted tariffs will reignite inflation, drawing stiff criticism from President Donald Trump, who has called for his resignation.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

Powell has repeatedly said he wants to see more inflation data before cutting rates, making the release of the July Consumer Price Index, or CPI, on August 12 key.

Ahead of the inflation data, Wall Street’s Morgan Stanley has offered its prediction for how inflation is evolving, what it may mean, and what could happen to interest rates next.

“While markets are treating a September cut as a near certainty, we think there is still a lot to play for,” wrote Morgan Stanley in a note to clients. “CPI data this week will matter.”

Federal Reserve Chairman Jerome Powell has avoided interest rate cuts in 2025, prompting calls for his resignation.

Federal Reserve Chairman Jerome Powell has avoided interest rate cuts in 2025, prompting calls for his resignation.

Image source: Kent Nishimura/Getty Images

The Fed won its inflation battle, but risks falling behind the curve

The Federal Reserve’s interest rate policy is governed by a dual mandate to set rates at levels promoting low unemployment and inflation.

That’s easier said than done. The two goals often contradict one another. Increasing rates, like in 2022, when inflation spiked above 8%, can cause inflation to fall but unemployment to increase. Cutting rates, like in late 2024, can lower unemployment but cause inflation to increase.

Related: President Trump sends strong message on Federal Reserve Chair decision

This year, the Fed’s job is made even tougher by tariffs. President Trump has enacted stiff import taxes, including on major trading partners China and Canada, and most economists, including Powell, worry that companies will pass along some of those higher costs to consumers.

While tariffs haven’t dramatically increased inflation yet, last month’s CPI report suggested the impact may have begun.

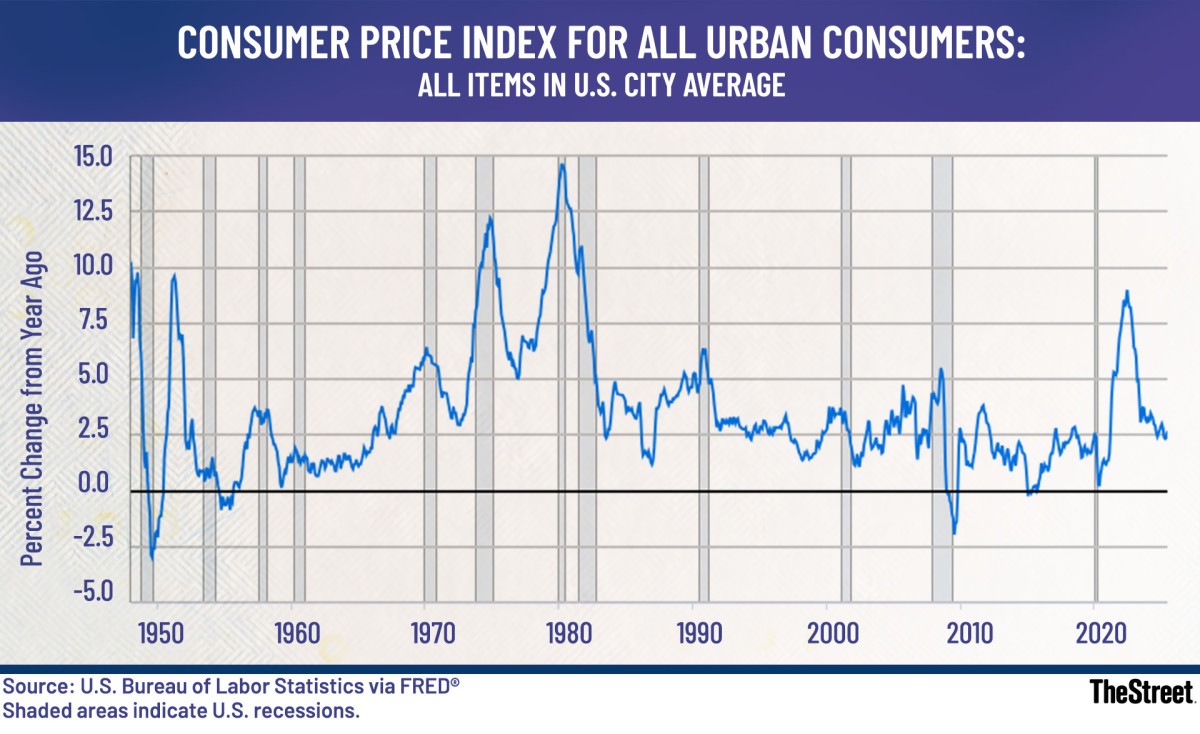

In June, CPI rose 0.3% month-over-month and 2.7% year-over-year. For perspective, year-over-year CPI was just 2.3% in April, before most tariffs kicked in, marking the lowest level since February 2021.

Consumer Price Index for All Urban Consumers year over year inflation chart since 1950.

Consumer Price Index for All Urban Consumers year over year inflation chart since 1950.

Source: U.S. Bureau of Labor Statistics via FRED

“The June CPI clearly showed the start of tariff-driven inflation,” wrote Morgan Stanley. “We have long argued that the experience of 2018 points to three to five months as the most likely lag for the full effects of tariff pass-through.”

Morgan Stanley unveils July CPI inflation prediction

The potential for tariffs to increase inflation is tied to decisions to keep prices low while inventory brought into the U.S. before tariffs were put in place gets sold.

As those pre-tariff inventory levels disappear, more import costs will likely flow to consumers.

Related: JPMorgan revamps strong forecast on Federal Reserve rate cuts

“Our analysis of disaggregated data shows that about 80% of the surge in 1Q “front loading” came from just seven of the over 5,000 HS6 product categories (mainly gold, pharmaceuticals, and AI-linked products),” wrote Morgan Stanley. “Hence, front loading may not be as pervasive as suspected, so we expect that inflation pressure will continue to build in the next couple of prints.”

If Morgan Stanley is correct that companies didn’t boost inventory as broadly as previously thought before tariffs, the impact on inflation should become more evident in July and August.

“We expect core CPI to rise by 0.32%M in July (3.04%Y), up from 0.23%M in June,” forecast Morgan Stanley. “Our base case remains that most of the tariff-related price effects will materialize over the summer. However, risks are tilted towards a more gradual and persistent upswing in monthly prints through year-end.”

More Economic Analysis:

- Trump sends strong message on Federal Reserve Chair decision

- A divided Federal Reserve mulls interest rate cut after wild week

- Federal Reserve reveals latest interest rate cut decision

Economists often consider core CPI, which excludes volatile food and energy, a better proxy for inflation than headline CPI. However, headline CPI is what consumers pay every day, given that most of us have to eat and buy gasoline.

Morgan Stanley expects July headline CPI to be 2.76%, rounded to 2.8%. If so, it would mark a second consecutive month of year-over-year increases and the highest inflation print since February.

An uptick in CPI could further muddy the waters for a Fed interest rate cut in September.

“Sequential firming in inflation is one key factor behind our view that the Fed will remain on hold at the September meeting, despite recent employment data that point to a sharp slowdown in labor demand,” wrote Morgan Stanley.